Chuck Schilling

Hi! I’m Chuck Schilling, Research Director for Agency & Media Analytics, and one of the more recent additions to the Nielsen Online team. For my first of many blog posts, I’m going to focus on what I know best – print media brands. My career path has taken me through the offices of most major print publishers – both as an employee and consultant – so I can say with a certain level of confidence that the economic pressures felt by these once-reliable ad revenue generators are unprecedented.

Back in 1995, there was a bit of an uproar when a major magazine publisher dared raise its ad rates while cutting circulation, boldly attempting to pass on its growing cost structure (increased paper, postal, printing, distribution, renewal costs) to advertisers. This happened at a time when consumer publications were shifting their traditional revenue model from equal shares circulation and advertising revenue to one dominated by advertising. This was also about the same time that a content-starved Internet was emerging as a consumer medium, and dial-up online service providers such as Compuserve and AOL actually paid media companies for the privilege to carry their high-quality content.

Fast forward 13 years and the tables have turned, with print media companies left holding the bag. Why? Well, some of it was their own doing. During the last decade or so, many print companies engaged in subscription practices that grew their rate bases to artificially inflated levels (higher rate bases mean higher rates can be charged for an ad), while simultaneously liberally discounting their higher published ad rates. As a result, much of the industry’s perceived vitality was in fact illusory. At the same time that the primary target audience was being diluted, costs – including those associated with building, updating and maintaining world-class media websites – were on the rise, all of which has led to serious consequences. Recently, we’ve seen drops in circulation, significant layoffs, the shuttering of the Christian Science Monitor’s print edition, the Chicago Tribune’s bankruptcy, and a possible rate base reduction for Newsweek from a circulation of 2.6 million to 1 million – and this is just the beginning according to many industry reports.

On the ad sales front, newspapers have been hit particularly hard. The Newspaper Association of America (NAA) recently reported that newspaper print ad revenues were down 16% for Q2 ’08, continuing a two year decline. In at least one notable case, this trend has led to an ironic twist in their ad sales proposition. A couple of months ago, we noticed a NYTimes.com ad that offered a *free* print ad for advertisers that bought an *online* ad. True, this example is for a lowly job listing, but it shows how far print’s fortunes have changed in a short while. It was only a few years back when a significantly pricier print schedule tossed in an online schedule as added value.

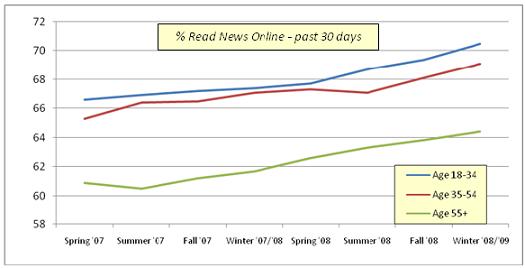

All is not lost, but the future for those that survive won’t be easy. Besides the necessary game-changing restructuring that must be take place, newspaper and magazine print brands must maintain their high-quality editorial reputations, and convince audiences and advertisers they should pay more for a premium experience. Moreover, these companies have heard it over and over, but now they must take heed – the audience they counted on for ever-increasing circulation levels has changed behavior and flocked to the web as a primary, more timely news source. Overall, two-thirds (67.7%) of all adults who went online in the past 30 days read News online – and we’re not just talking people under 35 years old.

Source: Nielsen Online, @Plan

We here at Nielsen Online are looking to support our branded print (and other) media clients in a number of ways, including looking at ways to measure the importance of a trusted media environment both to a user’s feelings toward the editorial and advertising, as well as the positive associations that benefit advertisers as a result of living in that trusted environment.

More to come!