For years there has been an almost continuous increase in advertising expenditure in the Dutch automotive sector. In ten years’ time, the joint importers budget has increased in an almost straight line by no less than 68 percent. Heavy pressure on the marketing costs for manufacturer and importer.

This and more is apparent from figures from Nielsen who AUMACON have been edited for Automobiel Management.

No brand can afford to ease the media pressure and be less visible. Nowadays everyone is competing with everyone. Brands are becoming more and more alike. So visibility is essential.

Importers accelerate in the second half of 2018

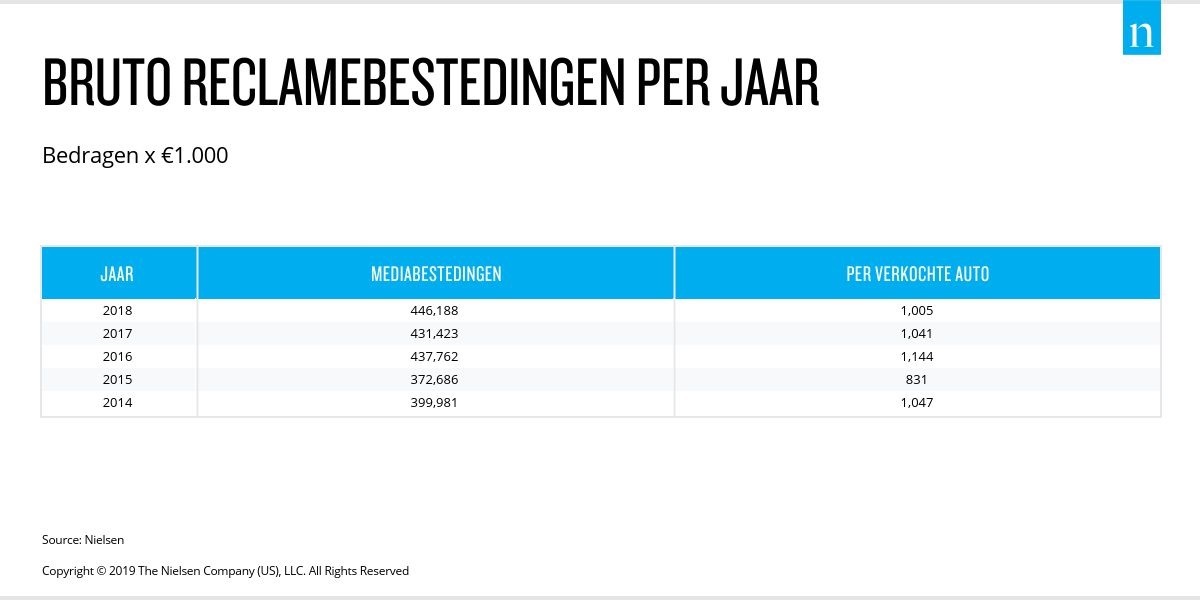

Last year was closed with a total budget of more than 446 million gross euros, three and a half percent more than in 2017. It did not look like that in the first half of the year. In H1-2018, ‘only’ was spiked for 181 million euros; about 22 percent less than in the first half of 2017. Importers therefore gave a lot of gas in the second half.

Renault continues to put considerable pressure on the market. The brand was supported in our country last year with a budget of almost 63 million euros. Converted to 1,631 euros per car sold – an astronomical amount for a volume brand. It also seems like a moderate investment; Renault sold almost 6 percent fewer new cars last year in a total market that increased by 7 percent.

The Koreans also resorted to the media weapon last year. Hyundai doubled the budget no less than 34 million euros and thus spent an amount of € 2,221 per car sold. Countryman Kia climbed to a budget of almost 30 million euros, good for 1,137 euros per car. Result: Hyundai climbed to 13th place in the brand ranking (was 14th in 2017) and Kia climbed from place 7 to place 5. Incidentally, the average amount across the market decreased from 1,041 euros in 2017 to 1,005 euros in 2018.

TV remains the most important channel, online spending rises sharply

Newspapers still only account for 2% Television remains by far the favorite of media buyers. After two years of decline, almost 7 percent more was spent on TV advertising in 2018. No less than 58 percent of all car advertising euros is for television. Brands such as Kia, Nissan, Toyota, Mitsubishi and Citroën spend more than three quarters of their entire budget on television. In contrast, Volkswagen and Mercedes-Benz use television to a very limited extent; both brands lean much more towards radio.

The winner in media land is mainly the internet (online disaply advertising). This medium earned almost 56 million (gross) euros in 2018, a record. The other media may distribute the remainder. Out-of-home (billboards) is still doing reasonably well with 17 million euros, although spending on them has fallen by 15 percent.

This article was originally published in Automotive Management in March 2019.