Less than a decade ago, most consumers could not have imagined the plethora of ways they’d have to engage with content. But the rise of technology and smart devices has opened the media option floodgates and consumption and old habits have changed accordingly. Engagement with AM/FM radio has not been immune to these changes. Now, with the click of a button, consumers can access their favorite radio station in sunny San Diego, listen to weather updates in New York or listen to pop music walking to school in Denver.

Location and Employment Drive Radio Consumption

But with so many listening options, how can AM/FM stations compete to have a greater “ear” share with consumers? Well, the popular adage “location, location, location,” rings true when it comes to radio.

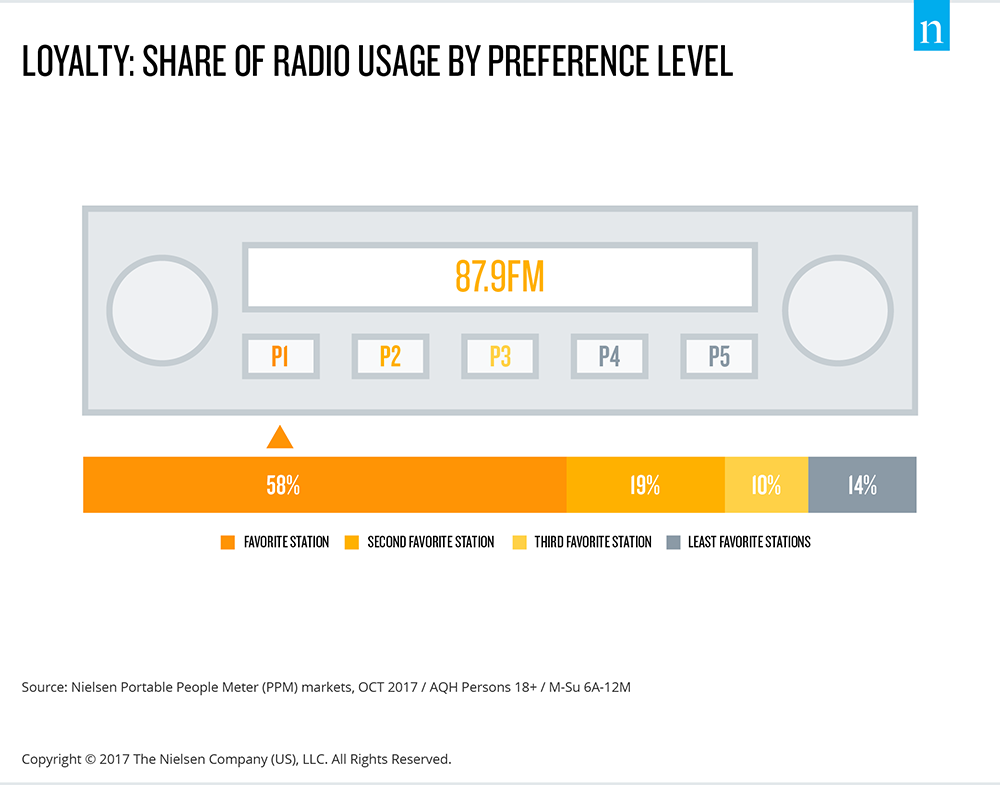

According to the second-quarter 2017 Nielsen Total Audience Report, Americans spend 87% of their AM/FM radio listening tuning into their three favorite stations (based on the amount of time spent with each). What’s more interesting is that 58% of all listening goes to just one station, the listener’s favorite (called the “1st Preference” station, or P1). While format preferences differ by listening habits, geography and even demographics, one thing is certain, AM/FM radio plays a very important role in the daily lives of consumers.

Compared with media choices 10 years ago, audio options today are much more diverse, but AM/FM radio still reaches 93% of U.S. adults. But where and when is listening taking place?

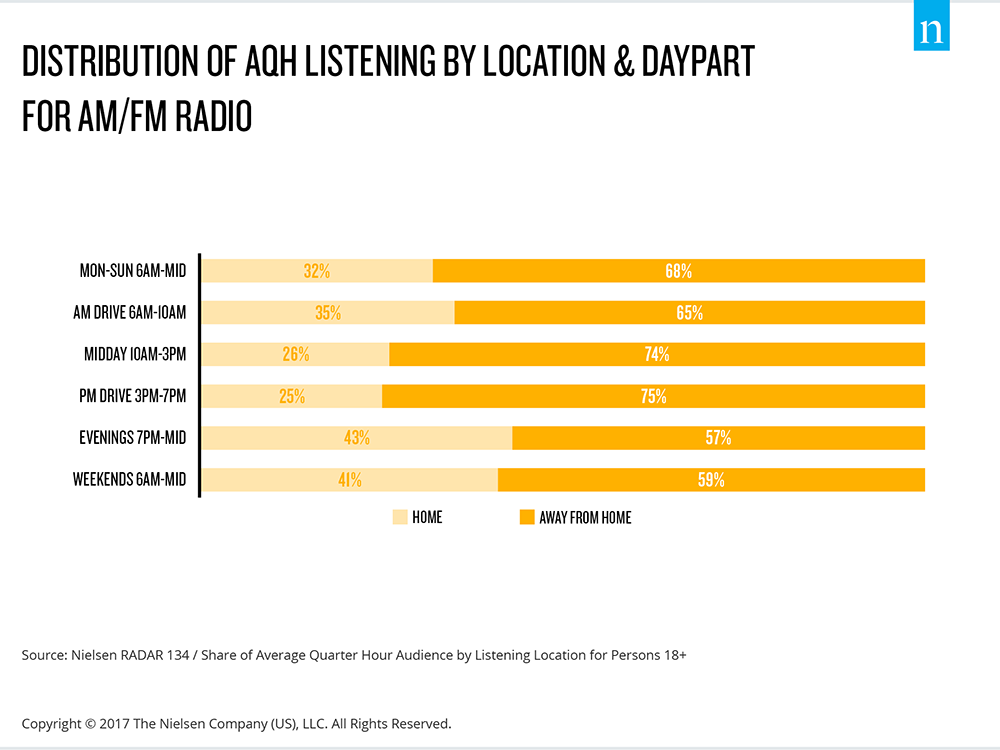

More than two-thirds of AM/FM listening happens away from the home

When it comes to listening to AM/FM radio, more than two-thirds of listening happens away from the home—when people are working or close to the point of purchase when they’re shopping. According to the report, at least 65% of American adults listen to the radio away from the home between 6 a.m. and 7 p.m. during weekdays. And consumption peaks at 75% outside of the home during the afternoon drive time, between 3 p.m. and 7 p.m. during the week. Not surprisingly, Americans who are employed listen to AM/FM radio more than those who don’t work.

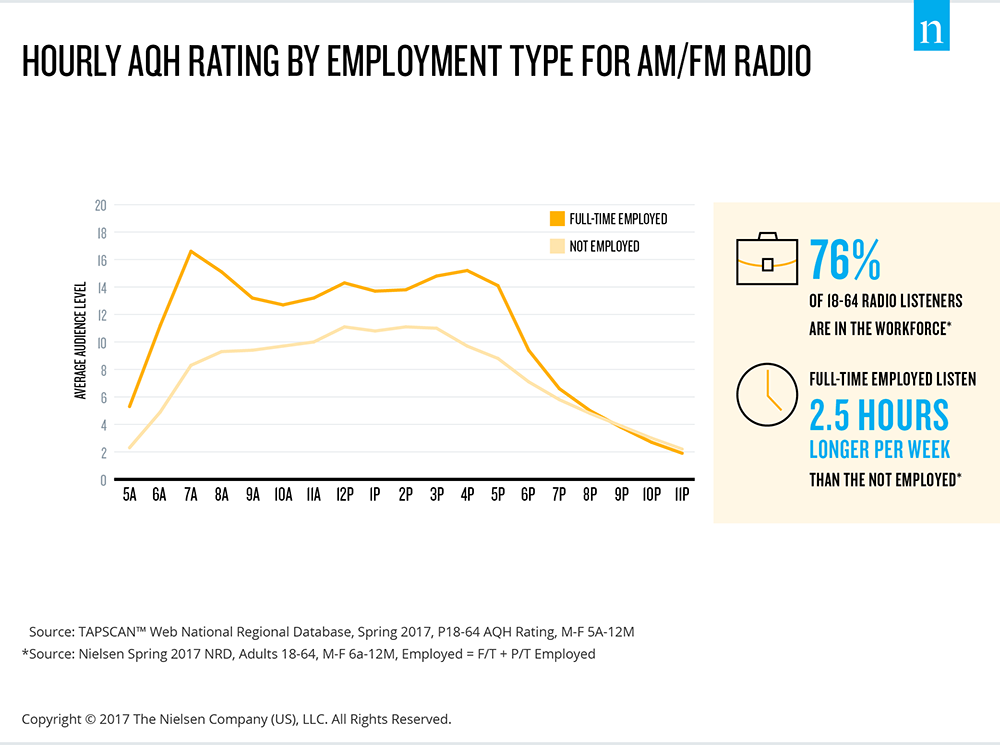

The report’s data also showed that 76% of radio listeners are between the ages of 18 and 64 and are in the workforce. Listeners who are employed full-time engage with radio 2.5 hours longer per week than listeners who are not. With the average commute to work in the U.S. at nearly 26 minutes (according to the U.S. Census Bureau), it’s no surprise that peak hours for listeners who are employed full-time are between 7 a.m. and 8 am and 4 p.m. and 7 p.m.

For advertisers, these are critical insights because they provide details about when they can engage with an attentive audience—an audience that spends nearly 2 hours and 45 minutes with the medium and has disposable income.

Reaching Diverse Listeners by Format

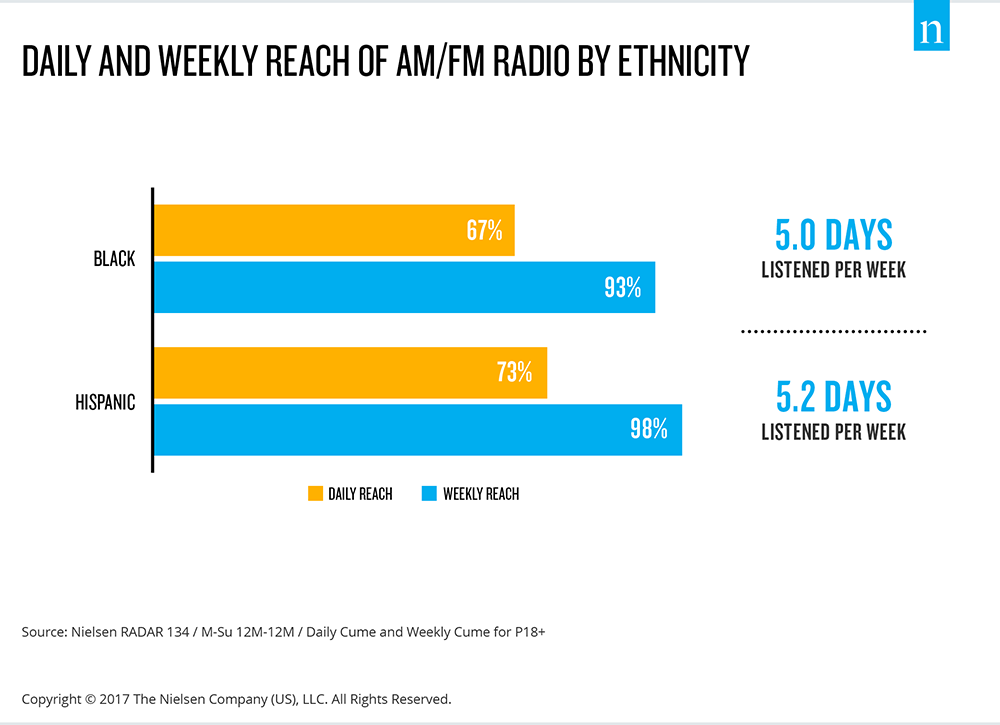

Knowing which formats consumers tune in is a critical part of understanding their listening habits. Of the top 20 formats in 2017, Country and News/Talk were the top two, securing 13.6% and 12.2% shares of audience, respectively (of all radio listening nationwide, 13.6% went to Country stations, and 12.2% went to News/Talk). Because radio formats are tailored to reach large groups of people with common interests, it’s an effective media to reach more diverse audiences. For example, at least 67% of black and Hispanic consumers listen to AM/FM radio daily: Hispanics tune in an average 5.2 days per week, and blacks tune in 5 days per week.

While the change in seasons brings changes in media consumption, there is very little seasonal fluctuation when it comes to AM/FM radio. Over the course of the year, the monthly radio audience in Nielsen Portable People Meter markets changes by only around 10% from the most-listened-to month (May) to the least-listened-to (January). Radio listening is also consistent year round, with a very high reach and frequent usage among average listeners (5 out of seven days per week tuned in).