To many football fans, the Super Bowl may feel like Groundhog Day (which, coincidentally falls one day before the NFL championship on Feb. 3), as the year’s biggest sporting event brings another round of family and friends gathering together to eat wings, drink beer, engage with ads and watch the New England Patriots vie for the championship (yet again).

And while that remains true to some extent, today’s viewing experience is far different from the one you enjoyed with your parents while you were growing up.

Yes, beer and wings are a staple of any Super Bowl, but a range of other categories are joining the party due to evolving tastes and the growth of the female football fan base.

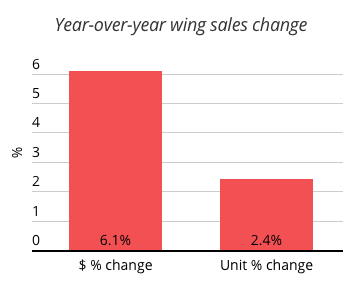

Chicken Wings: Less Processed and Convenience Wins for Wings

Frozen, fully cooked chicken wings still have a massive following, but with dollar sales down 7.9% year over year, consumers are signaling they want fresh, be it ones they cook or cooked for them. The deli counter wings remains a popular option for fully cooked chicken wings (with sales up 15% to $650 million from $565 million last year to $650 million); fresh meat wings have also skyrocketed, with sales up 31.4% in the past year.

Convenience comes in several forms, with the e-commerce landscape as proof. Online wing sales in the seven days leading up to and including the Super Bowl catapulted from $7,984,198 in 2017 to $11,562,723 in 2018, a 45% increase.

Alternate Food Options are Gaining Ground

Wings have staying power, but with a more health-conscious clientele, items like cauliflower provide a swapable option to add more veggies to the game day spread. As consumers take cues from restaurants making fried cauliflower dishes, cauliflower purchases across the store increased 19% year-over-year. On a day-to-day basis, 39% of Americans say they’re skipping meat protein and actively trying to include more plant-based foods in their diets. For example, more than a third of U.S. households say they follow a specific protein-focused diet such as high protein, Paleo or low carb.

Yet for all their health-conscious habits, Americans can’t stay away from cheese. Cheese doubled in online sales alone (from $442,230 on game day in 2017 to $894,505 on Super Bowl Sunday in 2018), demonstrating that everything is on the table for the hungry omnichannel shopper.

Female Tastes Are Altering the Adult Beverage Landscape

No surprise here: The female football fanbase is substantial. In fact, it’s held steady at about 46%-47% of total viewership from Super Bowl XLVII in 2014 to Super Bowl LII in 2018. Women contribute greatly to growing segments across the adult beverage landscape. They control $4.3 trillion (73%) of U.S. spending, and they’re the sole breadwinners in 40% of U.S. households with children. Marketers in the adult beverage industry are shifting from a once male-dominated marketing mindset to one with a more balanced, female focus—and with good reason.

While the on-premise (bar, restaurant) environment struggles on Super Bowl Sunday, breakfast and brunch proved popular for kicking off the day last year, as on-premise sales increased by 24% and 12%, respectively. One potential driver? Women are 32% more likely to drink cocktails on-premise than men, as they’re driven by their awareness of low-alcohol, brunch and wine cocktail trends.

Wine reigns supreme with women, remaining the most popular alcohol for off-premise sales among women. Hard seltzer, the relatively new, low-calorie flavored malt beverage (FMB) entrant, is also increasingly relevant during the big game, as Super Bowl sales have more than tripled since 2016, rising from 0.3% to 1.3% in 2018.

The base of female football fans, defined as women 21+ who watched (broadcast or cable) regular season NFL or the Super Bowl, have upped the ante for adult beverage consumption across the board. With regard to wine, 11% of female football fans drink Pinot Grigio, compared with 7.8% of the broader over-21 female population. But let’s not forget about beer, which is the top drink of choice for female football fans, as 38% choose the tried-and-true beverage. While the juicy/hazy craze has gotten plenty of attention, women are driving this more than men, as 63% enjoy it as a style, versus 60% of men.

Female or male, Super Bowl viewers continue to gravitate to the internet to make their alcohol purchases. Online wine sales jumped 46% from $716,792 on Super Bowl Sunday in 2017 to $1,047,993 on Super Bowl Sunday last year.

It’s Anyone’s Game

Some Super Bowl staples will last forever: count beer, wings and chips among them. But it’s a much more crowded space than it used to be, and marketers need to take note.

Methodology

The insights in this article were derived from the following sources:

- Nielsen CGA OPUS (On-Premise User Survey), Fall 2017

- Nielsen Homescan Panel survey, April 2017 (U.S.)

- Nielsen Measure Off-Premise Outlets: Super Bowl 2018 (two weeks, week ending 02/10/18), Super Bowl 2017 (two weeks, week ending 02/11/17),

- Super Bowl 2016 (two weeks, week ending 02/13/16)

- Nielsen NNTV Program Report, Super Bowls XXXIII-LII

- Nielsen Panelviews survey, March 2017 (Canada)

- Nielsen Retail Measurement Services, Jan. 2018-Jan. 2019

- Nielsen Scarborough, Total US 21+ (2018 Release 1, Dec 2016 – May 2018)

- Nielsen Scarborough, June 2016-Nov 2017

- Nielsen Total Food View, Aug. 2017-Aug. 2018

- Rakuten Intelligence E-commerce Daily Sales (Jan.-Feb. 2017, Jan.-Feb. 2018)

- The Harris Poll, July 26-30, 2018