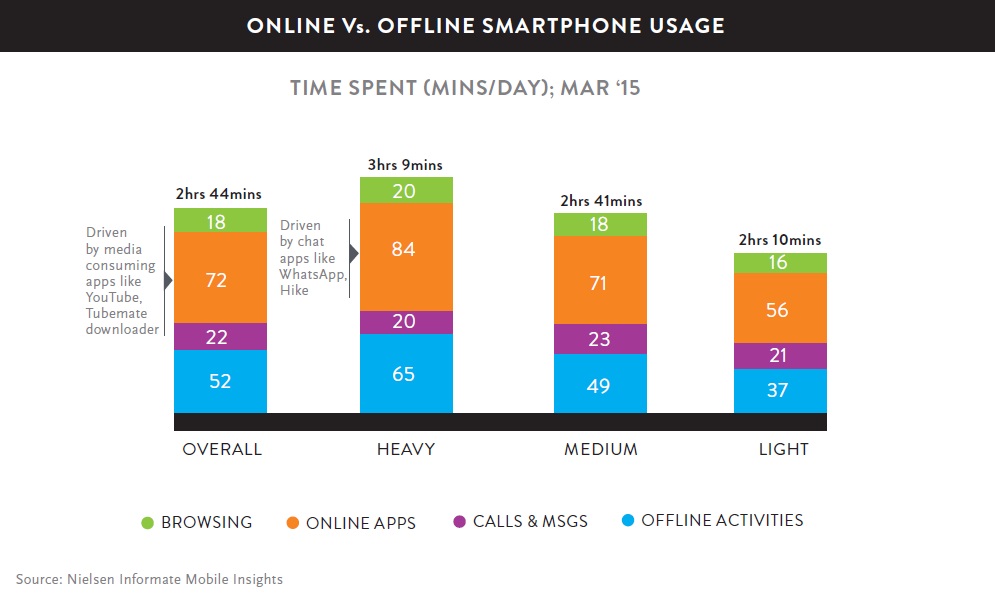

- The average Indian spends around two hours and 45 minutes per day on their smartphone.

- 33% of Indian smartphone users who access internet on their phones are ‘super consumers’ given their high engagement levels.

- Smartphone is seen not just as a tool for social media, but also a key enabler for information, entertainment and payments on the go.

India is an exciting destination for all retailers, but telecom service providers in particular have a more prominent twinkle in their eye as they view mobile sales figures. Narrowing price differences and a wider array of features have ensured that one in three phones shipped this year will be a smartphone. What’s more, market watchers believe these volumes will only grow, making India the market with the highest smartphone growth rate, surpassing even China.

Today, Indians increasingly want more from their phones than just the ability to make and receive calls. 3G and a host of mobile applications are helping the relationship between the Indian consumer and his smartphone blossom. The average Indian spends around two hours and 45 minutes per day on his or her smartphone. This is one of the highest usage statistics globally. Users in the U.S., for instance, spend only two hours and 27 minutes on their phones in comparison.

The Telecom Super Consumer

While these numbers are impressive, a more interesting phenomenon has been the increase in a certain type of consumer. Heavy users of the Internet are also substantially more involved with their phones than regular consumers. Although 33% of smartphone users heavily use internet on their phones, these “Super Consumers” can be very influential in trendsetting and influencing behaviours. They are also a huge area of opportunity for marketers of mobile applications, online products and digital services.

So Who Is This Super Consumer?

Based on data usage habits, we segmented smartphone users into three groups – heavy, medium and light. While the top 33% and the bottom 33% constitute heavy and light users respectively, the remaining have been considered medium users.

The telecom super consumer typically is a tech-savvy, urban smartphone user and they utilize three times more data than regular consumers.

ONLINE VS. OFFLINE SMARTPHONE USAGE

The telecom super consumer is more engaged on their devices, both online as well as offline. In fact, they spend 33 percent more time on their phones compared to regular consumers. While they mostly use Wi-Fi, usage patterns indicate high consumption for mobile Internet using cellular data also among smartphone users.

Predictably, teenagers form a huge chunk of the super consumer strata. We found that the age group of 18 to 24 years spent approximately three hours per day on their smartphones. Also not surprising is the fact that the mobile world tends to feature more participation from men—80 percent of smartphone users are male while just 20% are female.

There is a distinct correlation between the type of phone used and data usage patterns. Easy navigation and advanced operating systems (OS) enable frequent application downloads and media consumption, contributing to increased data consumption. Super consumers seem to favour the Android OS while users of the Symbian OS largely fall into the light user space.

The Good News

Super consumers present a big opportunity across the telecom industry, as these heavy users are also the ones ready to pay that extra buck for any useful and relevant services. Given their high engagement, they will also be willing to adopt newer services ahead of the curve. As a result, they present a very good opportunity for test marketing of newer services and applications.

However, for retailers and advertisers to cash in on this opportunity, it is highly imperative for the service providers to provide seamless data connectivity and experience. Super consumers are demanding a global experience, and poor broadband connectivity is still a huge challenge.

Nevertheless, preliminary forecasts indicate that smartphone usage in India is likely to exceed 45% by 2020. Reliable networks, as well as wider arrays of apps and digital solutions will positively affect numbers within this sector. More importantly, it will significantly change the way users interact, whether personally or professionally.

For more details, download the full report (top right).