- India’s online video viewership has increased 100% since 2011.

- Super viewers are largely from the SEC A and B category and are typically 21 to 26 years old.

- Approximately 78% of regular internet users watch or download digital content such as videos, television shows or movies.

Just a few years ago, Internet broadband was considered a luxury restricted mostly to corporate India. Today, it’s a whole different picture thanks to the advent of smartphones and a rapidly growing telecommunications industry. India is poised at the cusp of the digital revolution – be it finance, travel, ecommerce and even media and entertainment.

Online video viewership in the country has nearly doubled between 2011 and 2013. A 69% growth in unique viewers during the same period indicates that more Indians are accessing their entertainment online every day.

The Media Super Consumer

However, Internet users cannot be grouped solely by data consumption. Two factors—consumption and engagement—categorise consumers’ online behaviour. We’ve broken down India’s Internet users into three:

- Light: They spend approximately 90 minutes or less online.

- Medium: They spend between 90 to 120 minutes online.

- Heavy: They spend more than more than 120 minutes online.

THE SUPER VIEWER ONLINE

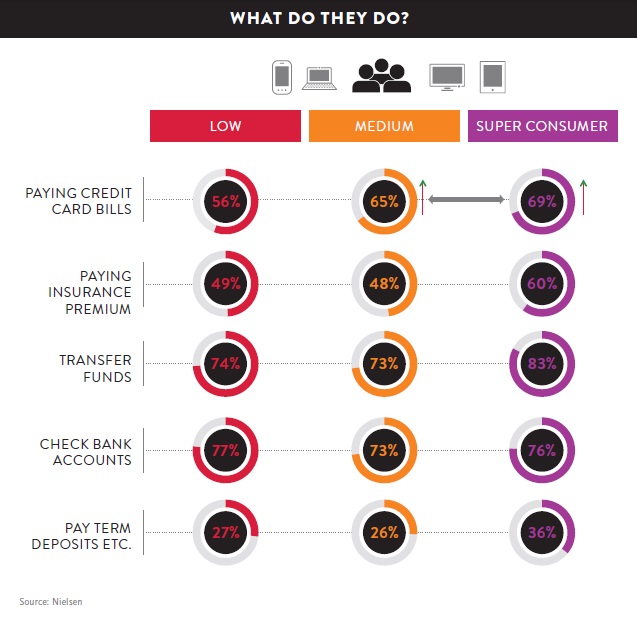

Super viewers do not limit themselves to merely entertainment; they’re comfortable with technology and know how to leverage it, taking to the Internet for many transactions. Our studies indicate that super viewers spend more than two hours a day accessing or downloading videos online. Not only do they spend more time online, they are ‘hooked’ on the content. The advent of smartphones have only made this easier for consumers.

Reaching The Super Viewer

This consumer group is relatively affluent, connected and young. They are familiar with and know how to leverage technology for their convenience. Companies can connect with this segment in two key ways:

ADVERTISING: This is a great avenue for FMCG retailers to support or position branded or customized video content, such as web episodes of a TV show. However, online advertising needs to be approached with care. While 36% of viewers said they would skip ads as they viewed them as irritants, 49% said they would watch advertising previously not seen.

Financial advertising could be a winner given that the super viewer is conducting most financial transactions online anyway. Going online could sway decision making in favour of the advertiser.

UNIQUE CONTENT: Super viewers have demonstrated a willingness to pay for their digital entertainment. There could be a market for the broadcaster creating exclusive ‘online content.’ Hindi tele-serials are also an area of opportunity. Going online offers a great way to connect with an audience currently not covered.

The biggest opportunity area, however, is English content. Television shows and serials currently not available in India have a potential target audience in the super viewer. Paid subscription could be a potential revenue generator.

With nearly 5 million new users taking their first step into the digital world every year, India’s internet users are expected to hit the 500 million mark by 2018, as per a report published by McKinsey & Co and Facebook. Today’s super viewer is not just a willing market for advertisers and broadcasters but also a good forecast of future consumer behaviour online. Leveraged correctly, the digital world is a new space waiting to be explored, and the super viewer is the compass with which to mark one’s direction.

For more details download the full report (top right).