When an unprecedented global pandemic forced many countries, cities, states and provinces to take drastic and restrictive social distancing measures, consumers had to hunker down. Like elsewhere in the world, consumers in the U.S. had to quickly adapt to not being able to do the things that were normal aspects of daily life: dining out, catching a ballgame with pals that weren’t cardboard cutouts—even just running out for groceries.

Used to having these freedoms, many consumers turned to a medium that still let them have near complete control, albeit for a small monthly fee in many instances: streaming.

COVID-19 has catapulted streaming to become the present, and perhaps the future, of content consumption—and perhaps creation as well.

In fact, COVID-19 has catapulted streaming to become the present, and perhaps the future, of content consumption—and perhaps creation as well. And according to the August 2020 Nielsen Total Audience Report, streaming among over-the-top (OTT) capable homes accounts for 25% of consumers’ collective time spent with the television. What’s more is that streaming has also taken hold among consumers 55 and older, often a technological sign of ubiquity and resolve.

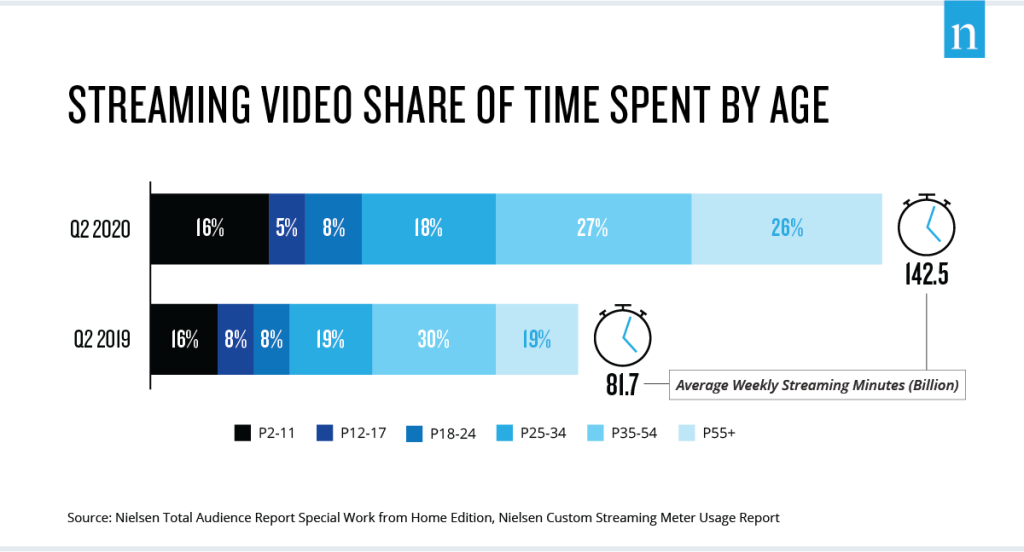

And the amount of time people are spending in front of the TV screen viewing streaming content continues to grow. According to data from Nielsen’s Streaming Meter, a subset of over 1,100 streaming capable homes from the National TV panel, as of Q2 2020, streaming comprised one-fourth of all television minutes viewed, with Netflix being the largest contributor to streaming share at 34%, followed by YouTube at 20%. In a short amount of time, newcomer Disney+ now accounts for over 4% of total streaming time.

Nielsen’s Remote Workers Consumer Survey also found that consumers aren’t just spending more time streaming video; they’re opening up their wallets to add options to boot. Beyond the steady rise in time spent streaming video, the number of services consumers are willing to budget for and subscribe to continues to grow as well. According to the survey, only 2% of adults say they are reducing the number of paid services they subscribe to, while 25% have added a service in the past three months. Hispanics have adopted new services even more wholeheartedly at 40%.

consumers aren’t just spending more time streaming video; they’re opening up their wallets to add options to boot: 25% have added a service in the past three months.

nielsen’s remote Workers Consumer Survey

With the number of new streaming entities coming to market and the demand for both original and legacy content growing by the day, how the streaming market evolves in the coming months and years should be not just top of mind for content creators. Additionally, these trends should be top of mind for media owners seeking to license programming, as well as marketers and brands, who might have additional opportunities for connecting products and services with engaged consumers via in-content brand placements. After all, there is a distinct and special opportunity for brands when that main character drives off in that uniquely-placed sports car prominently displaying the logo.

JOIN OUR WEBINAR

Understanding the Total Audience:

Insights, Trends & the Path Forward Amidst COVID

Tuesday, September 1 at 2:00 PM ET