Venkatesh Bala, Chief Economist, The Cambridge Group

SUMMARY: Consumers around the world are hungry for access to information and communication, especially in countries with a growing middle class. Defying classic economic models, the demand for communication (cell phones) leads traditional media growth, signifying a global, disruptive phenomenon. The demand for information via the Internet follows slower, more predictable growth patterns. The implications for marketers: lead with mobile advertising in high-growth, emerging economies.

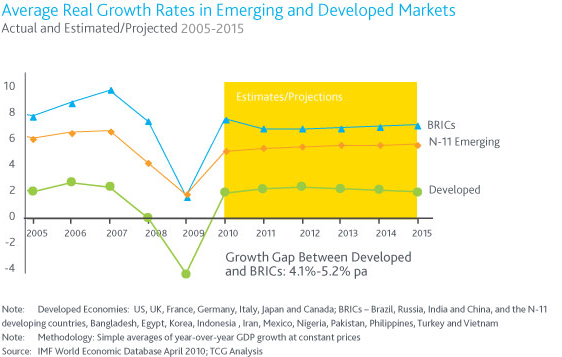

The demand for information and communication is being reshaped around the globe, especially in countries with a growing middle class such as the Russia, India and China and some N-11 (Bangladesh, Egypt, Indonesia, Iran, Nigeria, Pakistan, the Philippines, South Korea, Turkey and Vietnam) economies. Recent projections from the International Monetary Fund indicate that over the next five years, growth in real Gross Domestic Product (GDP) in emerging markets will be substantially higher than in developed economies.

Notably, the large BRIC economies are expected to expand by four to five percentage points more each year from 2010-2015 than the established markets of G-7 nations including the U.S., U.K., France, Germany, Italy, Canada and Japan.

New Markets, New Models

Market players in media, telecommunications, consumer products and financial services seeking to reach the rising middle class in forming markets will need to re-think standard market development approaches. The key to success lies in understanding the unique ways in which the demand for information and communication will evolve, and how those patterns differ from established countries.

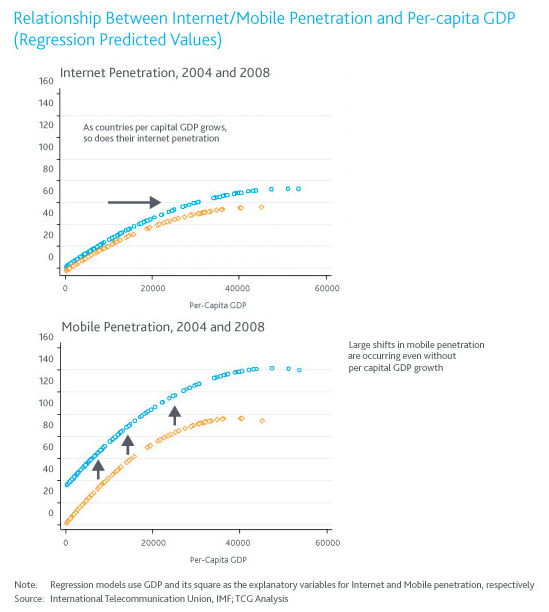

A simple way to think about the demand for information and communication is to examine Internet and mobile phone penetration for every 100 people in a country. Analyzing the relationship of those two technology penetration levels with other variables such as income and time provides a good forward looking window into demand evolution.

Defying Classic Economic Models

The difference in Internet (information) and mobile phone (communication) patterns and trends between developing and emerging economies is striking. Internet penetration for established economies follows a fairly typical pattern, rising with income levels, and requiring a threshold of around $20,000 of per capita GDP to achieve 50% penetration.

Not so for mobile communication, for many reasons, several of which are raised here. First, mobile penetration often exceeds 100% because people own multiple mobile phones. Second, while mobile phone penetration also rises with per capita GDP, it happens earlier, and faster, than Internet adoption. Instead of a $20,000 threshold, in many countries mobile phone penetration exceeds 50% with a per capita GDP as low as $5,000. In middle income countries such as Russia and Saudi Arabia, mobile phone penetration rates are even higher than those of more advanced economies such as the U.S. and Canada because mobile is an affordable, accessible alternative to the Internet. Altogether, the analysis on every dimension suggests that mobile communication is a truly disruptive phenomenon, acting on a global scale.

Uptake Outlook

Over the next 5-10 years, mobile penetration will rise to roughly 140 phones per 100 inhabitants, even in very low per capita GDP countries, and then rise gradually with income. At that point, the gap in mobile communication between developed and emerging economies will have largely disappeared, although some differences in technological sophistication will remain. In fact, within emerging markets, mobile communication may actually foster greater business and GDP growth, creating a feedback loop which will further boost mobile penetration, which is part of the disruption caused by this technology.

What Advertisers Think

Research conducted by The Cambridge Group and the Columbia University Business School on the future of advertising found that different media had different roles in the minds of advertisers. For example, TV was associated with achieving reach and awareness among key audiences, while online/Internet was viewed as better suited for targeting, reaching an engaged audience and the ability to measure ROI.

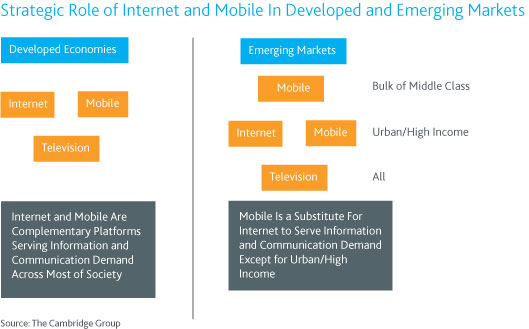

In developed countries, a combination of TV and Internet can produce effective advertising, enhanced by the addition of the emerging mobile platform. In emerging economies however, Internet penetration will still be low by 2014, and any ad campaign relying on the Internet as an integral component will miss out on a large section of the middle class.

Reverse Innovation

Because the vast majority of world economies can be classified as mobile dominant versus mobile/Internet balanced, a reverse innovation model is evolving, where effective mobile advertising platforms are identified first in emerging markets, then transferred back for further refinement in established markets. The implications of the disruptive growth associated with mobile technology in emerging markets also should readily transfer to other industry sectors.

For example, mobile banking holds much greater potential than online banking, with a high likelihood that it will leapfrog online financial activity in emerging markets. Value-add services ranging from personalized weather reports, to product and price information on-demand, to location-based and remotely-activated services will continue to bolster demand for mobile offerings.

Proof of the middle class appetite for mobile applications and the potential for businesses in developed economies can be found in the success of the iPhone. At last count, the iPhone store offered more than 200,000 individual applications. The mobile application potential is virtually limitless for companies with an innovative bent, quick to move on media trends. In advanced economies, the advent of 4G will blur the distinction between mobile and Internet, as consumers increasingly access the latter through mobile devices.

A vibrant set of mobile advertising solutions will be an essential ingredient for long-term growth in emerging markets to ensure adequate trade-up to higher price points and brands as per capita income rises. The respective importance of different media by market development suggests that mobile serves as a substitute for the Internet among the middle class in emerging markets for the distribution of broad-based marketing messages, and a complementary platform in established economies. Like any good investment, timing is everything, and mobile should be the leading-edge technology deployed by advertisers in developing markets and added to the portfolio in established sectors.