Graham Gee, Vice President, Nielsen Home Entertainment

While DVD sales declined for a third straight year in 2009, consumer appetite for viewing movies at home remains very healthy as new physical and digital services for buying and renting movies gain in popularity. The proliferation of movie rental kiosk machines over the last year was probably the most visible sign of consumer interest in viewing movies at home.

To understand the impact of rental kiosks and other movie services on household disc purchasing (DVD and Blu-ray), Nielsen fielded a survey to our panelists who were identified as disc buyers and asked them to report their movie transactions from channels not tracked by scanning. This included rental transactions (both physical and digital rentals) and downloads.

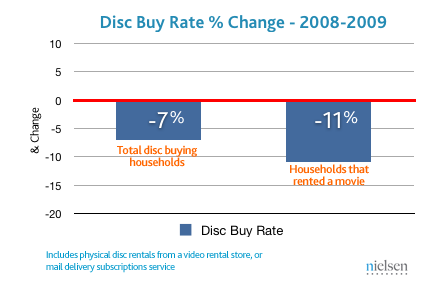

One finding from the study was that average disc purchasing (buy rate) among households who also rented movies on physical DVD or Blu-ray declined in 2009 at a steeper rate compared to the average for all disc buying households. The buy rate among households renting a movie on DVD or Blu-ray declined by -11% in 2009 vs. -7% among all disc buying households.

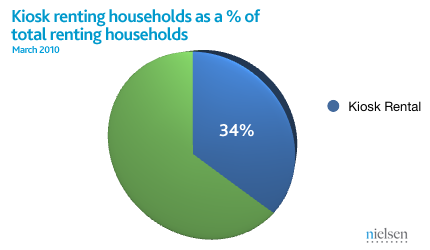

Survey results indicated that 34% of these renting households had rented a movie from a kiosk.

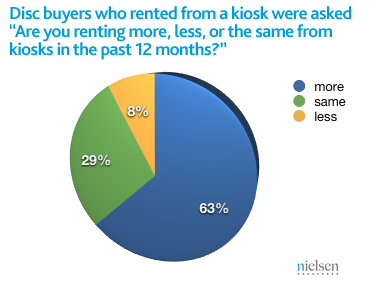

In addition, households renting from a kiosk are increasingly turning to kiosks to rent movies with 63% reporting that they had rented more movies from a kiosk in the past 12 months compared to the prior 12 months.

Demographically, disc buying households who also rented from a kiosk were more likely to have children under the age of 18 and skewed towards a suburban lifestyle when compared to the average disc buying household. Despite the value proposition of renting a movie from a kiosk for a dollar a day, these households are more likely to be on the upper end of household incomes.

| Kiosk Rental Index by Demographics | |

|---|---|

| Profile | Kiosk Rental (index) |

| HH Income | 72 |

| HH Income $30-50K | 94 |

| HH Income $50-100K | 117 |

| HH Income $100K+ | 108 |

| HH w/ Kids | 134 |

| HH w/ no Kids | 74 |

| Cosompolitan Centers | 92 |

| Affluent Suburban Spreads | 127 |

| Comfortably Country | 103 |

| Struggling Urban Cores | 70 |

| Modest Working Towns | 109 |

| Plain Rural Living | 83 |

| Source: The Nielsen Company – Indices based on total DVD buying households |