Doing business in sub-Sahara Africa can be full of disparate challenges, and anyone looking to identify a classic African consumer will struggle. Despite sharing a common border, inhabitants of one country differ from those in a neighboring country with respect to their attitudes, buying and media preferences. Given this degree of diversity within and across geographies, new research from Nielsen shows that marketers need to look beyond the obvious to reach and resonate with both niche and mass audiences.

Significant advancements in digital connectivity over the past decade in sub-Saharan Africa have run in parallel with evolving living standards, rising wages and heightened consumption levels. At the same time, consumers have generally become increasingly savvy in the ways they admit brands and messages into their lives, making the marketing efforts even more challenging.

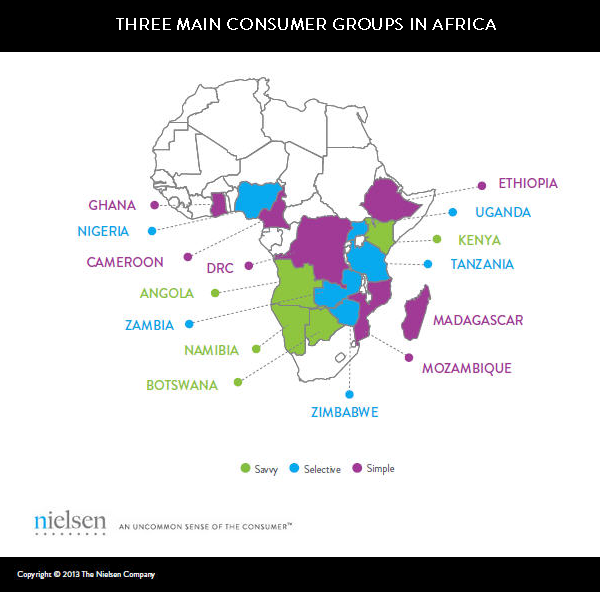

By observing trends in demographics, lifestyles, attitudes and purchasing behaviors with media consumption, Nielsen identified key patterns to classify 15 sub-Saharan countries into three groups of media consumers: savvy, selective, and simple. These segments offer insight into the diverse media behavior and preferences of the sub-Saharan African consumer, providing a more defined roadmap for marketing success.

For example, instant messaging and social media usage in savvy consumer countries is high. Among users, the frequency of accessing social media is daily. Selective consumer countries, on the other hand, have the largest and most diverse range of consumers who exist at various stages along the development spectrum, from less involved media usage to becoming more engaged. Simple consumer countries, in contrast, have the least media involvement and lowest GDP per capita.

While media preferences and availability may differ among consumers in the three country segments, the power of conversation rings true for all consumers—both in person and digitally. While print and electronic media work well to create awareness in these countries, word-of-mouth endorsements can be true game changers when it comes to purchase decisions. According to survey results, respondents rate buying based on recommendations from their families and friends over all other forms of advertising.

With the rapid rise of social media platforms across some countries, virtual word-of-mouth messages can be as powerful as in-person conversations. Consumers tuned into social media conversations may also tap into buzz from people they may not know personally, such as celebrities and community figure heads.

In Africa, the message and messenger is as important as the medium. Despite growing media exposure—a myriad of TV and radio channels, print, digital, outdoor and mobile mediums—word-of-mouth communication is extremely powerful when integrated into marketing and media campaigns. But it needs to be adapted to the consumer segments within the different countries to be most effective.

For more insight, download the Nielsen Blueprint for Media Strategies in Africa report.

About the Media Strategies for Africa Report

To help businesses navigate sub-Sahara Africa opportunities, Nielsen surveyed more than 8,100 urban and peri-urban consumers across 15 countries. Through this survey, Nielsen identified seven consumer segments, using variables such as lifestyle, attitudes, demographics, and purchasing behavior, to gain insight into the minds of the diverse consumers of Africa. Further, by observing broad patterns in media engagement Nielsen has been able to delineate key patterns to classify countries into three groups of media consumers: savvy, selective and simple.