Among British first-time buyers, nearly four-in-ten say the biggest reason for buying a car is because they’re embarrassed not to have one Financial ability and a love of driving are strongest motives to buy Buyers find the most helpful advertising is Online

London – 15 April 2014 – Almost half (45%) of British consumers online plan to buy a new or used car in the next two years, according to a new study by Nielsen, a leading global provider of information and insights into what consumers watch and buy. While this represents a degree of health for the UK automotive industry, the figure trails the 65% of people globally who plan to do the same.

The Nielsen Global Survey of Automotive Demand polled more than 30,000 Internet respondents in 60 countries to identify where automotive demand is greatest and to reveal the strongest motives for buying a new car. Car-buying intent is greatest in developing economies; India (83%), Brazil (82%), Indonesia (81%), Thailand and Mexico (both 79%) lead the way.

Financial ability and a love of driving are strongest reasons for buying

Among UK car owners, a love of driving is the biggest reason for buying a new car, cited by 83% of respondents, followed by being able to afford to upgrade (81%).

Among UK first-time buyers, being able to afford a car (92%) is the biggest reason, followed by a love of driving and wanting to have access to a car (both 67%). But almost four-in-ten (37%) say it’s because they’re embarrassed not to have one – a bigger issue for Britons than for Europeans in general (29%).

“There’s clearly a demand for cars across the world,” explains Nielsen senior vice president for automotive in Europe Eleni Nicholas. “But manufacturers need to understand the nuances of each market’s buying motives, as this allows them to fine-tune their marketing strategies so that their messages can resonate with consumers across different nationalities.

“In Europe, for example, simply wanting to have access to a car is a much bigger factor for UK buyers than those on the continent, so ‘functional’ messaging will play more of a role here – in contrast to countries like Norway and the Netherlands where an ‘emotional’ love of driving is more important.”

But not all people want a car. The biggest reason why UK consumers say they don’t have a car is because they’re ‘more hassle than their worth’ (60%), followed by a preference for other forms of transport (58%) and not being able to afford one (51%).

Online is most helpful form of advertising for car buyers

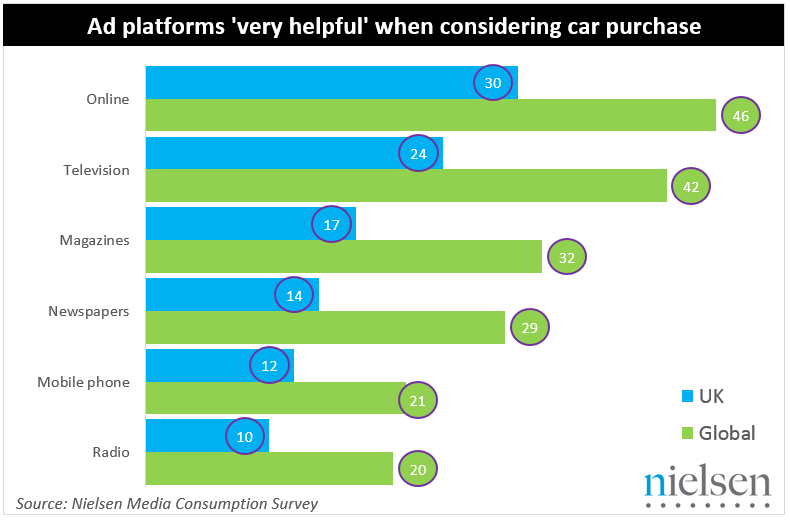

According to Nielsen’s complementary Media Consumption Survey (2012-2013), online advertising is cited by 30% of British consumers as being “very helpful” when considering the purchase of a new car, ahead of television (24%) and magazines (17%). Newspapers are cited by 14% of Britons, mobile advertising by 12% and radio by 10%.

The websites considered most informative among consumers globally for buying a car are manufacturers’ sites (65%), professional product review sites (41%), other third-party informational sites (38%) and dealer sites (38%). One third (34%) of global respondents finds social media sites very useful, and almost one quarter (23%) say video sites with product demonstrations are very useful.

E.g. 30% of UK respondents say online advertising is ‘very helpful’ when considering a car purchase

Nicholas continues: “The car industry has a terrific opportunity if marketers can identify and reach potential buyers in the most conducive environments. Online advertising is seen as the most helpful platform, but there are various ways of reaching new buyers online. While ‘owned’ assets such as car brands’ websites are considered the most helpful, social media sites are also a vital decision-making tool for a significant number of potential customers.”

About the Nielsen Global Survey

The Nielsen Global Survey of Automotive Demand was conducted between August 14 and September 6, 2013, and polled more than 30,000 online consumers in 60 countries throughout Asia-Pacific, Europe, Latin America, the Middle East, Africa and North America. The sample has quotas based on age and sex for each country based on their Internet users, is weighted to be representative of Internet consumers and has a maximum margin of error of ±0.6%. This Nielsen survey is based on the behaviour of respondents with online access only. Internet penetration rates vary by country. Nielsen uses a minimum reporting standard of 60-percent Internet penetration or 10M online population for survey inclusion. The Nielsen Global Survey, which includes the Global Consumer Confidence Index, was established in 2005.

About the Nielsen Media Consumption Study

The Nielsen Media Consumption Study was conducted in 2012-2013 and polled more than 85,000 consumers in 11 countries using a combined online and offline methodology. The countries in the study include: Australia, Brazil, China, France, Germany, India, Italy, Russia, Spain, Thailand and the United Kingdom.

About Nielsen

Nielsen Holdings N.V. (NYSE: NLSN) is a global information and measurement company with leading market positions in marketing and consumer information, television and other media measurement, online intelligence and mobile measurement. Nielsen has a presence in approximately 100 countries, with headquarters in New York, USA, and Diemen, the Netherlands.