Many U.S. consumers began expressing an eagerness to start spending again late last year, and now it seems as though brands and advertisers are starting to catch up. The good news for those brands is that a growing number of consumers believe 2021 will be the year that they will be able to resume their normal activities, and the vast majority of those activities involve spending money.

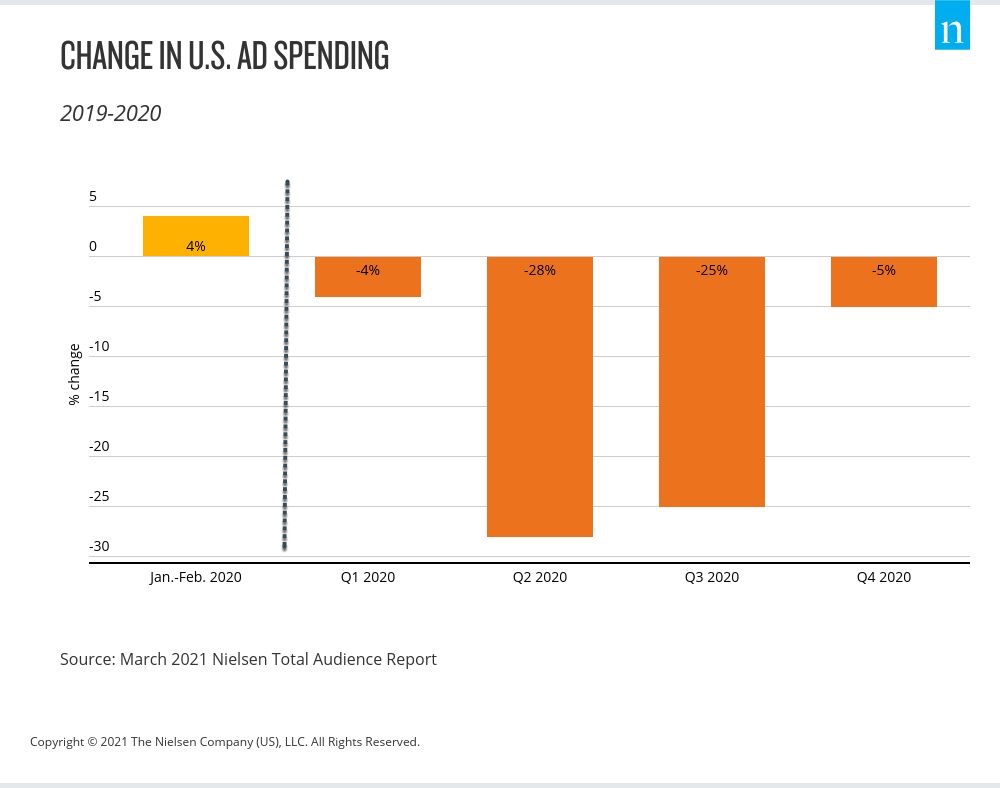

That’s an open invitation for brands, and based on ad spending trends, many have turned the corner from mid-2019, which is when most of the year’s drop in ad spend occurred. By fourth-quarter 2020, ad spend was just 5% below the prior year, compared with much steeper year-over-year declines in the previous two three-month periods.

Importantly, the increase in ad spend complements rising consumer confidence in the U.S., which increased 16 index points in fourth-quarter 2020 according to the Conference Board’s Consumer Confidence Index. So as consumers increasingly think about life and their activities away from home, brands and marketers need to focus on how individual consumers and consumer groups are prioritizing their re-emergence.

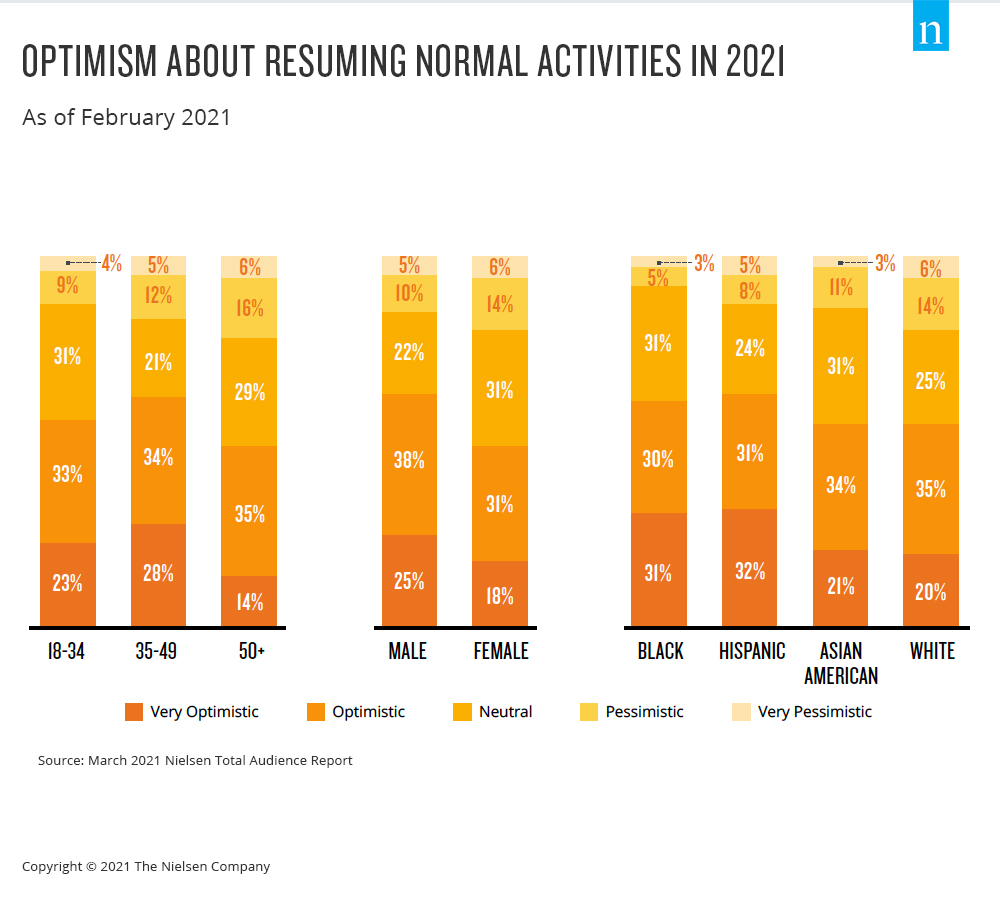

In terms of timing, a recent Nielsen survey found that 55% of Americans 18 and older believe they could get back to their normal routines this year. Men, however, are notably more optimistic than women, as 63% believe this year is the year to return to normal activities, compared with 49% of women.

Financial wellbeing is a critical consideration when it comes to consumer spending habits, and U.S. economic conditions continue to improve from an employment perspective. While the unemployment rate remains above its pre-pandemic level, it has come down dramatically since peaking at 14.7% in April of last year. And what’s more, when it reported a rate of 6.2% in February, the Bureau of Labor Statistics noted that many of the recent gains have taken place in the leisure and hospitality industries.

That data aligns with consumer interest in travel, as 73% of the Americans we surveyed say they’re very or somewhat eager to plan or book a vacation. The only activities that rank higher are attending a religious service in person (75%) and going to a hair salon or barber shop (74%). Interest in traveling by airplane is also rising, with 67% of survey respondents saying they’ll be ready to fly in the next three months.

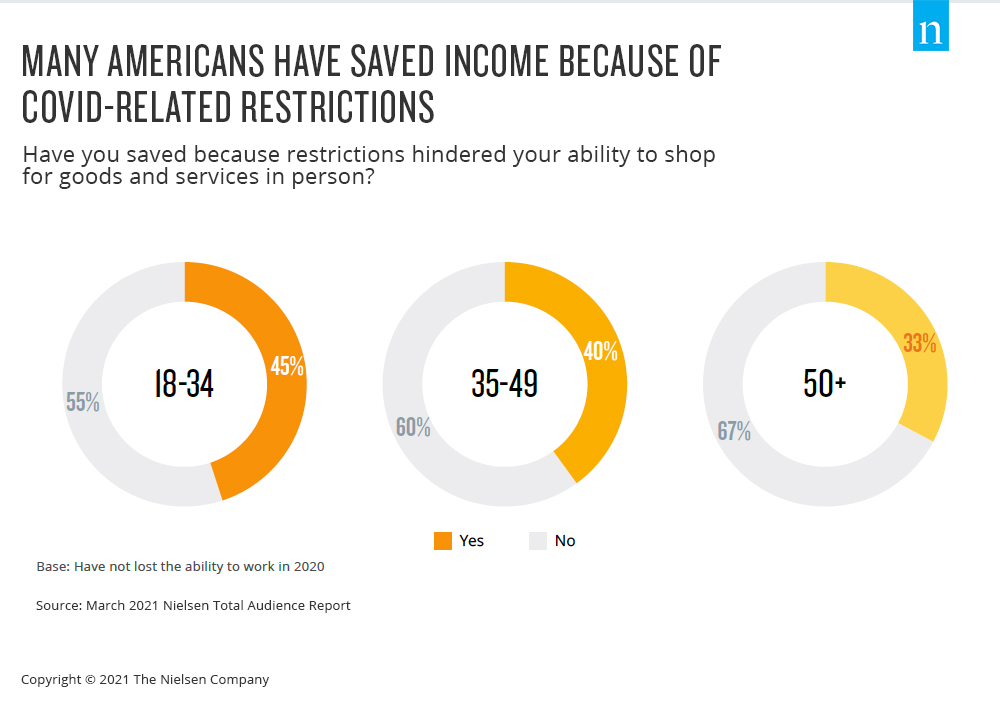

In addition to improving employment conditions, many working consumers report spending less over the past year due to COVID-related restrictions. In fact, 40%-45% of employed 18-49 year olds say they were able to save more of their income because they weren’t able to spend normally last year.

Given that many consumers put certain large purchases on hold last year, we expect reemergence to be coupled with shifting spending patterns for larger purchases. For example, nearly half of adults 35-49 and 45% of adults 18-34 made a purchase of $500 or more last year, but those purchases were heavily centered around technology, household equipment, home improvements and clothing. With COVID restrictions easing, 40% of adults 18 and older say a new or used vehicle is in their future, and 20% say they intend to buy a new home in the next 12 months.

It will take some time for all consumers to feel comfortable away from their homes, but the tides are beginning to turn. Improving optimism, sentiment and purchasing intent are clear indicators for marketers to assess whether their campaigns reflect consumer mindsets—mindsets that appear increasingly ready and willing to get back to normal.

For additional insights, download the latest Nielsen Total Audience Report.