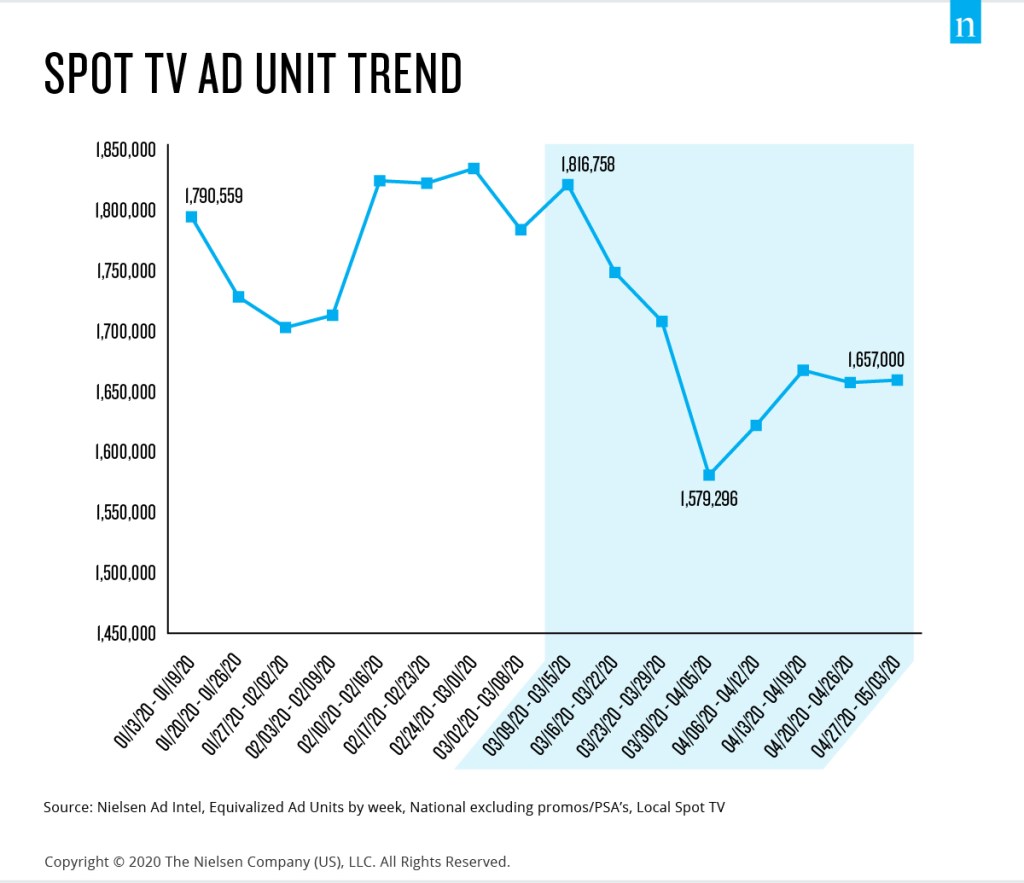

There’s no short-selling the impact of the COVID-19 pandemic on the global media industry, and the wide-reaching ramifications will exist for the foreseeable future. Despite the epic fragmentation, certain indicators offer guidance about what the future will look like. Advertising, particularly local advertising, is one of them, given that local businesses are the lifeblood that fuels the thousands of communities across the U.S. And importantly, a new Nielsen analysis indicates that spot advertising in local markets appears to be starting to turn the corner after declining in some areas by as much as 35% at the end of March.

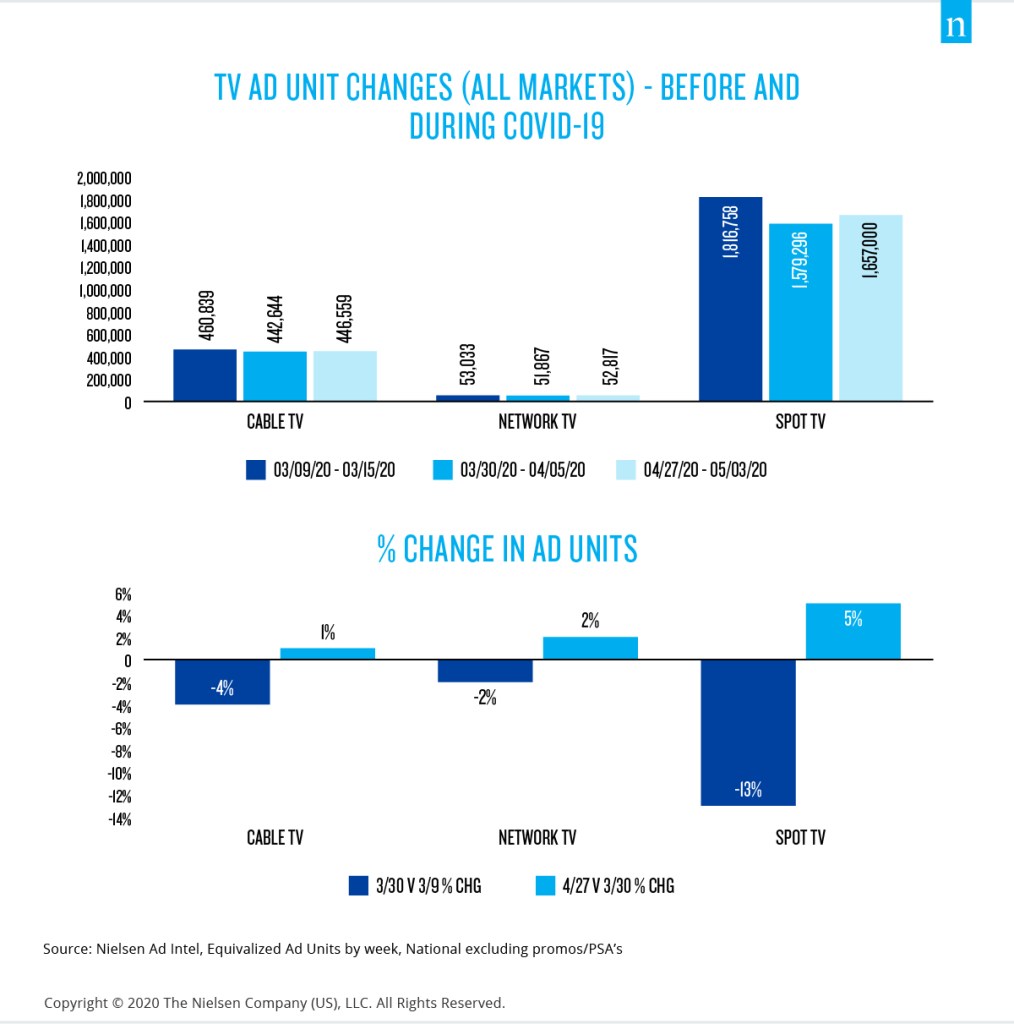

Even in tough times, there’s a need and place for advertising. In more recent weeks, local spot TV ad units are coming back faster, rising 5% during the week of April 27, 2020. Unlike national and cable TV ads, which most TV viewers in the U.S. see regardless of location, local spot ads appear in specific markets and clusters of markets. As such, monitoring local ad spot trends provides insight into the future health of our local media markets.

Notably, the pandemic and resulting shelter-in-place restrictions hit local businesses particularly hard. With 49 U.S. states now at least partially re-open, local businesses can actively use local advertising to re-engage consumers seeking to get back to life away from their homes. Many advertisers are already activating, as we’ve seen an uptrend and leveling of ad units following the local ad spot low during the week of March 30, 2020.

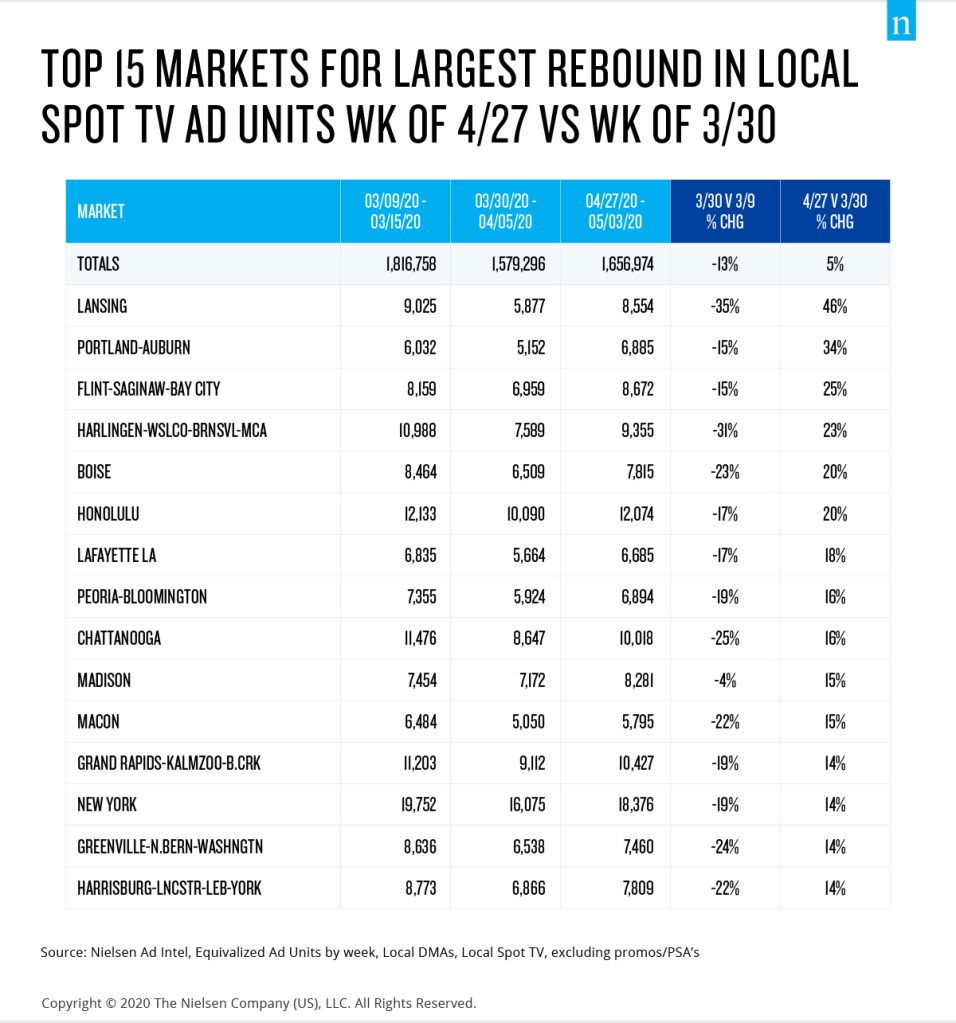

Not all markets are on the upswing from a local spot ad perspective, but a majority are, indicating a strengthening business environment for many regions. For the week ended April 27, 2020, ad units in 101 out of the top 132 markets increased. While the average increase was 5%, some ad units in some markets are up by double-digits. Ad units in Lansing, Mich., Portland, Maine, Flint, Mich., Harlingen, Texas, Boise, Idaho, and Honolulu, Hawaii, for example, were up more than 20%.

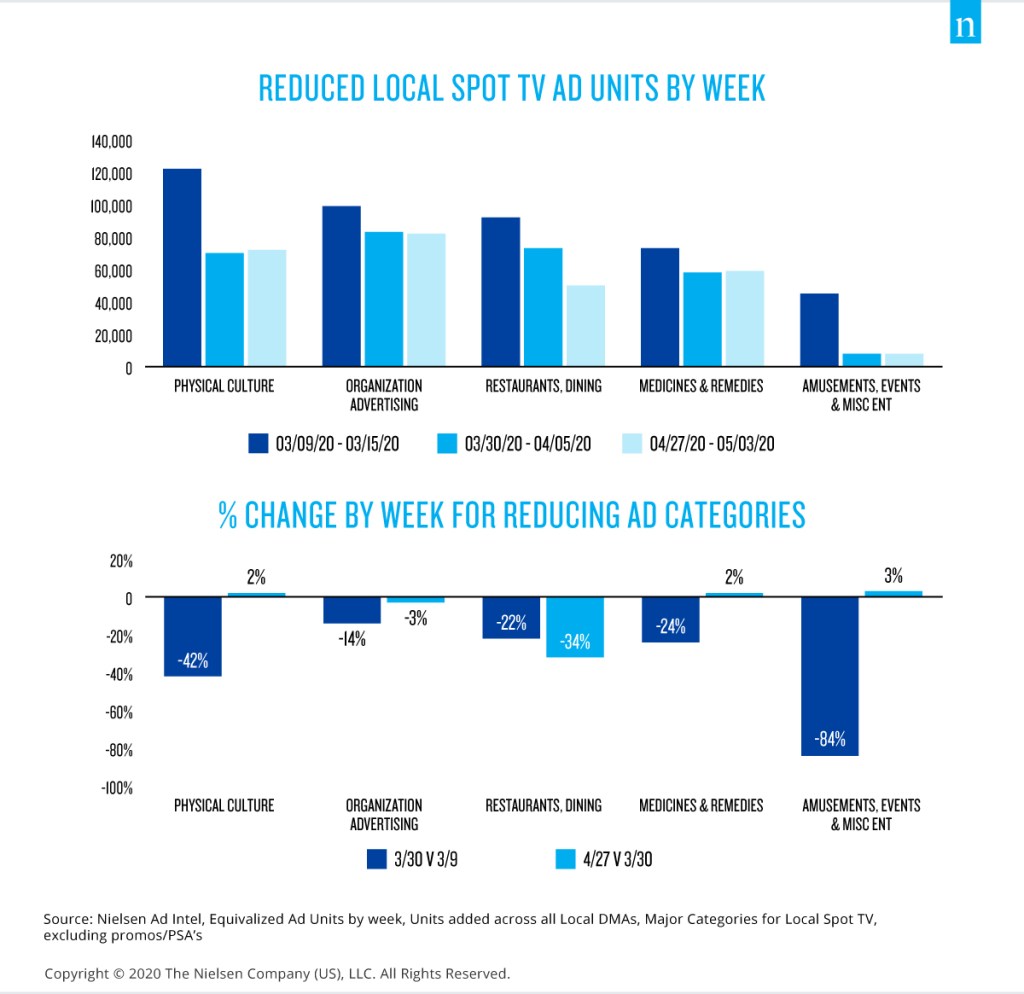

Importantly, aggregate and regional trends don’t highlight insights around specific ad categories. So, to better understand ad category trends at the local level, we examined ad unit changes across all local markets and bucketed the categories into three groups: reduced, resilient and rebound.

Businesses in the reduced bucket include those most affected by business closures during the height of shelter-in-place restrictions, such as gyms, restaurants and salons. These businesses reduced advertising the most and ad units in this bucket remain low.

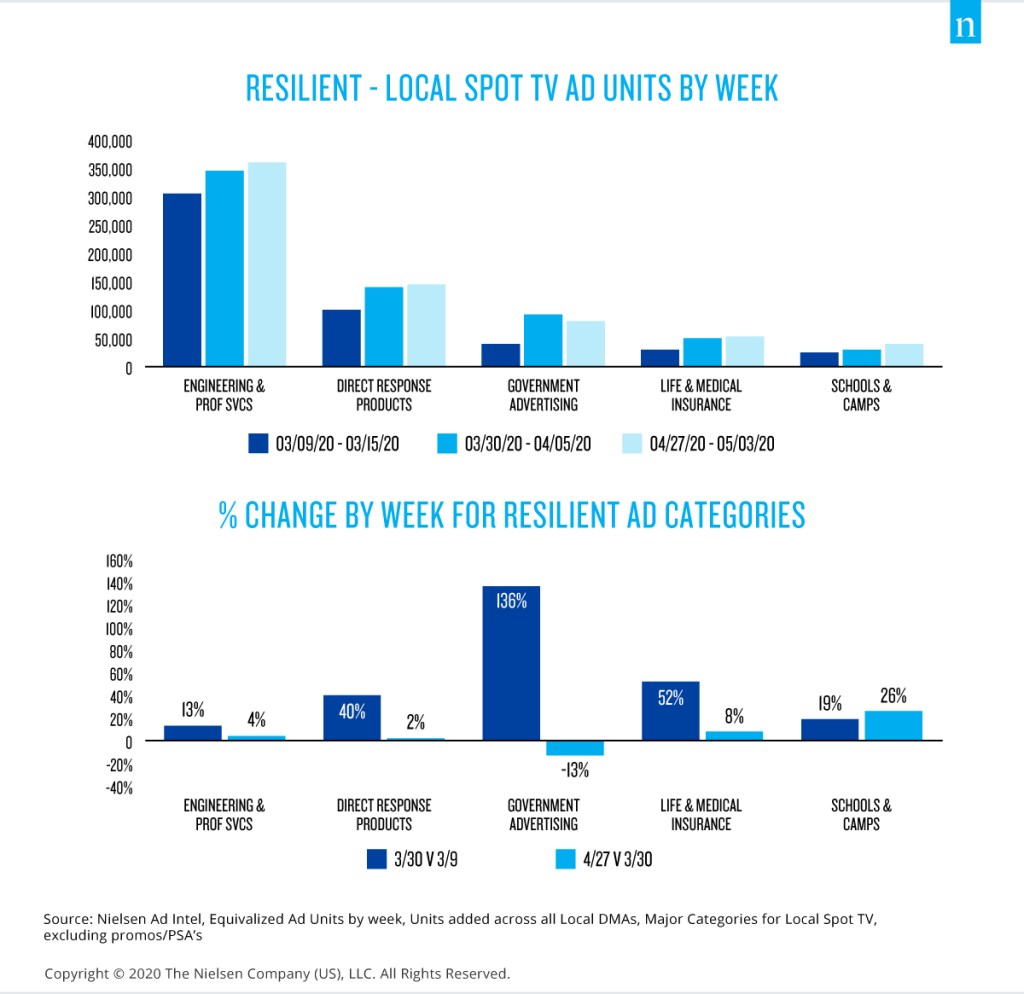

Businesses and organizations in the resilient bucket include those that were somewhat insulated from the shelter-in-place restrictions and have stayed the course over the past few months. Examples include direct response, engineering and government. In the local ad market, ad units from this grouping increased from just under 25% to almost 36%.

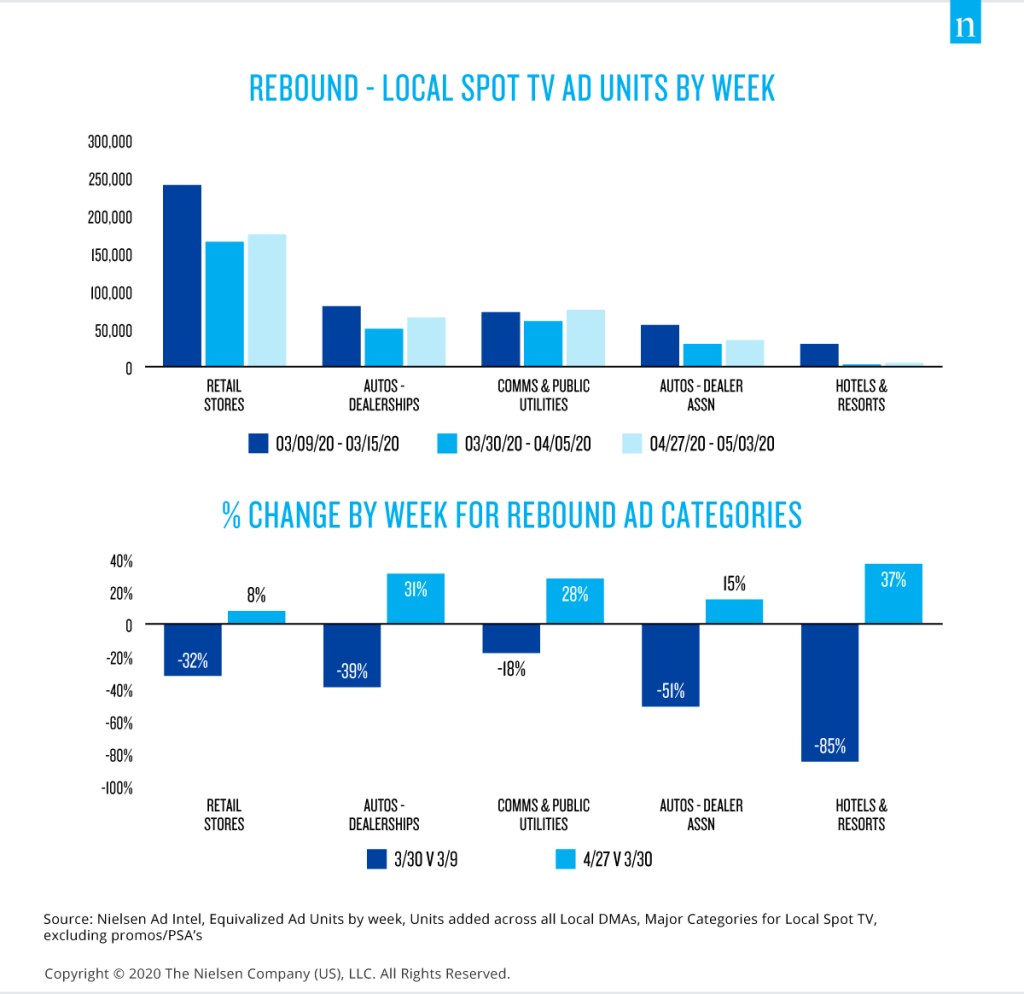

Businesses and organizations in the rebound bucket are the ones to watch going forward, as they are largely connected to the communities in which they operate. Retail stores are the most prominent in this bucket, as they account for more than 10% of local spot ads. Ad units in the rebound bucket dropped 32% between March 9 and March 30, but then increased 8% by April 27. Auto advertising, like retail, is a key business health indicator for a local market, and share of all spot TV ads began trending up during the week of April 27 (up to almost 6%) after dropping just under 5% in late March. Other rebounding sectors include communications and public utilities, and hotels/resorts.

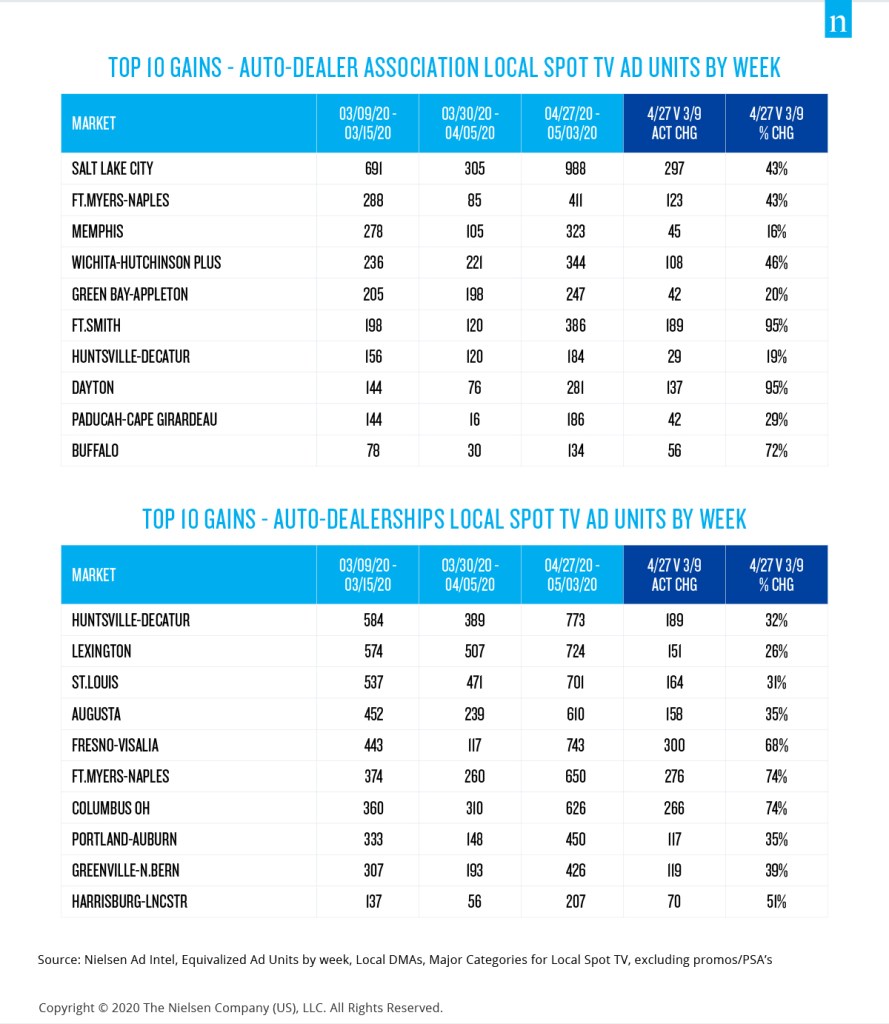

Looking more closely at the auto realm, the dealership and dealer association sub-genres have posted an even stronger rebound in certain markets. Salt Lake City, for example, benefited from statewide eased restrictions for dining, gym and salon businesses on May 1. The market saw almost 300 more ad units in the week of April 27 than in the week of March 9. Dealership ad units were also up more than 100 in nine of the top gaining markets. Fresno, Ft. Myers and Columbus, Ohio, led the way with gains of more 260 units over the same period.

Case Study

Political Ads: A Sweet Spot for Local Spot TV

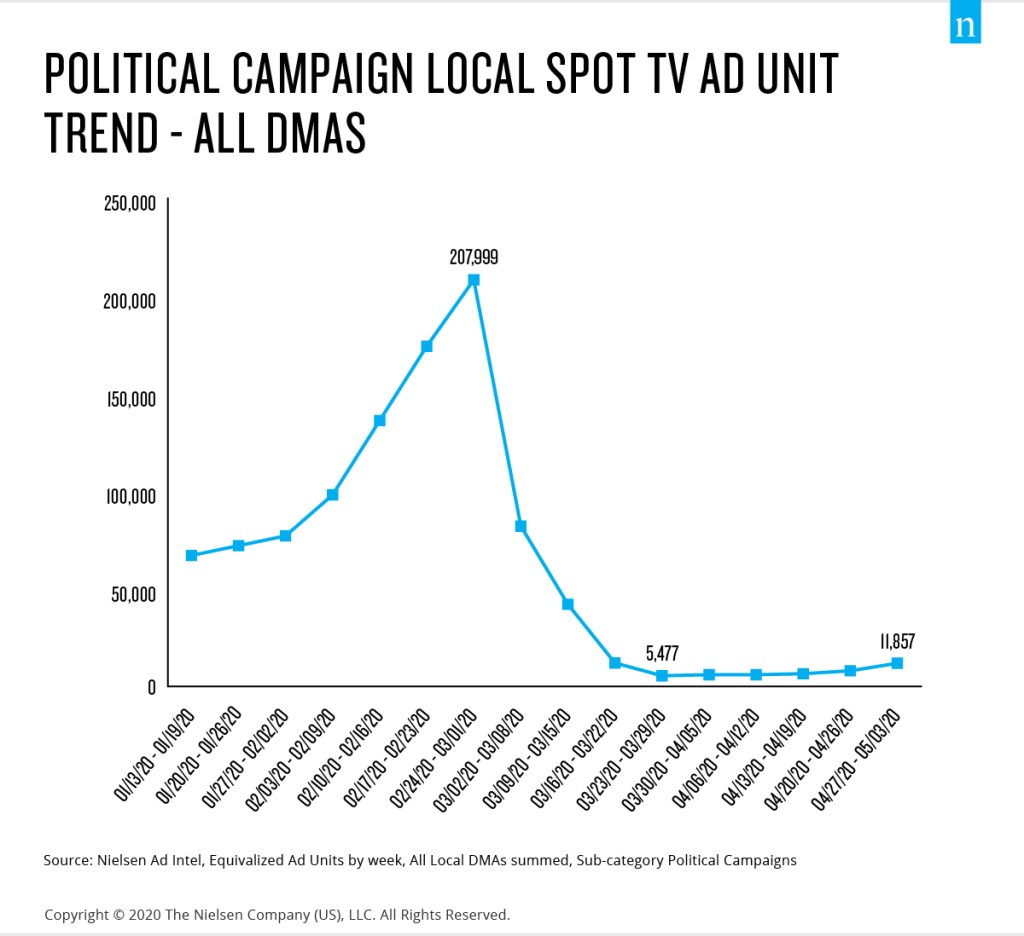

While consumers and businesses around the globe have been focused on health, safety and well being amid the COVID-19 epidemic, Americans remain steadfast in their interest in the upcoming presidential election—as well as the messaging from the candidates. As with other categories, however, political campaign advertising across local TV dropped notably between late February and late March. The decline topped 200,000 ads.

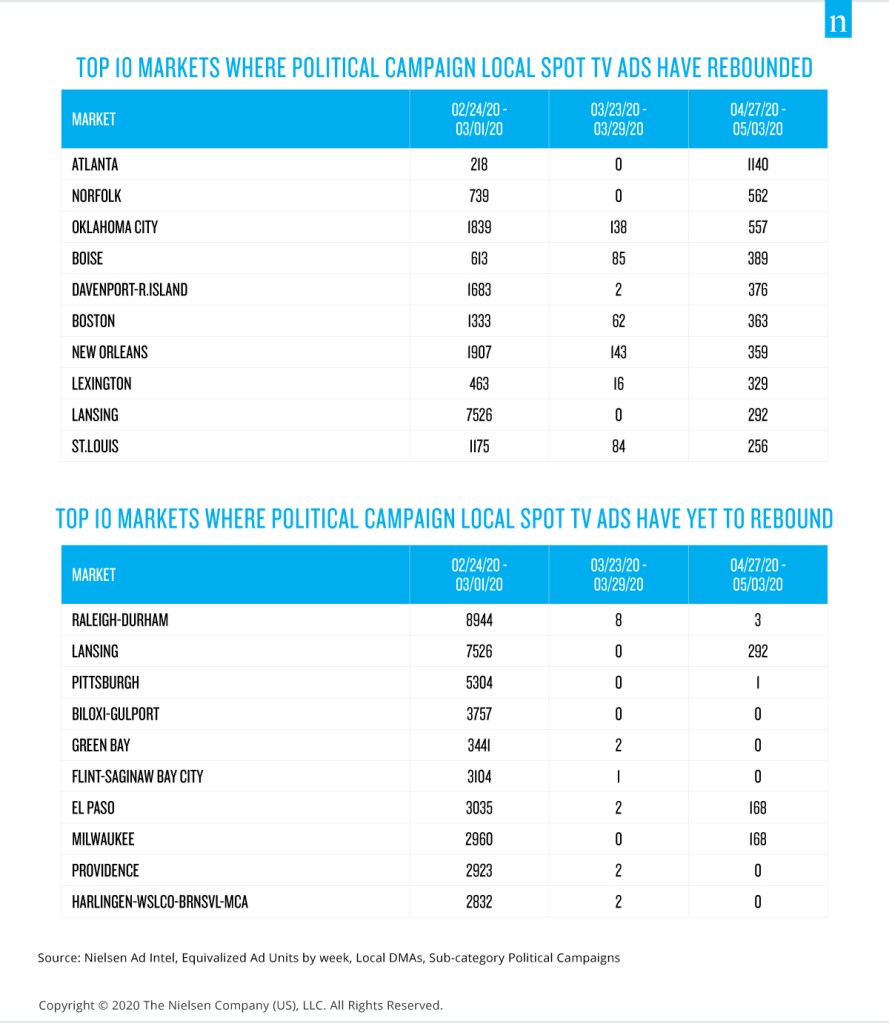

Local spot TV ads for political campaigns, however, have significantly bounced up from their trough, with ad spots more than doubling since March 23 and increasing steadily through the week of April 27. This places them in the rebound bucket, and as more businesses re-open and states continue to reduce restrictions, we expect political advertising to continue increasing as we get closer to key election dates.

As with other categories, political ad units have not come back in all markets. Ad spend across the political landscape, however, will ultimately correlate less with business re-openings and more with final battleground states for the candidates. Presidential elections are equivalent to the Super Bowl in U.S. politics, which means local TV—and advertising—will be hugely important.

As we’ve already started to see, different markets will have different approaches to regeneration. Even so, there are signs across all markets that consumers and businesses are inching into a new normal. That inspires hope for a stronger ad market.

Learn more about Nielsen’s Ad Intel solutions.