Hispanic consumers are continuing to progress. This consumer group is making economic gains, influencing mainstream consumption and being credited for advancements in digital—and Hispanic women are at the forefront of these changes.

The U.S. Hispanic population is rapidly expanding and will continue to do so: Hispanics are projected to account for 65% of the growth of the overall U.S. population over the next 45 years. With this population’s immense growth—and women increasingly becoming the main decision makers in this country—it is especially important to note the size and influence of the Latina population in the U.S.

Nielsen’s latest installment in its Diverse Intelligence Series, Latina 2.0: Fiscally Conscious, Culturally Influential & Familia Forward explores their power in numbers. Six states are home to over one million Hispanic women in their larger metro areas, representing the majority of the total female population in those areas. Along with their population gains, Latinas are also achieving higher educational attainment, experiencing growth in entrepreneurship and emerging as some of the most powerful and influential consumers in the U.S. These are consumer that should be on marketers’ radars—fortunately, there are few ways to reach this key audience utilizing up-to-date technology and social media.

Staying Connected

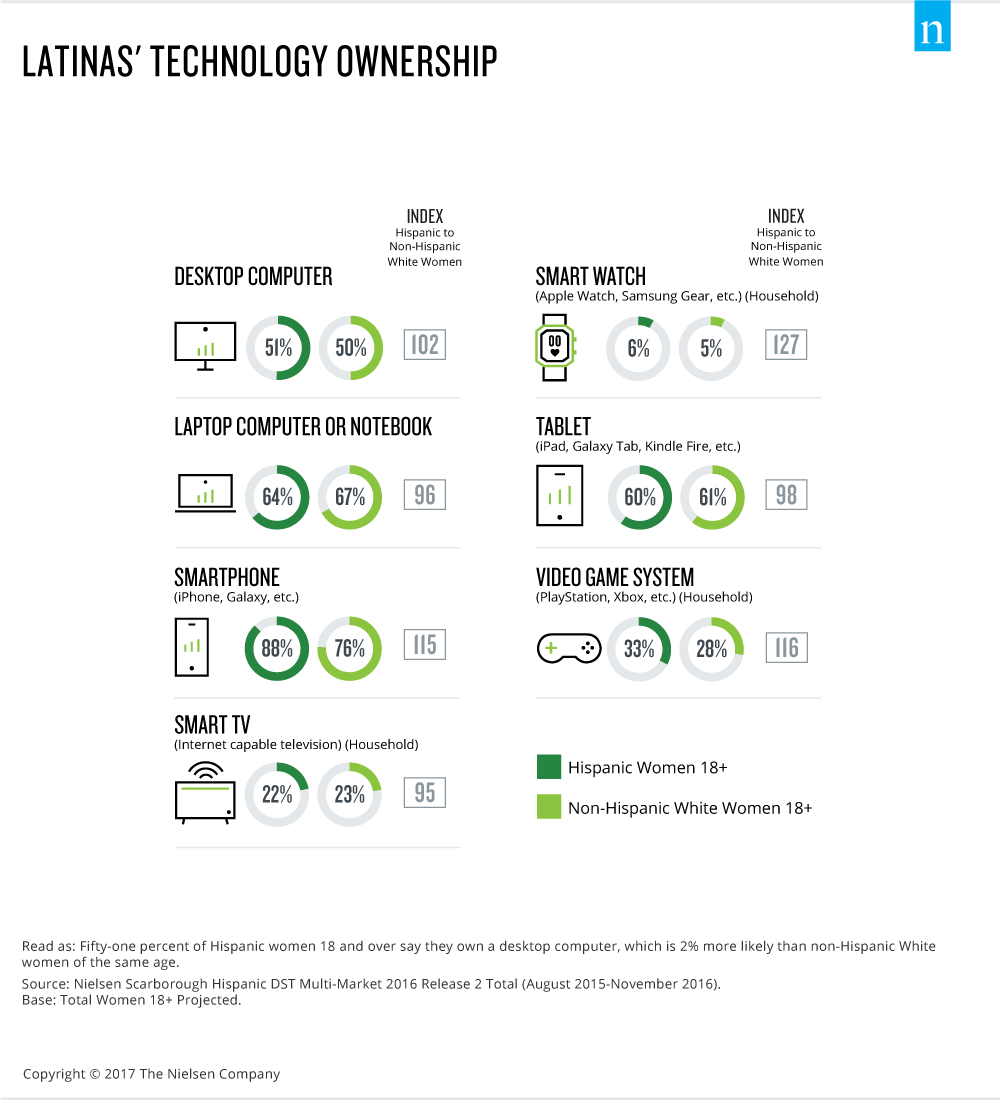

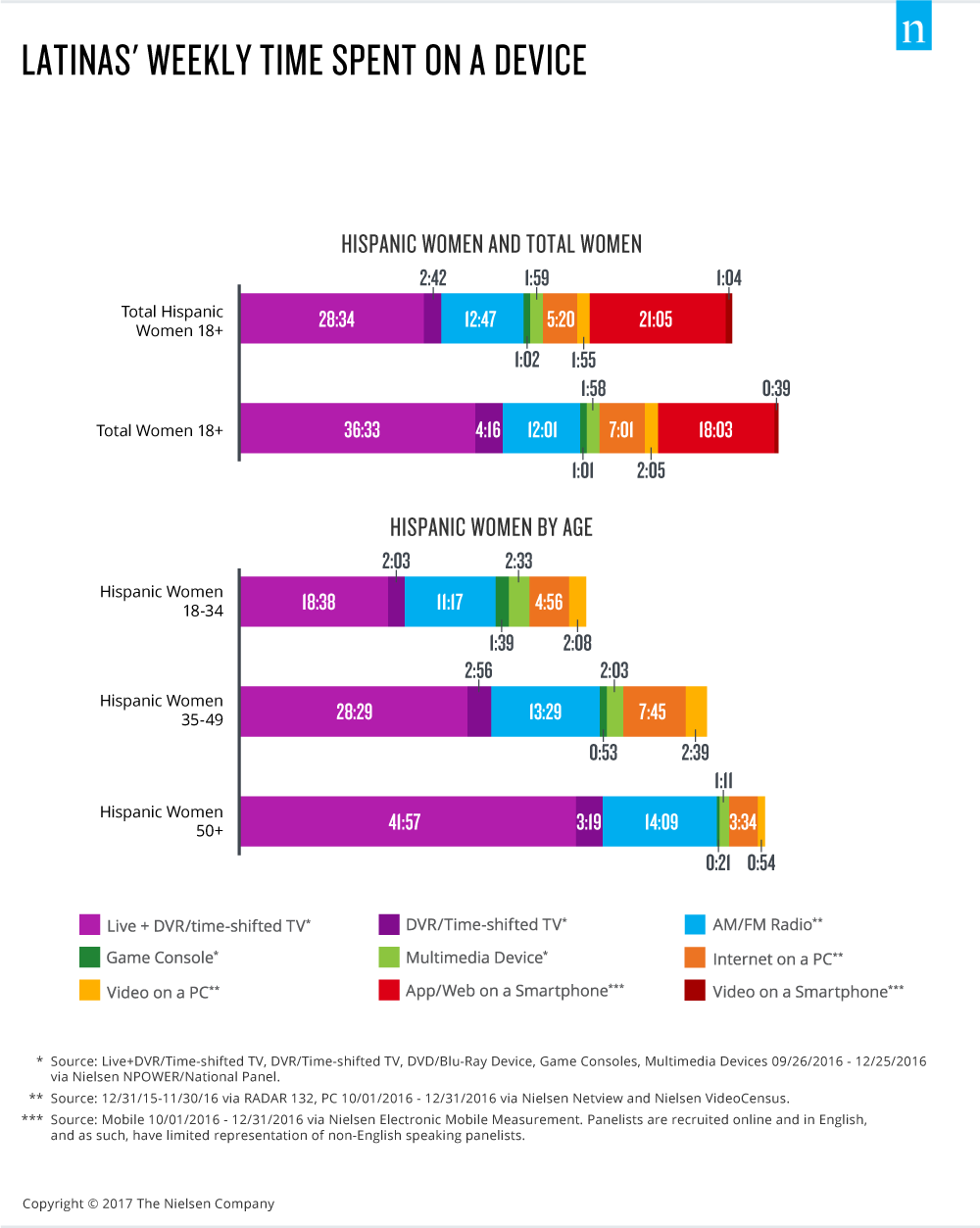

Keeping in touch with family and friends, plus seeking and/or offering product advice to peers is very important to Latinas. In order to stay connected, their mobile devices are invariably in tow. Smartphones are the mobile device of choice for Hispanic women. Eighty-eight percent of Latinas say they own a smartphone, and they are 15% more likely than non-Hispanic white women to own such a device. On average, Latinas spend 22 hours each week watching videos and using apps or the Internet on their smartphones. They are also early adopters of newer tech gadgets, as they are more likely than non-Hispanic white women to own smart watches.

Still, Latinas of all ages spend most of their time watching TV. By age, Hispanic women 50+ spend more time watching Live and DVR TV, as well as listening to AM/FM radio, than their younger counterparts. Latinas ages 35-49 spend more time using the Internet and watching video on PCs. By comparison, Latinas age 18-34 spend more time than all other age groups on multimedia devices. Marketers who seek to reach Latinas of different generations, should take note of the multiple mediums they use to get information and find entertainment.

Social Networking Mavens

Latinas also use social media to stay connected to family and friends. In fact, 50% of Latinas say they use social networking sites to remain in touch with their family and friends, and 44% say they use social media to follow the activities of their family and friends.

Product reviews and brand support are important, as well. Nineteen percent of Latinas say they use social media to show support for their favorite company or brand, compared with 16% of non-Hispanic white women. And 19% of Latinas say they use social media as an important source for reviewing or rating a product or service, compared with 17% of non-Hispanic white women.

As for actual platforms, Latinas used certain apps more than their non-Hispanic white women counterparts. During a 30 day period, Latinas use Snapchat at a rate 96% higher than non-Hispanic white women, Instagram at a rate 64% higher, Spotify at a rate 59% higher and both Google+ and Pandora at rates 58% higher.

More and more companies are using social media to connect on a personal level with their consumers—and there’s a clear opportunity for brands to engage Latinas through these channels. Social media is a platform that is welcomed and utilized among this digital, savvy group.

Additional highlights from the report include:

- 40% of Hispanic women agree that people often seek their advice before making a purchase.

- Hispanic households led by Latinas tend to shop more at warehouse club stores by 21% and 11% for dollars per buyer as compared to non-Hispanic white households.

- 51% of Latinas agree that their children have a significant impact on the brands they choose.

- 74% of Latinas over the age of five speak a language other than English in the home, despite 34% of Latinas being foreign-born.

For more insights, download Nielsen’s Latina 2.0: Fiscally Conscious, Culturally Influential and Familia Forward report.