When President Obama announced last year that reforming the practices of credit card companies would be a top priority, many consumers hit hard by the recession cheered. Congress passed the Credit CARD Act in May 2009 to provide more disclosure to consumers about credit terms and to reign in what were viewed as abusive practices by financial service companies. Now that the law has gone into effect, consumers are confused, ambivalent – and some even angry – about it, according to new research by The Nielsen Company.

Nielsen BuzzMetrics reviewed 8,000 discussion forums, 45,000 Usenet forums and more than 135 million blogs to gauge consumers’ thoughts on this law, with particular focus on the following issues:

- How are consumers reacting?

- How are card companies communicating changes?

- What actions do consumers plan to take?

- Who is to blame?

- Which companies are being implicated?

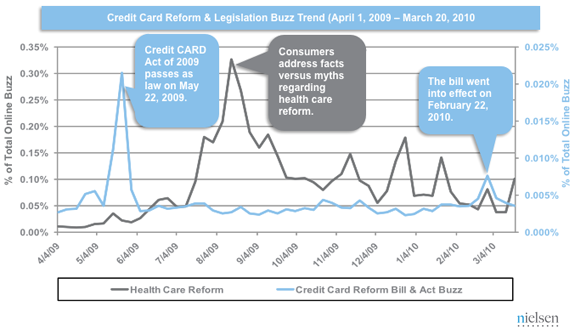

Online buzz spiked at the end of May 2009 as Congress passed the Credit CARD Act, and then tapered off until the end of February 2010, when the law went into effect. Overall, however, this discussion about this issue paled in comparison to the rancorous health care reform debate, which took center stage for much of 2009.

Almost immediately upon the President’s signing the bill into law, online sentiment began to turn against it. A USA Today post on the law received more than 600 comments – most of them quite negative. Many people thought that the legislation did not go far enough in protecting consumers, while others felt the new law penalized those who were responsible credit users. Meanwhile, there was widespread belief that card issuers would find loopholes for raising fees and interest rates prior to the law’s enactment.

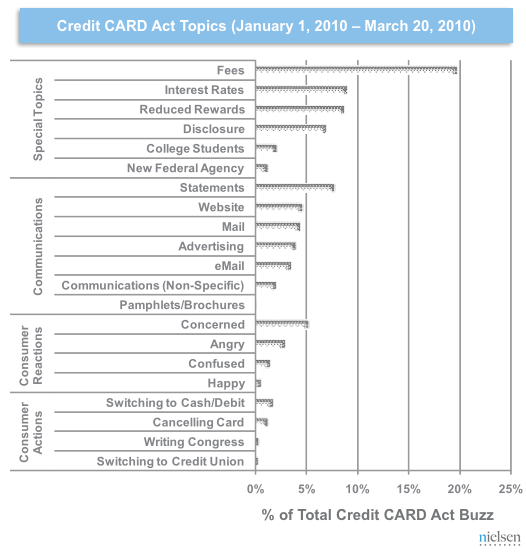

Overall, consumers seem concerned about how the law changes the use and availability of credit. They said that their credit issuers communicated with them primarily through statements or via a web site. A fair number of people went online to search for information about the law and how it might affect them. Financial and political web sites were the top destinations for online discussions, and searches on Google and other engines are being actively used by consumers to learn more about the law. So what actions might consumers take in response to this law? Switching to cash or debit cards was the top action, followed by canceling credit cards.

“It was a little surprising to see the widespread negative or ambivalent consumer sentiment towards the credit card reform law. What was initially hailed as an important step in protecting consumer rights quickly turned into an exercise of public mistrust of both financial service companies and the government. As we have seen with the health care reform debate, many Americans think that companies will find ways around the law and find new sources of revenue,” said Ron Coyle, Lead Analyst at Nielsen BuzzMetrics. “Now that the law is in effect, buzz about the topic will likely quiet down. But it will be interesting to see how consumer sentiment about this law changes.”