Long gone are the days when consumers had only one option to view their favorite TV show. Today, the content options are seemingly infinite, and so are the places they can tune in. Whether it’s watching at a friend’s house, in a waiting room at a doctor’s office or at the workplace, consumers are taking their viewing habits out-of-home (OOH) and wherever the road takes them. That’s why understanding this independence from viewing content at home is vital in helping inform marketers on their total audience.

There’s no dispute that news and sports are the leading beneficiaries of OOH viewership. But an in-depth, year-to-date analysis of OOH TV viewing data from the Nielsen Total Audience framework highlights that many other genres benefit. In our first look at this data, we shed light on how this tune-in is adding new viewers to contestant competitions, game shows, comedy entertainment and audience participation content.

In the first six months of this year, across English-language broadcast networks that aired content from these genres, the average audience lift was 5%. From an audience perspective, that equates to nearly 300,000 more viewers ages 6 and older per telecast. When we drill down to examine the OOH impact among viewers 18-49 for these program genres, we see that the additional average of nearly 115,000 viewers per telecast equates to an average lift of 8%. For Spanish-language networks, these types of shows deliver an average increase of 6% lift.

Who’s Watching?

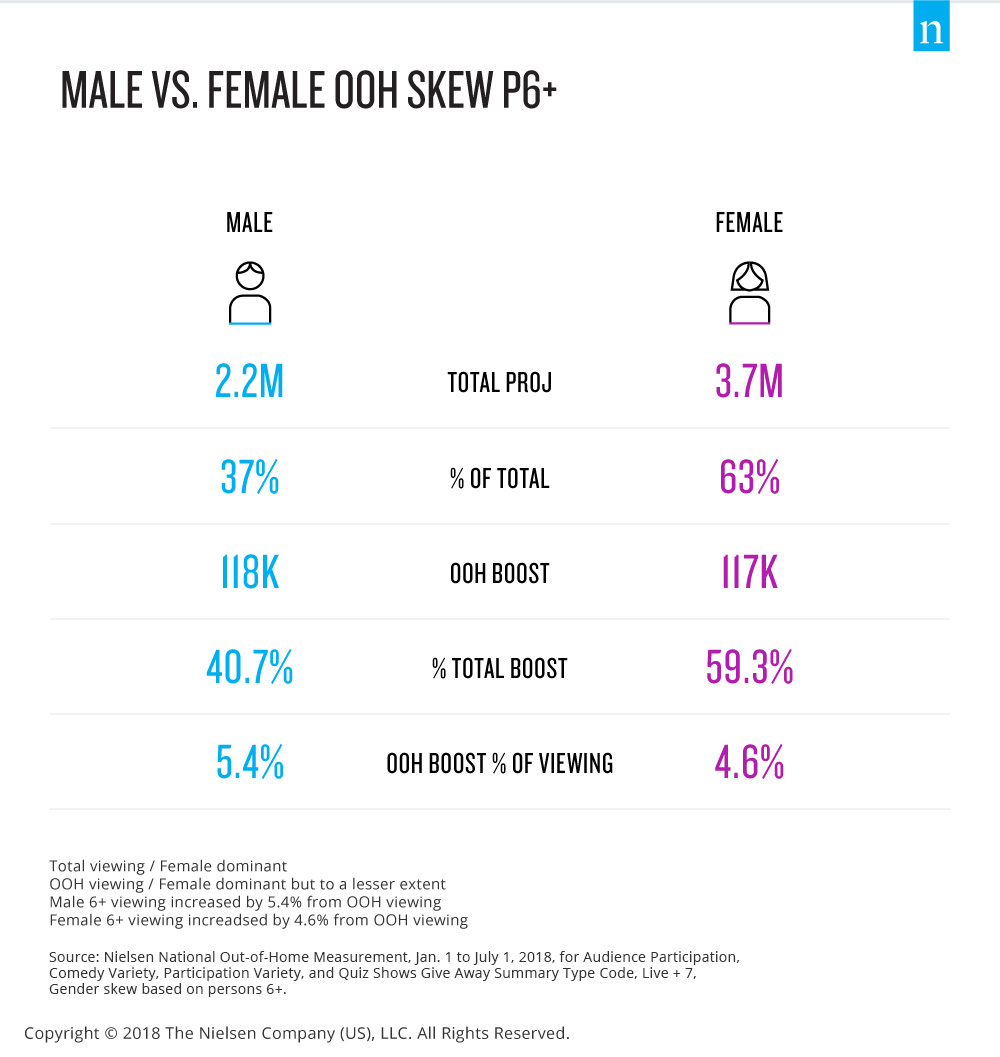

Understanding the gender skew among the viewers tuned into these program genres can prove valuable to both media buyers and sellers, largely because findings from the in-depth analysis uncovered some interesting preferences from male and female viewers.

For example, 63% of the total broadcast tune-in for contestant competitions, game shows, comedy entertainment, and audience-participation shows is female. With OOH, however, that concentration drops to 59%. Overall, OOH viewing across these genres adds nearly 175,000 female and nearly 120,000 male viewers per telecast. For cable, OOH viewing is consistent across males and females.

Broadcast TV is Reaping the Fruits of OOH

But there’s more to the lift picture than just program genre. Individual programs are enjoying healthy audience and percent lift from OOH viewing. When we looked at how OOH affects the top 10 broadcast programs for persons 6 and older and persons 18-49, we see that they experienced up to a 20% percent audience lift in the first half of 2018. Across the top programs among the main English-language broadcast networks for persons 6 and older, OOH added more than 500,000 additional viewers to the top two telecasts.

For those same programs, OOH added at least 205,000 more viewers in the 18-49 demographic—that’s at least 40% of their total OOH audience. Compared with national viewing, OOH generated more than an 8% lift for the top program (Participation Variety 1) and a 5.3% lift for second-ranked program (Participation Variety 2).

With OOH, Spanish-Language Broadcast Networks See Double-Digit Percentage Lifts

Similar to English-language stations, OOH contestant competitions, game shows, comedy entertainment, and audience participation programming on Spanish-language broadcast networks delivered an impressive audience and percent lift during the first-half of 2018. While contestant competition programs are at the top of the OOH pyramid for English-language broadcast networks, comedy entertainment is the OOH genre of choice for most Hispanic viewers among the top 10 programs. Nevertheless, a quiz show program took home the top crown among Spanish-language networks for persons 6 and older and persons 18-49 in terms of OOH audience lift.

For specific Spanish-language content that aired during this period, OOH delivered double-digit percentage lifts for seven of the top 10 programs among viewers 6 and older. During the period, a quiz show was the No. 1 program from an OOH perspective, as just over 81,000 viewers watched it away from their homes, generating a 10% lift over the national viewing (in-home) among viewers 6 and older. And what’s even more impressive is the core buying demo, persons 18-49, accounted for 55% of this program’s total OOH audience.

Among Spanish-language networks, OOH offers an unprecedented opportunity to reach younger viewers and those that matter most to advertisers. In the first six month of 2018, eight of the top 10 OOH programs delivered double-digit percentage lifts among viewers 18-49. For the top five programs, this demo represented between 49% and 55% of the total OOH audience. This is an opportunity to reach younger consumers that marketers simply can’t overlook.

Cable TV: OOH Viewers Love Comedy Variety But Participation Variety Ranks as the No. 1 Program

Historically, cable news and sports programs have carried a large share of the OOH viewing minutes; however, consumers are watching other types of cable content outside of the home. The contribution of OOH viewing to cable programs isn’t just bringing in additional viewers; it’s bringing in viewers in the key buying demo (P18-49). Across audience participation, comedy entertainment, contestant competition and quiz show programs, OOH viewers aged 18-49 delivered over 4% lift in the first half of 2018. For individual programs across these same genres, the OOH lift for among people 6 and older and 18-49 extends up to nearly 22%.

But which of the four genres reviewed is most prevalent on cable?

During the first half of 2018, contestant competition programs were most popular on broadcast from an OOH perspective, and comedy entertainment programs were most popular on cable. Of the genres analyzed, comedy entertainment programs accounted for six of the top 10 programs among people 6 and older as well as people 18-49.It’s also important to note that while OOH cable viewers prefer comedy entertainment, a contestant competition program was the No. 1 show. Through the OOH lens, a single cable contestant competition telecast added nearly 47,000 additional viewers, representing a 3.7% lift over national viewing. Nearly 30,000 of those viewers were 18-49, accounting for 62% of the total OOH audience. And while broadcast TV delivers more OOH viewers from the key 18-49 buying demo, cable attracts a larger share of this group for a program’s overall audience. For the top six audience participation, comedy entertainment, contestant competition and quiz show programs, this group accounts for 62%-90% of the telecast audiences, a very desirable target for any advertiser.

With marketers demanding higher accountability for their media buys, it’s important to maximize all opportunities to reach the right consumers. And while News and Sports command a significant number of OOH viewing minutes, other program genres provide ample opportunity to reach unique consumers outside of the home. Unscripted content like game shows, contestant competitions and audience participation programs all seemingly provide content that audiences are willing to enjoy from the comfort of outside their own home.

As consumers continue to watch content on their own terms, especially the core media buying demo, OOH viewing offers networks and agencies additional audiences to consider as part of their media negotiation process.