Advertisers across industries share a common challenge: how to know which marketing activities are actually driving profit and which are wasting spend.

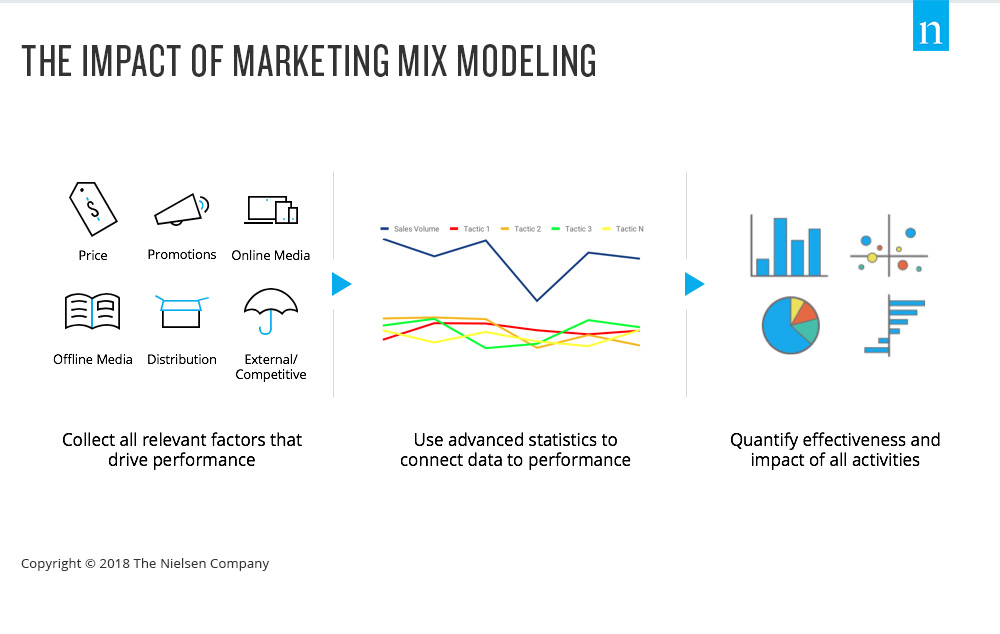

One way to answer these questions is a measurement approach called marketing mix modeling. Marketing mix modeling calculates the total effect that every marketing channel and its key dimensions, such as product and geography, have on sales and other performance metrics, while controlling for exogenous factors such as weather and seasonality that impact business performance.

CMOs use marketing mix modeling to support fact-based budget allocation decisions. The insights provided by the model allow them to divide limited resources as efficiently as possible and with the highest return on investment (ROI). Marketers in every vertical have adopted this approach because it both serves their business’ operating cadence and supports this type of strategic planning.

However, not all marketing mix models (or vendors) are created equal.

There are a number of critical factors that can affect the overall success of a marketing mix analysis. For example, factors such as the source of the data inputs, project team structure, or the format of the deliverables can influence the accuracy and actionability of results.

Sadly, some marketers don’t realize how important these things are—or which questions they should be asking—until they have begun to work with a particular vendor and the project is well underway.

While these vendors may have made glowing promises in their marketing and sales pitches, when it comes to the actual experience on the project, marketers find, too late, that they aren’t receiving what they expected.

Marketing teams that haven’t chosen the right vendor find that they:

- Get lackluster templates instead of creative thinking

- Have very junior analysts assessing their marketing instead of experienced consultants

- Have timeline slippage turn into weeks of delay

- Receive results that aren’t accurate or actionable

- Don’t get the insights they need to drive revenue

Ultimately, choosing the right marketing mix modeling vendor has a huge impact on your overall marketing effectiveness and business growth. To help you avoid regretting your decision, get the answers to these five questions before taking the plunge.

Question 1: Which sales drivers are included in the marketing mix model?

Why this is important:

The more comprehensive a marketing mix model is across potential drivers of volume, the more likely it will accurately attribute influence to the right touchpoints.

What Your Vendor Might Not be Telling You:

A vendor can choose which data to include in the model. Some limit inputs to those that are most easily obtained (media execution for a subset of all activities, for example) and exclude information that is harder to obtain (changes to distribution, pricing or competitor actions).

What to look for:

The best vendors work with advertisers to understand their industry. This allows them to hypothesize influences on sales that may be unique to that market and devise a plan to collect that information. Make sure your vendor includes the most important drivers of sales in the model including price changes, product and distribution changes, competitor actions and external factors, such as weather and economic conditions.

Question 2: How is data collected?

Why this is important:

Marketing mix modeling requires gathering data from a variety of sources into a standard format to be analyzed in an econometric model. This data can include point-of-sale data (including pricing and promotions) and media data (including TV data, print data, digital data).

What Your Vendor Might Not be Telling You:

If the vendor uses a manual process to collect and normalize data rather than an automated one, the process will be error prone, introducing noise and requiring a significant investment of time from the advertiser, their agency, and their data partners.

What to look for:

Choose a vendor that has direct access to data and/or partnerships with third-party sources that allow it to collect information in the right format. Vendors with a simple, centralized analytics console for collecting and validating inputs will preserve the integrity of the data and save you time.

Question 3: What level of granularity are the data inputs?

Why this is important:

The more granular the data inputs, the more accurate the results of the model are. For example as a retailer, if you have visibility into the marketing tactics and results at a store-level, the results will be more accurate than if you only have information at the geographic market or national level.

What Your Vendor Might Not be Telling You:

Some vendors only incorporate aggregate data at a geographic market or national level, which reduces the accuracy and actionability of results.

What to look for:

Look for a vendor that incorporates the most granular data available — store-level, branch-level, retail location or product-level data — to ensure the most accurate and actionable results.

Question 4: How do you ensure the accuracy of the data inputs?

Why this is important:

The old saying “garbage in, garbage out” holds true for marketing mix modeling. It’s not possible to carry out a sufficiently accurate statistical analysis with highly inaccurate data. If you don’t have the right inputs, then the results won’t be helpful.

What Your Vendor Might Not be Telling You:

Some vendors rely on the advertiser to provide all data inputs directly. They don’t review or run tests against it to validate its accuracy. It’s not until the end of the study (or ever!) that data errors are identified.

What to look for:

The best vendors review the data for accuracy as they collect it. If the data looks incorrect or there is some anomaly (such as a big spike in activity), they will check with the data providers to ensure accuracy. After data is collected, the vendor should meet with key stakeholders to review a summary of the inputs, ensure that what is collected reflects reality, and call out any questionable data. This summary is a useful aggregation of activity from many different sources and is often the first comprehensive look across all of the advertiser’s activities.

Question 5: How granular are the insights?

Why this is important:

Insights that report granular results — of specific campaigns, tactics, products, retailers or geographies — allow you to take specific actions to improve results. For example, how drivers of sales differ depending on product variants.

What Your Vendor Might Not be Telling You:

Results that only show impact at the channel level (e.g. TV in Total) and don’t drill down further won’t allow you to tease out what’s really driving impact and how to optimize your marketing.

What to look for:

The most effective marketing mix models are built on very granular data and yield granular insights. For example, the impact of TV can be broken out by dimensions such as creative/campaign, spot length or daypart; print by campaign or genre; and digital into YouTube vs. digital display.

Accurate, Actionable Insights

Advertisers’ need for a holistic view of their marketing performance is as critical as ever. You want to spend your time building great products, honing your messaging and crafting effective media strategies – not haggling with your vendor or doubting your measurement approach.

Marketers deserve a comprehensive and insightful understanding of their marketing – not compromised measurement services that lack actionability or accuracy. Use these nine questions to help you pick the best vendor for the job and you won’t have to accept second best. To learn more, download our ebrief: 9 Things Your Marketing Mix Vendor May Not Be Telling You.