Radio has come a long way since it first began crackling across the airwaves in broad fashion 100 years ago. Today, in addition to entertaining listeners around the globe, radio is a powerful way for companies and brands to engage with consumers.

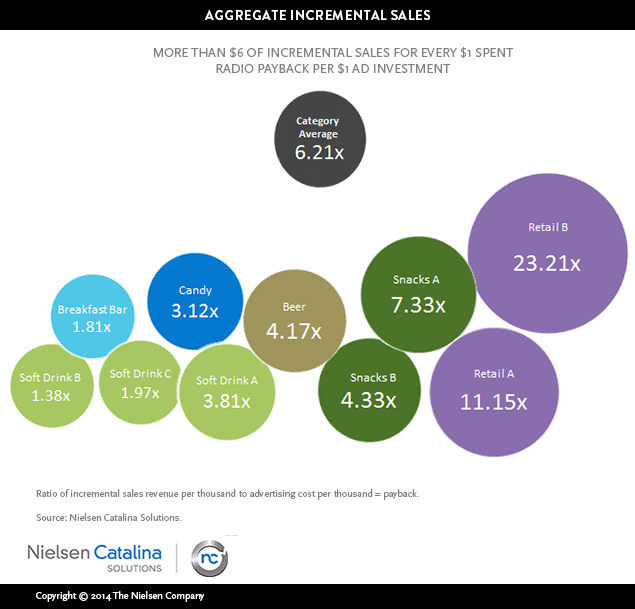

In fact, a recent Nielsen Catalina Solutions (NCS) study found a direct link between radio advertising and brick-and-mortar retail sales—evidence that money spent on radio is money well spent. In this first major radio effectiveness study, the research found that each dollar of ad spend generated an average sales return of $6 from the listeners in the 28 days after they heard the ads.

For the study, NCS reviewed the effectiveness of radio advertising by looking at the impact of specific ad campaigns across 10 brands—eight consumer packaged goods (CPG) brands and two retail brands. To reach its findings, NCS used a combination of data collected from Nielsen Portable People Meters (PPMs) and information from 60 million shopper households to arrive at a single-source methodology that measured the specific media buys of the 10 brands across all radio commercials measured by Media Monitors on national and local stations.

Radio Works

While the study found that advertisers gained an average $6 return for every $1 spent, it identified significantly different returns across categories. Notably, the two retailers generated more than 10 and 23 times the return on the high end, while a soft drink brand and breakfast bar pulled in less than two times the return on the low end—though all provided positive return.

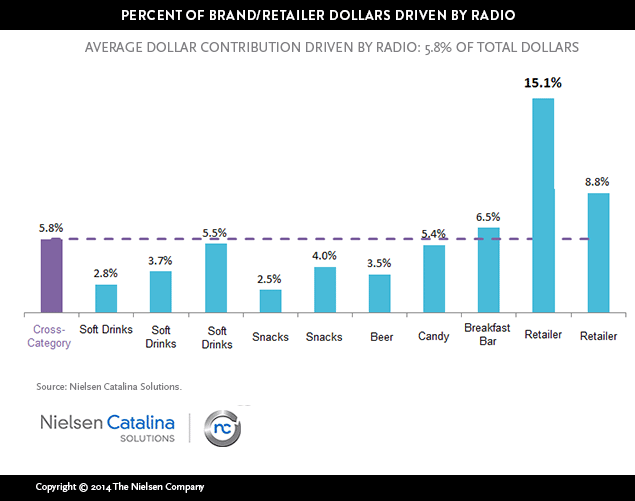

On average, radio drove 5.8 percent of total sales across the 10 brands, although the actual percentages differed by product category: retailers were at the high end and soft drinks were at the low end. Among the brands, a mass retailer experienced the highest contribution to total brand sales at 15.1 percent.

Radio Ad Response Also Varies by Audience Segment

In addition to measuring across categories, NCS measured the response among African American and Hispanic households for the brands with large enough sample sizes. Overall, the radio campaigns proved to have a substantially stronger impact on sales among both of these demographics than the total population.

For African Americans, the indexes range between about 150-240 and 140-185 for Hispanics. For example, the share point gain driven by radio for the soft drink category among African Americans was 7.7 percent, or 92 percent higher than the 4.1 percent share gain among the total population

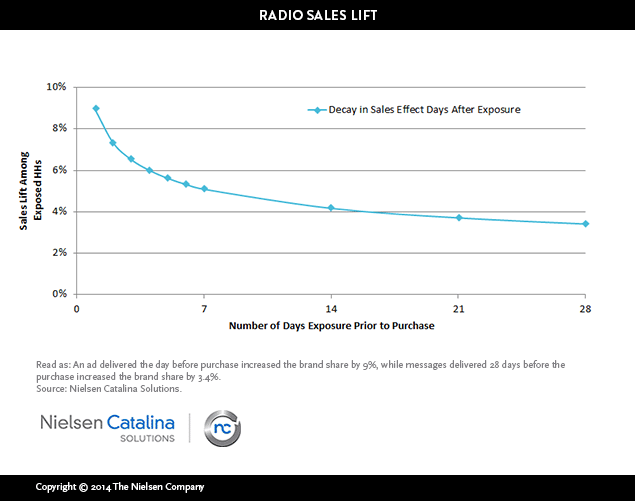

“Recency” matters

In addition to proving to be strong sales generators, radio ads deliver the goods quickly. In fact, the study found that radio had an immediate impact in delivering a powerful sales lift when the audience heard the ad within a few days of purchase. A consumer exposed to an ad within one day of purchasing increased the brand share by 9 percent, while messages delivered 28 days prior to purchase only increased share by 3.4 percent.

The Key to Gaining Meaningful Sales Results

Since CPG brands typically run low gross rating point (GRP) levels in radio, especially as compared to retailers, radio doesn’t appear to be effective for driving sales. This, in turn, inhibits marketers from upping the ante in their radio spend, fostering a cycle of low investment.

So what’s the key? A single-source methodology.

By using single-source methodology, which links advertising and sales response for the same households, we can determine that radio does indeed drive sales. However, the increase in sales is only among the small number of audience members that the ad reached due to the low GRP levels of the media schedules.

For one of the snack brands, the radio campaign increased actual brand share by 32 percent and by 3.4 share points among consumers who heard the ad versus those who did not hear it. These are large increases, though among a small number of people.

Into the Golden Age

Over the past year, we’ve learned that measuring the actual retail sales impact of radio advertising is both possible, and scalable. Using single-source data with purchaser information to determine marketing effectiveness is a significant leap for advertising in this traditional, mass medium. And as a result, radio may just now be coming into its golden age.

Methodology

These studies were conducted May 17, 2013 to Sept. 21, 2013 using a true single-source dataset. This single-source dataset was created by matching households from the NCS 60 million frequent shopper card data and Nielsen’s listening (PPM) data from 72,748 persons.

The Nielsen persons are combined into 32,000 households. Of those, 14,244 were the same frequent shopper data (FSD) households, thus delivering 14,000 households that had both exposure to radio and purchased the supermarket products.

Within those 14,000 households, there were between 3,500 and 9,000 category-buying households eligible for analysis depending on the category of each brand. The study included all CPG brands that had enough exposed brand purchases. In other words, they had enough advertising against a large enough brand to produce a large enough sample to report.