With iconic superheroes, action-packed first-person shooters and fast-paced sports action, today’s video gaming industry is certainly not short on energy or flash. And given the hype around many of the industry’s most-anticipated game franchises, it’s easy to lose sight of the genres that don’t have a popular brand like Marvel or Madden promoting them—as well as who’s engaging with them.

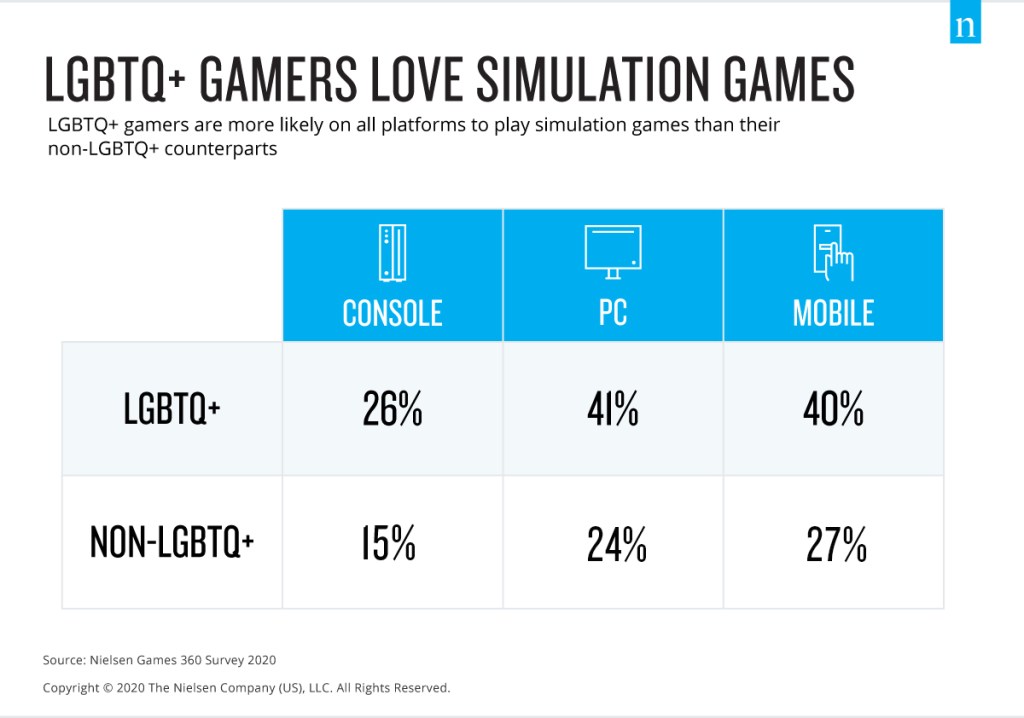

Simulation games—those that span a super-category of immersive gameplay allowing users to simulate real world activities—inherently move at a different pace than role-playing, adventure and sports games, but they’re a go-to favorite among many players in a key gaming demographic: the LGBTQ+ community. In fact, Nielsen’s 2020 Games 360 Survey found that LGBTQ+ gamers are significantly more likely to play simulation games across all platforms than their non-LGBTQ+ counterparts.

As video games and digital channels remain at the forefront of the modern entertainment experience, it’s clear that the gaming industry should continue innovating to keep audiences engaged and online. Given the LGBTQ+ community’s penchant for simulation games, the industry stands to gain by amplifying its efforts in this sub-genre. According to SuperData, a Nielsen company, the simulation game audience accounted for 13% of the U.S. games audience last year and accounted for $1.5 billion in revenue.

In addition to gravitating more frequently to simulation games, LGBTQ+ consumers are younger (33 vs. 44) and more likely to have a gaming system (54% vs. 44% [non-LGBTQ+ consumers]) than the general U.S. population. They also spend more money on video games each month ($13.14 vs. $10.40) and amplify their experience along the way, as they’re much more likely to own a specialized headset for media/music than the general population (29% vs. 19%) and continue the conversation online via gaming social media platforms like Twitch and Discord.

While the video game industry has been growing steadily in recent years, it’s been among the industries best suited for the new normal that the novel coronavirus (COVID-19) has forced on consumers. With a shift toward life online, a Nielsen study found that 82% of global consumers were passing the time at the height of shelter-in-place restrictions earlier this year by playing video games and watching video game content. And the increase was highest in the U.S. (46%), followed by France (41%), the U.K. (28%) and Germany (23%).

Now, eight months into living in a pandemic, many of our media behaviors have largely normalized, while the gaming industry continues to adapt to a more virtual world—a world where games have become a place to hang out with friends, see a concert and participate in other communal experiences. That increased engagement is good news for the games industry, as worldwide digital game revenue was up significantly in March, April, May and June of this year on a year-over-year basis.

And when we look at spending intent, Nielsen’s 2020 Games 360 Survey highlights how LGBTQ+ gamers spend more money than the general public across devices and services.

Importantly, the COVID-19 pandemic has not deterred this group’s video gaming appetite. September 2020 data from Nielsen Scarborough shows that LGBTQ+ households are 25% more likely to own a game console than the general U.S. population and are 91% more likely to be planning to buy a new one in the next 12 months.

While Americans’ media consumption has been trending up in recent years, there’s no mistaking the early spring spike brought on by the COVID-19 pandemic. The latest Nielsen Total Audience report found that Americans now spend 12 hours and 21 minutes with media per day, which is up nearly an hour from the previous year. As the U.S. prepares for the colder fall and winter months, many will turn to media options as social distancing remains the safest way to stay healthy. And if the options are there, many in the LGBTQ+ will be in search of simulation options as they seek to get their gaming fixes.