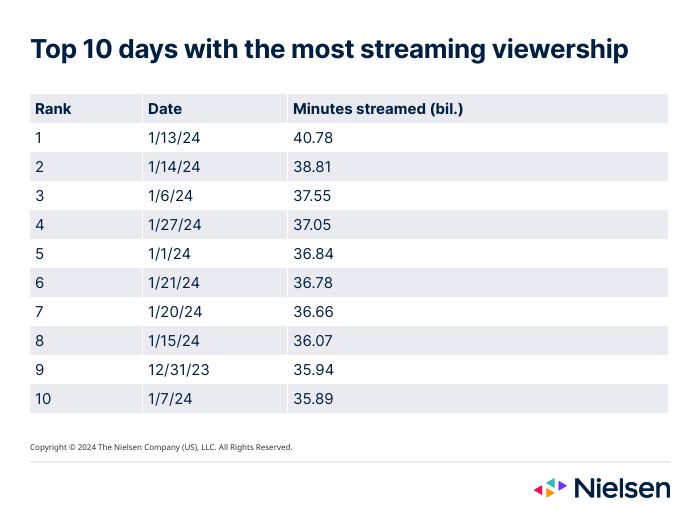

Audiences stream a record 40.8 billion viewing minutes on Jan. 13, 2024

Chilly weather, coupled with the excitement of the NFL playoffs, helped boost total TV viewership 3.7% in January. While historically characteristic for the month, the uptick was perhaps more noteworthy because it was 1.4% above its level last year—a reporting period that was longer and wasn’t in short supply of new programming. In fact, January 2024 included three of the top 10 days with the most TV viewing since Nielsen began producing The Gauge in May 2021.

While football is always a heavy driver of TV viewing, colder-than-usual weather played a role in TV viewing in markets that aren’t as seasonally cool, including Tulsa and Portland, where TV viewing increased 10% and 7%, respectively. And in Tampa, the cooler temps and the Buccaneers’ playoff run combined to bolster TV viewing by 14% on a year-over-year basis.

The power of the NFL playoffs also rippled into the streaming landscape, as the Wildcard game between the Miami Dolphins and Kansas City Chiefs on Peacock generated almost 3.9 billion viewing minutes (including local viewing in Kansas City and Miami), and helped Jan. 13, 2024 take the crown for having the largest daily volume of streaming on record. In total, January 2024 included nine of the top 10 days with the highest streaming volumes ever recorded by Nielsen, with New Year’s Eve 2023 (which was recorded in the December interval) sneaking in at No. 9.

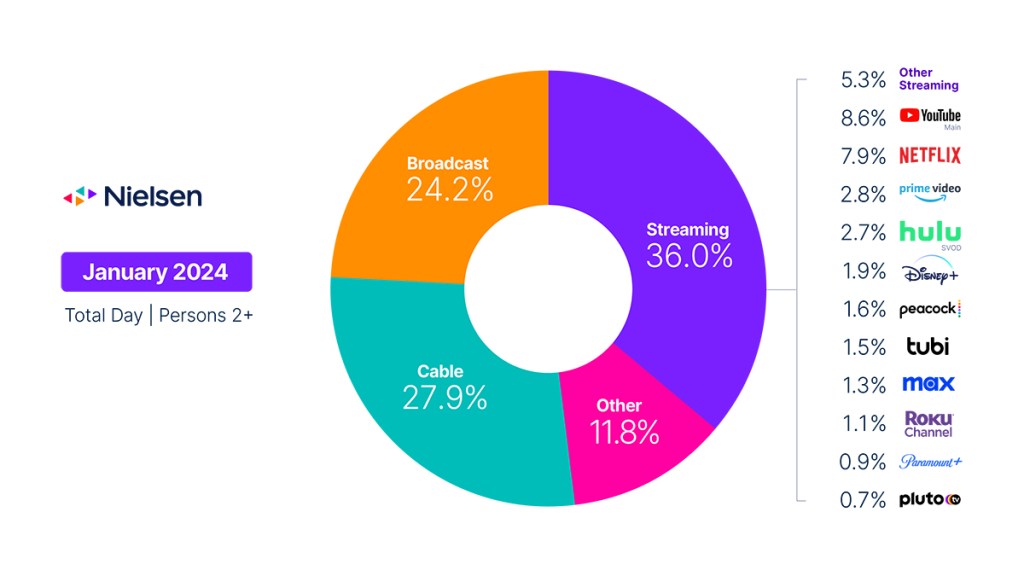

In addition to colder weather, January welcomed the beginnings of new, scheduled drama programming, which accounted for a 20% increase in viewing on broadcast networks. NBC’s Chicago franchise (Chicago Fire, Chicago Med, Chicago P.D.) led the way, representing some of the first “new” scripted content of the broadcast TV season. Combined with a 36% rise in sports viewing, broadcast was able to grow its share of TV by 0.7 share points to end the month at 24.2% of TV. With the arrival of new programming still somewhat limited, however, broadcast viewing was down 20% compared with a year ago.

Cable viewing was up 2.7% in January, but the rise in total TV usage resulted in a 0.3 share point loss to land at 27.9% of TV. Seasonality played a role here, as viewers transitioned away from holiday-themed movies, which led to a decrease of more than 19% in feature film viewership. Comparatively, news viewing picked up, accounting for 19% of overall cable usage, with the Iowa Town Hall on Fox News Channel becoming the only non-sports program to land in the top 10 cable broadcasts (excluding sports commentary). And while sports programming was less prevalent on cable, football games dominated the most-watched programs, including the College Football Playoff game between Michigan and Alabama on New Year’s Day, which took the top spot with 26.1 million viewers.

Like broadcast, streaming also benefited from the return of new scripted programming, with Fool Me Once on Netflix topping the list of most-watched programs with 6.5 billion minutes—the first time an original has topped the streaming charts since Queen Charlotte – A Bridgerton Story did so in May 2023. Bluey, on Disney+, and Reacher, on Amazon Prime Video, were close behind, with 5.5 billion minutes and 4.3 billion minutes, respectively. In total, streaming usage was up 4.1% in January.

At the platform level, YouTube marked its 12th consecutive month as the top streaming service. Peacock saw a 29% spike in usage, driven by NFL playoff coverage, to account for a record 1.6% share of TV. Netflix gained 0.2 share points to end the month at 7.9% of TV, its highest since August 2023, and the 10% increase in Roku Channel usage bumped its share back to 1.1% of total TV.

February, in addition to including viewership for the Super Bowl, will mark the formal start of an abbreviated broadcast TV season, which could offset some of the viewing declines that typically follow the end of the NFL season. With spring not yet on the horizon, the continued arrival of new content across traditional and streaming channels will likely keep audiences engaged until warmer weather arrives.

January data trends with Brian Fuhrer

The Gauge provides a monthly macroanalysis of audience viewing behaviors across key television delivery platforms, including broadcast, streaming, cable and other sources. It also includes a breakdown of the major, individual streaming distributors. The chart itself represents monthly total television usage, broken out into share of viewing by category and by individual streaming distributors.

Methodology and frequently asked questions

How is ‘The Gauge’ created?

The data for The Gauge is derived from two separately weighted panels and combined to create the graphic. Nielsen’s streaming data is derived from a subset of Streaming Meter-enabled TV households within the National TV panel. The linear TV sources (broadcast and cable), as well as total usage are based on viewing from Nielsen’s overall TV panel.

All the data is time period based for each viewing source. The data, representing a broadcast month, is based on Live+7 viewing for the reporting interval (Note: Live+7 includes live television viewing plus viewing up to seven days later for linear content).

What is included in “other”?

Within The Gauge, “other” includes all other TV usage that does not fall into the broadcast, cable or streaming categories. This primarily includes all other tuning (unmeasured sources), unmeasured video on demand (VOD), audio streaming, gaming and other device (DVD playback) use.

Beginning with the May 2023 interval, Nielsen began utilizing Streaming Content Ratings to identify original content distributed by platforms reported in that service to reclassify content viewed via cable set top boxes. This viewing will credit to streaming and to the streaming platform which distributed it. It will also be removed from the other category, where it was previously reflected. Content not identified as original within Streaming Content Ratings and viewed through a cable set top box will still be included in other.

What is included in “other streaming”?

Streaming platforms listed as “other streaming” includes any high-bandwidth video streaming on television that is not individually broken out. Apps designed to deliver live broadcast and cable (linear) programming (vMVPD or MVPD applications like Sling TV or Charter/Spectrum) are excluded from “other streaming.”

Where does linear streaming contribute?

Linear streaming (as defined by the aggregation of viewing to vMVPD/MVPD apps) is excluded from the streaming category as the broadcast and cable content viewed through these apps credits to its respective category. This methodological change was implemented with the February 2023 interval.

What about live streaming on Hulu and YouTube?

Linear streaming via vMVPD apps (e.g., Hulu Live, YouTube TV) are excluded from the streaming category. ‘Hulu SVOD’ and ‘YouTube Main’ within the streaming category refer to the platforms’ usage without the inclusion of linear streaming.