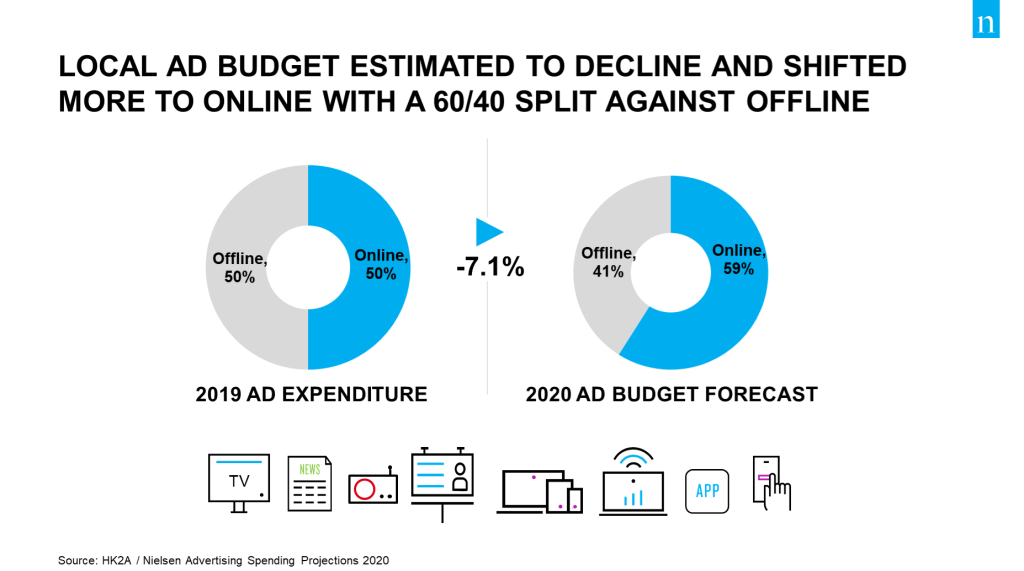

Spending has remained cautious in Hong Kong amid multiple uncertainties concerning economic and social climates. The split between online and offline advertising spending is expected to shift from 50/50 last year to 60/40 this year, while ROI on advertising investment, especially online, will continue to increase in importance.

Amid concerns with job prospects and financial security, Hong Kong’s consumers are increasingly conservative with spending, reflected by a new low in Consumer Confidence Index (CCI) at 83 during the last quarter of 2019, compared with 99 at the end of 2018. Against this backdrop, Hong Kong’s advertisers forecast an even tougher year ahead in 2020.

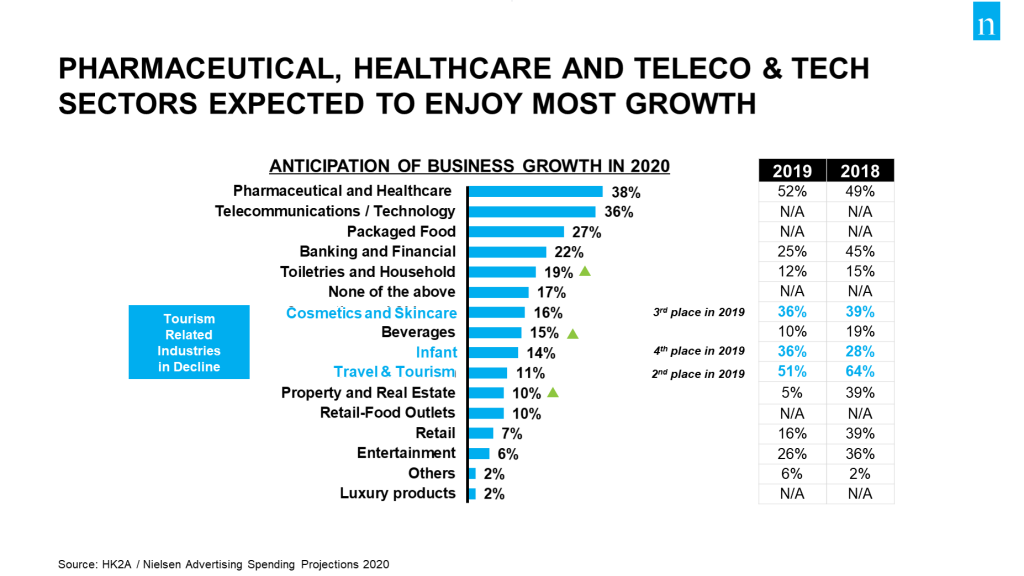

The figures, which come from the latest Advertising Spending Projections Survey conducted by Nielsen in collaboration with the Hong Kong Advertisers Association(HK2A), show that brands will continue to use advertising to defend market share in the coming year. Advertisers predict most growth in the Pharmaceutical & Healthcare, Telecom & Technology and Packaged Food sectors and least growth in Luxury, Entertainment & Retail in 2020.

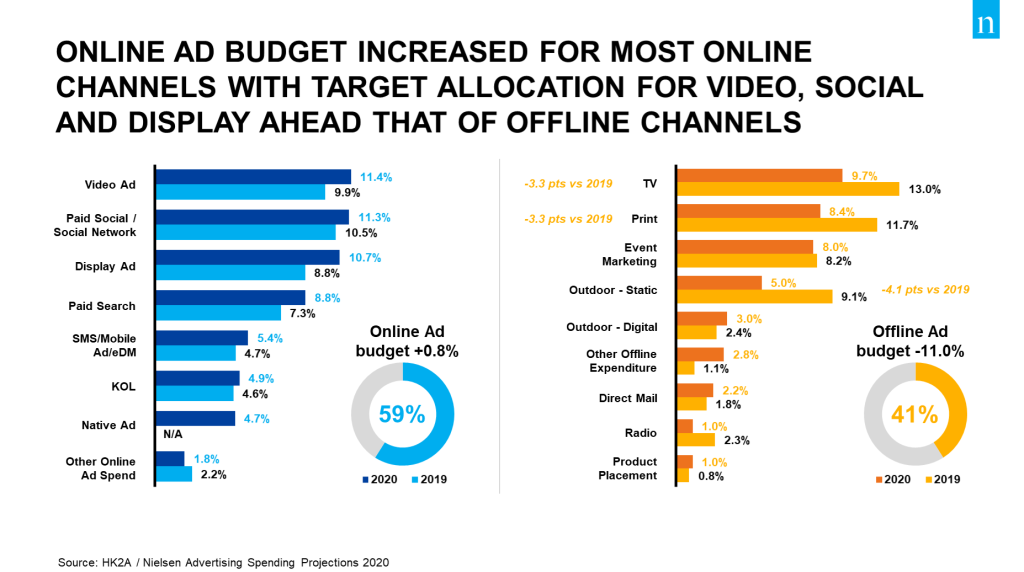

Half of the responded advertisers expect a decrease in advertising budget in 2020. Following a 1.4% increase in 2019, the advertising budget is expected to reduce 7.1% in 2020. The decline is mainly contributed by an 11% budget cut for offline advertising, while the budget for online advertising expands by a marginal 0.8%. It should be noted that the actual decline might be even deeper as the true impact of the coronavirus outbreak is not included in the research conducted from the end of 2019 to early 2020. The online advertising budget is set to increase for most online channels in 2020, led by video ad, paid social / social network and display ad, accounting for 11.4%, 11.3% and 10.7% of the total budgeted spend respectively. In terms of offline advertising, TV, print and event marketing will be allocated the most advertising budgets.

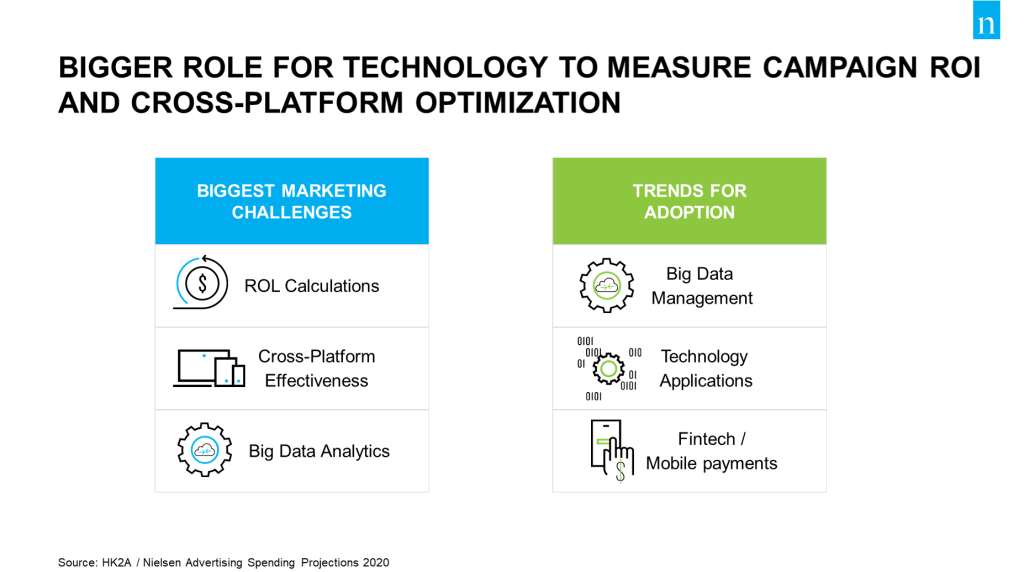

Under such circumstances, more investment is expected in the measurement of advertising effectiveness as a result of the increased need to pursue return of investment (ROI) on advertising spending. According to the survey, most advertisers (44%) say ROI calculation is the No. 1 challenge for marketers. Research shows that advertisers are more inclined to spend on research for online advertising effectiveness evaluation in 2020, echoing the results that online advertising will be allocated more advertising budget.

Of the responded advertisers, 83% expect an economic downturn in the territory over the coming year. They in general expect it would take at least six-12 months for the rebound to take place and feel. Hong Kong’s economy is likely to remain on a weak footing in 2020 and will be subject to high uncertainties.

“Under current economic uncertainties, marketers should always be ready to adopt and integrate new technology for successful marketing strategies. We need to keep abreast of different media platforms to optimize various opportunities,” said David Yeung, Chairman of the Hong Kong Advertisers Association.

Technology has proven to be the most critical supporting system to ensure timely and accurate decision making, with Artificial Intelligence (AI) playing an increasing role for the implementation. “The tough economic situation can be a good differentiator for those who know how to adopt technologies to stand out from competitors. Whether they can turn potential crises into opportunities with the smart and cautious allocation of advertising budget, with the aid of state-of-the-art technology, is critical to business survival in the coming year,” Clare Lui, Vice President, Media, Nielsen Hong Kong, suggested.

Methodology

The Advertising Spending Projections 2020 survey was conducted in two waves by Nielsen, from November 29, 2019 to January 14, 2020 for an online survey and from February 5 to 21, 2020 for executive interviews. The survey covered various commercial sectors including top-spending advertisers and concentrated on both their planned advertising spending and business focuses in 2020. Close to a hundred self-administered questionnaires were received from key advertisers and screened for final analysis, which provide timely reference on the trends of advertising expenditure, media selection and planning and the media landscape for 2020. Telephone interviews were also conducted with randomly selected advertisers for qualitative feedback.