Digital redefined, and now dominates, the music business landscape. Whether downloaded, streamed or watched on a computer or mobile phone, the hyper-fragmented world of music offers unprecedented opportunities and challenges where both the consumer and the industry need to find their way. A recent Nielsen global survey of 26,644 online consumers across 53 countries explored the music industry’s toughest questions: how to optimize marketing and how maximize revenue in a digital and increasingly mobile world.

You can download all of the reports at Nielsen.com

Putting a price on music’s value

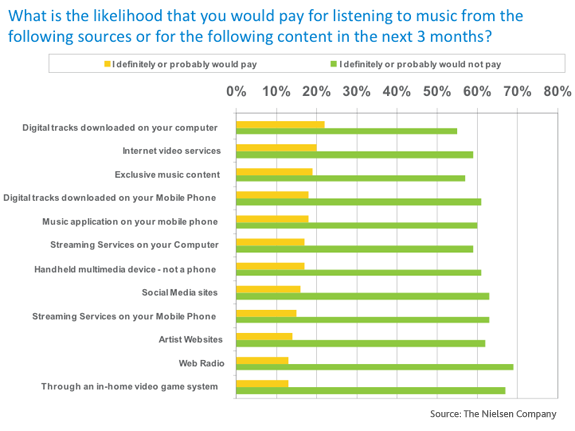

With more music available than ever from an unprecedented number of sources, we have seen that customers do use (and therefore value) music and the different channels. For content providers, understanding consumers’ willingness to pay for content and via what channel(s) will be essential to the industry’s future.

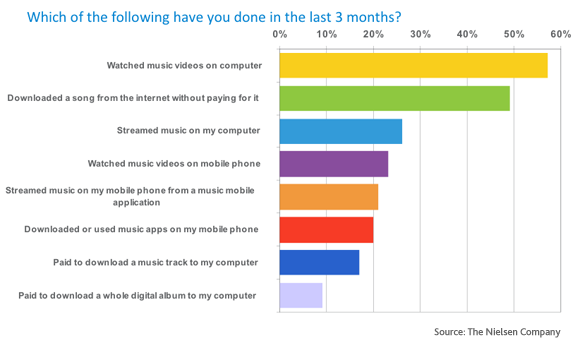

The most popular form of digital music consumption was the “watch” habit with 57 percent of respondents having watched music videos on computers in the last three months. Other popular forms of consumption were streaming music on a computer (26%), streaming music on a mobile phone (21%), watching music video on mobile phones (23%) and downloading or using music apps (20%).

The sources for consuming music are as diverse as consumers’ willingness to pay. The industry is continuing to investigate alternate revenue streams and the broad approach makes sense as consumers diversify their digital music sources.

Music goes mobile

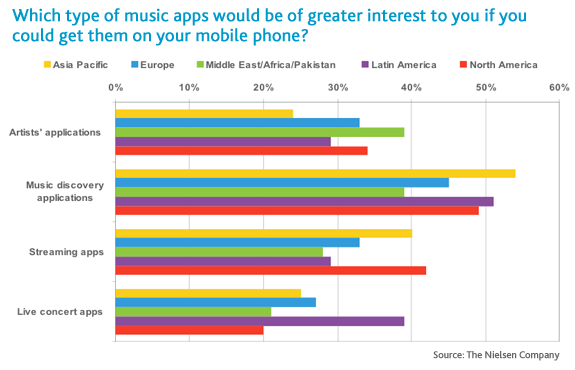

Mobile phone technology and increasing popularity of smartphones are providing a new and potentially lucrative revenue opportunity for the music industry. Especially among digital music’s early adopter 20-24yr segment, the mobile phone is fast becoming the mainstay of how they stay connected to the world (via internet) and how they listen to and increasingly buy music. More promisingly, nearly one in four (24%) of the 20-24yr old segment globally indicated they would be prepared to pay to download music videos on their mobile phone. According to the Nielsen survey, males aged between 20-24yr are the global early adopters for digital music consumption and industry marketers need to understand and anticipate the changing habits of this segment to develop viable revenue models. Generating the most interest to those looking for mobile music apps were music discovery tools and streaming apps.

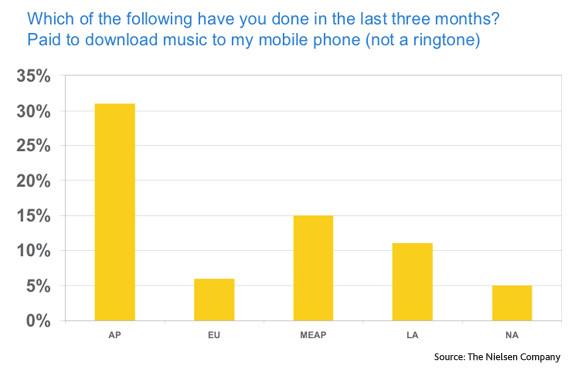

On a regional level, consumers in Asia Pac by far showed the highest activity for music downloads on mobile devices.

For more regional and demographic insights on consumers’ willingness to pay for music and more, download The Hyper-Fragmented World of Music, a series of reports released in conjunction with MIDEM at Nielsen.com.