In addition to engaging millions of fans across the country, sports are big business, especially when it comes to television rights. And when we look at commercial opportunity, nothing tops football—something the media industry has experienced firsthand amid the most recent member changes within the top NCAA conferences.

The changes aren’t likely to affect individual team fandom, but the shifts, which are the most extensive in recent history, will affect how teams show up on TV and who will get to see their games.

As with many aspects of the media industry, the audience is the key factor in the conference realignment, much of which won’t take effect until the 2024 season. That’s when eight teams will leave the Pac-12 to join conferences with more lucrative TV deals: Four will join the Big Ten and four will join the Big 12.

Unlike the other Power Five1 conference members, the Pac-12 does not have a long-term TV rights deal, which has a direct impact on the revenue each member school receives. For example, the Big Ten expects its seven-year deal with CBS, FOX and NBC to be lucrative enough to distribute between $80 million and $100 million annually to each member school. The $8 billion deal is the biggest in the history of college athletics, and it gives the contract holders access to some of NCAA football’s highest-ranked and most-watched teams, including Michigan, Ohio State and Penn State.

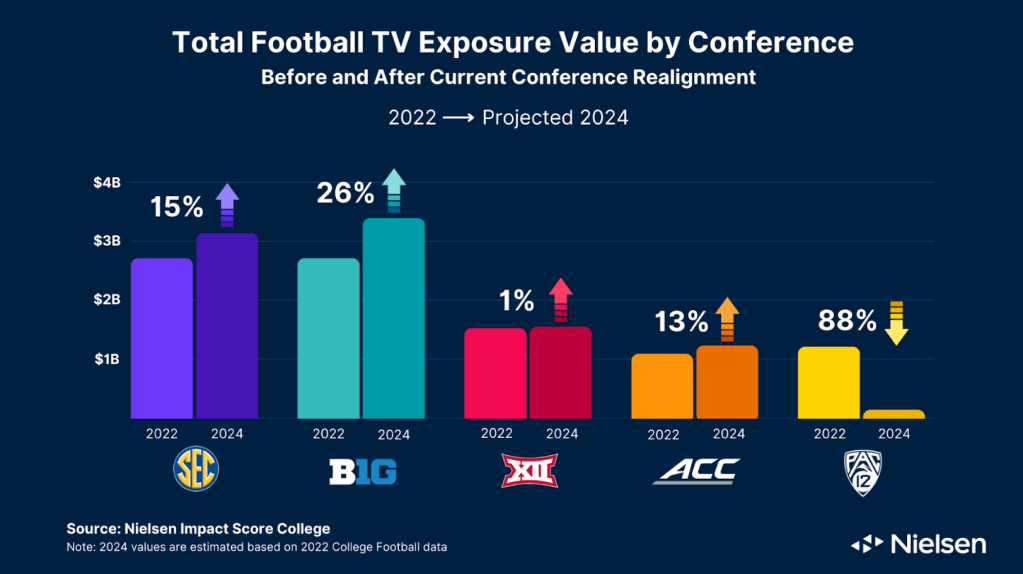

Conference membership affects all sports within each member school, but the shifts in recent years have all been motivated by the rights associated with live football games. Based on an analysis of the value associated with each conference’s TV exposure during the 2022 season, the realignments that take effect next year will have a significant impact for the SEC, Big Ten and Pac-12.

The value of TV exposure is clear. One-third of Americans say they’re college football fans2, making the league the fourth-most popular in the U.S. (behind the NFL, NBA and MLB). And big teams draw big viewership: More than 17 million viewers3 watched last year’s marquee late-season matchup between Ohio State and Michigan, the highest viewership of the regular season. For comparison, nearly 2.3 million viewers3 watched the Brooklyn Nets play the Philadelphia 76ers in the first round of last year’s NBA playoffs.

While top-ranking teams and storied rivalries will always command national TV coverage, the implications of the conference membership changes will have different outcomes at the local market level. Last year’s week 8 game between UCLA and Oregon (which will both leave the Pac-12 next year) attracted a national audience of 3.34 million3. Once these two teams join the Big Ten, they will expand the conference’s TV audience across the entire country and both coasts.

To better understand how the conference changes will shape local TV viewership beyond individual games, we examined the difference between Pac-12 and Big Ten TV viewing in Los Angeles, Portland and Seattle during the 2022 season. These designated market areas (DMAs) are home to four West Coast teams4 that will switch conferences next year.

Due to the size of these three markets, last season’s Pac-12 programming reached 123% more households and 151% more individual viewers than Big Ten programming did5. And while the 0.1 difference in co-viewing might seem insignificant at face value, it becomes far more meaningful when you multiply it by the total viewing population of the three DMAs.

When we break down the aggregate conference viewing, we can see the impact that the conference changes will have on each individual market. Despite the sprawling population of Los Angeles—home to UCLA and USC—Portland stands to gain the biggest percentage lift in viewership next season.

While the Big Ten will benefit next year from the arrival of USC, UCLA, Oregon and Washington, the Big 12 will benefit from the arrival of the University of Colorado, home to this year’s hottest college football story. The Colorado Buffaloes have been in the news ever since NFL legend Deion Sanders took over as head coach last year, but the team’s 3-1 start, including an upset over TCU (Texas Christian University) to open the season, has made their games must-see TV for football fans. In fact, the team’s double-overtime victory over Colorado State on Sept. 16 attracted 9.3 million viewers3 despite the fact that it didn’t start until after 10 pm ET. The team’s Sept. 23 game against Oregon attracted more than 10 million live and same-day viewers, the largest audience of the season.

While our national TV exposure value analysis doesn’t suggest a significant change (+1%) for the Big 12 when Colorado joins next year (along with Arizona, Arizona State and Utah), the impact on local TV viewing is a different story. The impact of Coach Prime was immediate, as the Denver TV audience for the Buffaloes’ first game was 117% higher than last year’s. And that was just a starting point.

In aggregate, the increased attention bodes well for the Pac-12 this year and the Big 12 next year, as the average viewership at the household level is up 976% and up more than 1,100% among viewers 2 and older. The hype over the Buffaloes is also boosting co-viewing by 15% this year.

There’s no mistaking the appeal of NCAA college football among sports fans, especially when big matchups come to town. And while marquee rivalries will always command national TV exposure, we can see how local market TV viewership contributes to the value associated with the teams involved with the most recent changes among the Power 5 NCAA conferences.

Sources

1The five most prominent and highest-earning athletic conferences in Division I NCAA football: ACC, Big Ten, Big 12, Pac-12, SEC

2Nielsen Fan Insights; Q2 2023

3Nielsen National TV Panel; live + same day viewing (3 a.m.-3 a.m.)

4UCLA, USC, Oregon, Washington

5Nielsen Local TV measurement