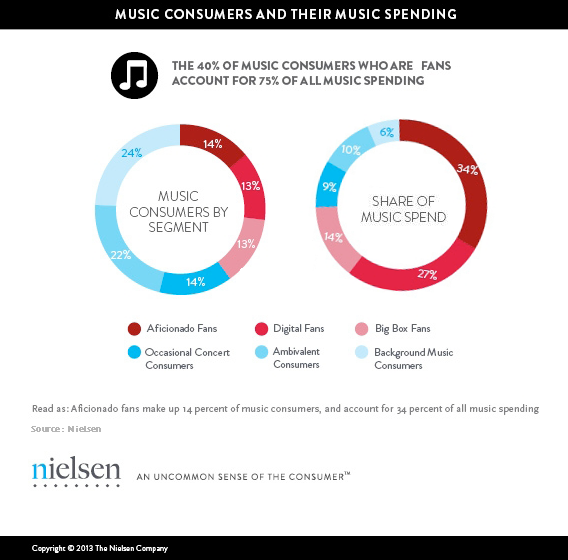

Music is the universal language that fans speak fluently. In fact, a recent Nielsen study found that 40 percent of U.S. consumers—those classified as fans—are responsible for 75 percent of music spending. These fans, who spend between $20 billion and $26 billion on music each year, could spend an additional $450 million to $2.6 billion annually if they had the opportunity to snag behind-the-scenes access to the artists along with exclusive content.The study results, presented at this year’s South by Southwest (SXSW) festival in Austin, Texas, showed that the high level of spending from a relatively narrow group of music consumers is dominating the share of overall music spend. These big spenders have indicated that, at large, they’d be willing to pay even more for exclusive extras, like in-studio updates, real-time emails, pre-orders, limited editions, autographed copies, vinyl records and lyric sheets handwritten by the artist.

Different fans, however, have different preferences so Nielsen took a closer look at music fans, analyzing the different spending behaviors among each segment.

Aficionado Fans

Aficionado fans are the top-tier connoisseurs of music. They love music from a variety of genres and periods. They tend to like indie music, and they’re always listening and discovering. This segment is willing to spend on all formats of music, including artist merchandise, concerts and online streaming services. As such, aficionado fans, who make up only 14 percent of the total music consumer population, comprise a whopping 34 percent of the share of music spend.

Digital Fans

Digital fans consider themselves to be the tune trend finders, listen to music through social networks and are very engaged, but they tend to be less aware of indie bands and the ins and outs of the music industry. Due to their extensive connectivity, these fans enjoy free access to internet radio and spend less than aficionado fans. While only accounting for 13 percent of the total music consumer population, digital fans account for more than twice its size in share of spend (27%). This segment is also more likely to listen to music on YouTube than radio (66% and 57%, respectively).

Big-Box Fans

Big-box fans identify themselves as having an intense relationship with music, most notably the pop and country genres. Big-box fans connect with music that they hear in movies, on TV, in video games and in commercials. They tend to be discount shoppers whose music and other purchase decisions are heavily influenced by discounts or deals. Thirteen percent of music consumers are big box fans, and this segment accounts for a comparable 13 percent share of spend.

The other 60 percent of music consumers that Nielsen identified account for 25 percent of spending.

Ambivalent Music Consumers

Ambivalent consumers are not particularly engaged with music, but they use free internet radio services like Pandora to get content. They are willing to pay for special or unique content. Ambivalent consumers like pop, contemporary Christian, and adult contemporary, hip-hop/R&B and classical. Ambivalent music consumers have average incomes but spend less on entertainment than any other segment. This segment, representing 22 percent of music consumers, does, however, account for the largest share (a still modest 10%) of music spend among the non-fans.

Occasional Concert Consumers

Occasional concert consumers attend concerts for a favorite artist or band. They tend to listen to music during work hours, but listen significantly less at home. Occasional concert consumers, who account for 14 percent of the music-consuming population, spend heavily on other types of entertainment like video games, but only account for 9 percent share of music spend.

Background Music Consumers

Background music consumers are the least engaged with music and they spend less money on entertainment in general. This is a larger consumer segment, making up 24 percent of all music consumers, but only accounts for a meager 6 percent share of music spend.

Methodology

Data for “The Buyer and the Beats: The Music Fan and How to Reach Them” was collected via 1,000 consumer surveys using Nielsen’s proprietary, high-quality ePanel in the U.S.; 1,800 PledgeMusic contributors; and 1,200 SXSW attendees.