Knowledge is power. While no two people are exactly alike, knowing certain characteristics—age, location, background, gender, income—can help organizations group consumers. For businesses, understanding consumer segments and tailoring communications to them can boost sales and garner shopper loyalty. But for-profit companies aren’t the only ones that can benefit from this type of information. While nonprofits don’t aim to grow sales, they can tap into new opportunities by identifying potential donor groups that support their cause.

The Food Group, a Minnesota-based food bank with more than 200 hunger relief partners statewide, had thousands of donors in its contributor base, but it needed to improve retention and increase giving. And to do so, the nonprofit had to prioritize its outreach efforts and encourage increased donations.

“There’s a big need for donor segmentation. As a nonprofit, we have two streams of revenue, food sales and financial contributions,” said Lori Kratchmer, executive director of The Food Group. “Fifty-three percent of the dollars that come in the door are financial contributions. Forty-one percent of those dollars are from individual donors. This is a very important group of donors for us.”

Without the time, staff, or expertise to carry out the project, the nonprofit turned to Nielsen to provide assistance through skills-based volunteering under its global corporate social responsibility program, Nielsen Cares. Chris Enck, vice president of retail management at Nielsen, led the volunteers’ efforts to identify The Food Group’s donors by groups and improve its donor communications.

Nielsen focused on segmenting The Food Group’s donor base into three categories: core, moderate, and potential. Core donors make up 43% of the organization’s donor households and are its most critical group to maintain. Slicing the segments further helped identify donors in another light: whether they are new, lost or retained donors.

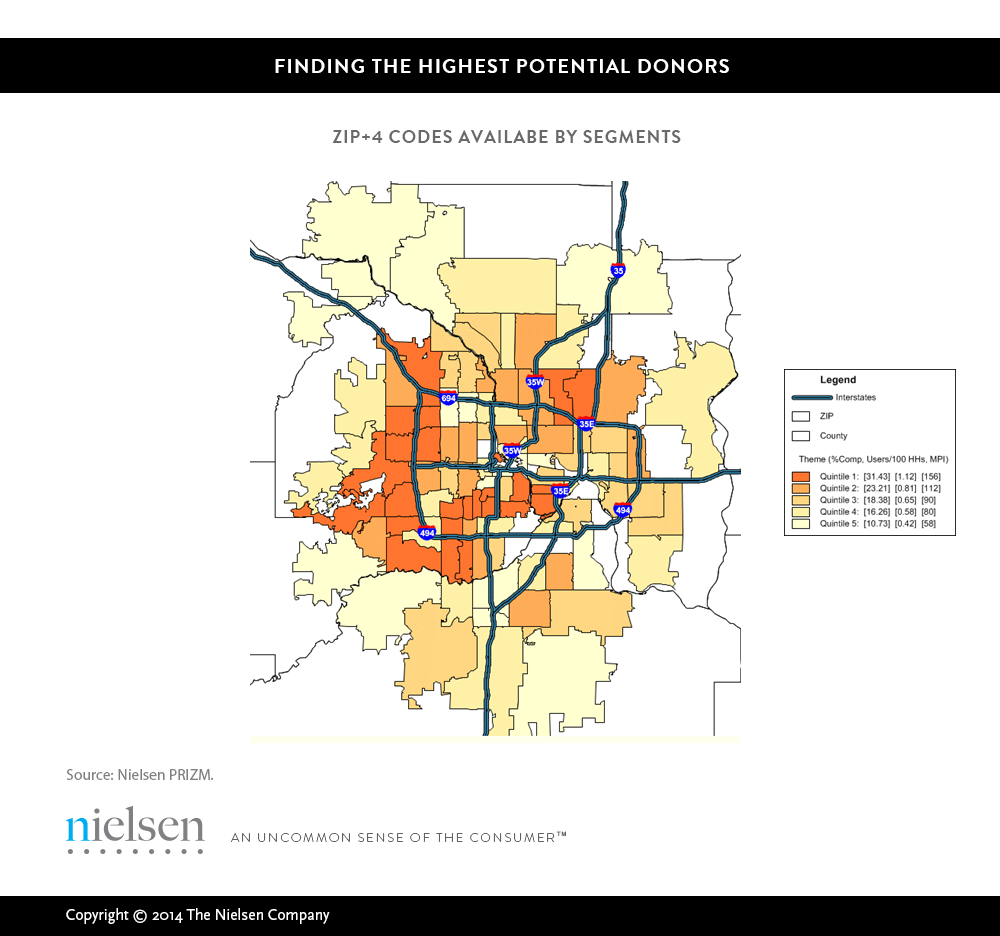

Through this analysis, The Food Group learned where its donors fall in terms of demographic categories, how many donors it has in each segment, and how much donors contribute. This segmentation also allowed the nonprofit to see where it should focus more outreach effort. For example, more than 50,000 households in Minneapolis consist of the nonprofit’s top two segments from its core donors. These two segments also make more than 28% of the donations that The Food Group receives. However, the organization is currently engaging with only 2.5% of households in these two segments. Mapping these segments by zip code can help the nonprofit improve its mailing efforts to reach key donors.

Segmenting consumers also helps organizations—and companies—determine how the audiences they’re trying to reach fit into larger categories based on buying preferences and media habits. The Food Group’s core segments, for example, have a strong connection to news radio, making local radio channels a good avenue for the organization to reach these key donors. Information like this allowed the nonprofit to take Nielsen’s insights and recommendations and develop strategies to put these insights into action.

Given these insights, The Food Group is completely rethinking how often it interacts with donors through direct mail and what that looks like. This holiday’s direct mail campaign—which is the organization’s biggest campaign of the year—will be run differently, with a more focused letter to core donors and a shift in resources to focus on the core segment. From treating them differently during the holiday campaign, to rethinking its spring and summer campaigns, identifying donor segments will help the nonprofit more efficiently reach key givers and find new supporters.