Thanks to the internet, researching a car has never been easier. What used to take days traveling from dealer to dealer now takes minutes as potential purchasers cruise websites and forums to view details on new models, check dealer inventory and pricing, read reviews and even negotiate entire transactions.

According to Nielsen Scarborough, almost 22 million Americans took to the web during the past 12 months to research and shop for a vehicle. For automotive manufacturers and dealers, a strong digital strategy is no longer a “nice to have”—now, it’s a necessity. To create that strategy, they must understand the online auto researcher audience and create content that will engage them. To get a glimpse under the hood, Scarborough examined the demographics and behaviors of online auto researchers, adults 18 and older who meet two key criteria: they say they research and compare as many vehicles as possible before making a final purchase decision and they say they’ve shopped for a vehicle on the internet in the past 12 months.

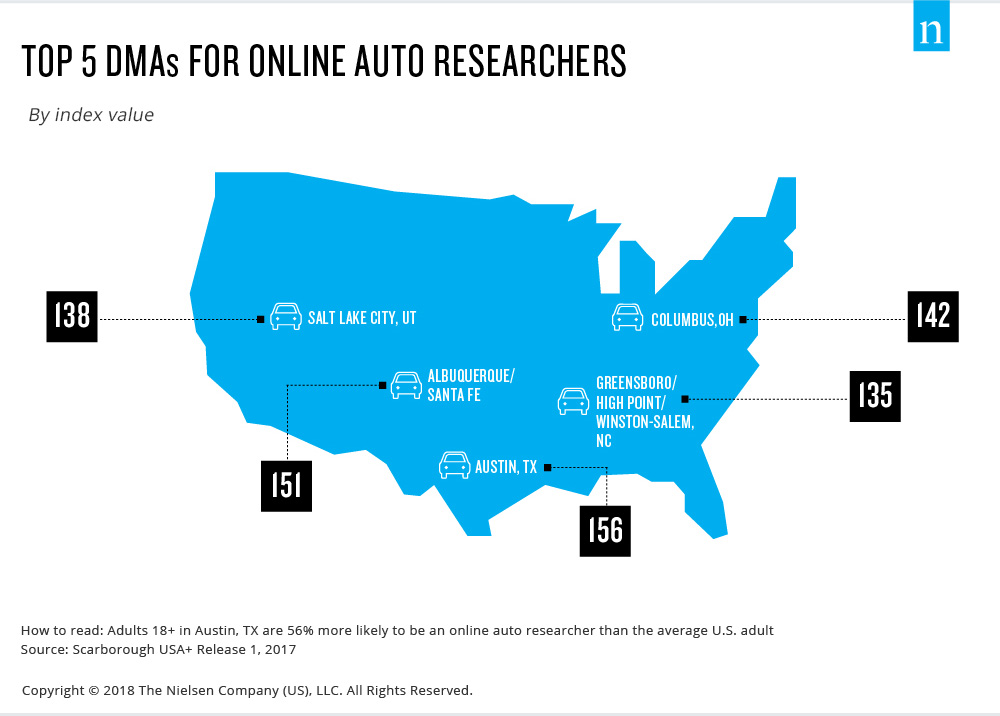

What is the makeup of an online auto researchers? Generationally, they cover the spectrum: 34% are Millennials, 29% are Gen Xers 27% are Baby Boomers. They’re 27% more likely to be male and have household incomes that are $17,000 higher than the average U.S. adult. Online auto researchers span the U.S., but penetration varies with higher concentrations in Austin, Albuquerque, Columbus, Salt Lake City and Greensboro. This diversity will require content creators to step away from a one-size-fits-all strategy. But the extra effort should pay off, as online auto researchers are a lucrative consumer group. They plan to spend $4,700 more than the average adult on their next vehicle purchase, and almost one-third (30%) have purchased a vehicle on the internet during the past 12 months.

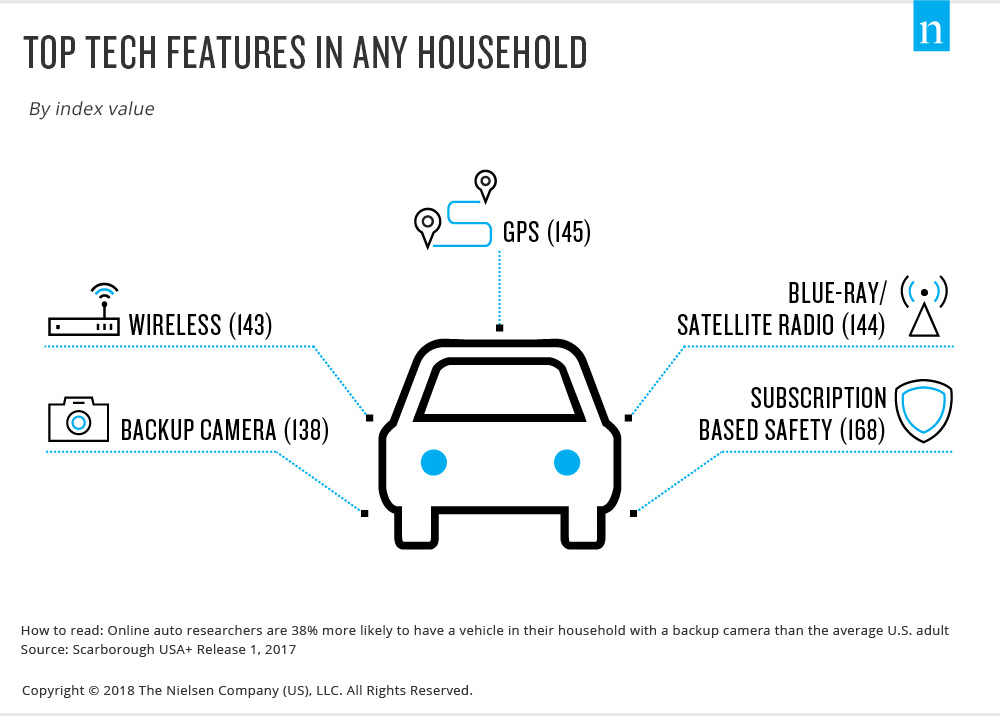

Knowing the makeup of this group is a start, but developing digital content to engage and motivate them to purchase is where the rubber hits the road. To start, engage researchers with content about technology and the environment. Three-quarters (73%) agree they look forward to technological advances in new vehicles. They already have and expect features like backup cameras, GPS, Blu-ray players, satellite radio, subscription safety services and wireless access. Additionally, half consider themselves more environmentally conscious than most, and they’re 41% more likely than the average adult to own or lease a hybrid vehicle.

When it comes to motivating these consumers, feature the types of vehicles they prefer and the perks that come with them. Online auto researchers are 18% more likely to plan to purchase a new Sports Utility Vehicle (SUV), 58% more likely to own a foreign luxury vehicle and 34% more likely to own a domestic and/or foreign subcompact car. Synchronizing dealership and manufacturer offerings will reap benefits, as online auto researchers use both manufacturer and dealership sites/apps to gather information (29% say they use dealership sites/apps; 22% say they use manufacturer sites/apps). Dealership messaging should stress selection of vehicles, price/value, financing and warranties.

Knowledge is power, engagement is king. Convert online auto researchers into buyers by engaging them with content that speaks to their automotive needs and preferences.

For additional insight, download our related infographic.

Methodology

The insights in this article were derived from Nielsen Scarborough USA+, Release 1, 2017