A message for Journalists and Editors:

• Nielsen highly recommends journalists and editors to include a brief explanation of Nielsen

methodology into the article, whenever referring to Nielsen data as source of information.

• To avoid any possible inaccuracy in using Nielsen data as reference, please do not hesitate to contact the above person for clarification.

• Nielsen has the Right of Reply for any inaccuracy of Nielsen data usage in the article.

NEW REPORT REVEALS HOTSPOTS FOR GROWTH OUT TO 2030 IN ASEAN—AND THEY ARE NOT YOUR MEGA-CITIES

SINGAPORE, 6 JULY 2017 – ASEAN’S middleweight regions with population between 500,000 to five million are the region’s next big bet for growth, according to a new report by performance management company Nielsen and economic strategy firm AlphaBeta, debunking commonly held belief that mega-cities such as Jakarta, Manila and Bangkok are the region’s sole engine for growth.

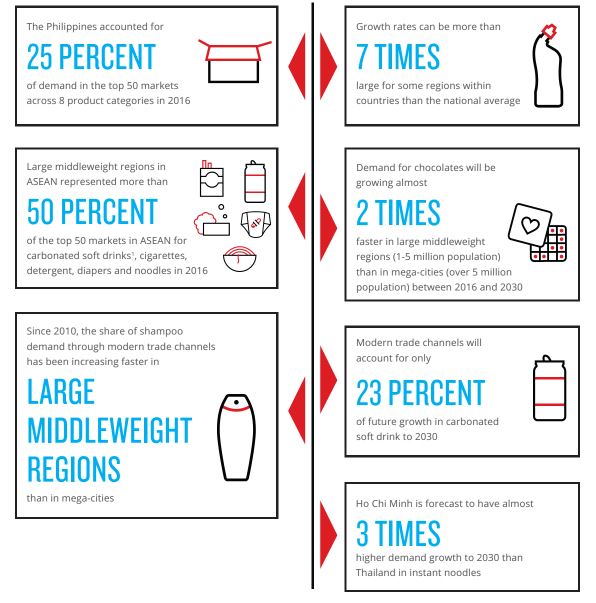

The Nielsen/AlphaBeta report, Rethinking ASEAN, dispels common myths about the consumer and marketplace dynamics within the region to reveal the real ASEAN consumer landscape (see Chart 1), and forecasts the hotspots for growth out to 2030. The analysis looks into the current and future potential consumer demand for over 700 cities and regions within the seven largest economies of ASEAN and covers 10 of the most popular product categories: chocolate, instant noodles, carbonated soft drink, beer, cigarettes, shampoo, laundry detergent, baby diapers, facial moisturizer, and vitamins.

“While ASEAN has been enjoying economic recognition in recent years, businesses tend to view it as a single entity and surprisingly, little is known about the many cities and regions that make up the archipelago. The diversity of its 625 million people represents a multitude of ethnicities, languages, and religion. This makes it crucial for companies to take a granular approach to understanding market opportunities in ASEAN,” says Patrick Dodd, Nielsen Growth Markets Group President. “It’s time for companies to look beyond mega-cities to see the growth opportunity hotspots within middleweight regions.”

The Nielsen/AlphaBeta report identifies three primary city-tiers within ASEAN – mega-cities, with a population of over five million, large middleweight regions or cities with a population of more than one million and less than five million, and small middleweight regions or cities with a population between 500,000 to one million.

The report is fuelled by ASEAN Consumer Demand Forecaster, a tool that can forecast out to year 2030 for 10 leading product categories. It provides a lens on more than 700 regions and provinces so companies can have a granular perspective of the markets.

In examining regions and provinces in ASEAN, the report further revealed that within one country, there can be regions with annual growth rates in double-digits, and other regions with no growth at all. As an example, in Thailand, country-level demand has grown at a relatively modest 1.2% per annum since 2010, however, Chiang Mai (with more than 500,000 inhabitants) grew seven times that rate.

“When targeting consumer markets, looking at country-level data doesn’t cut it anymore,” states Dodd. “While country-level analysis provides a holistic view of the market landscape, it does not show demand growth between regions within a country, which can differ substantially.”

What is driving growth in middleweight regions?

The six main drivers of growth in the middleweight regions highlighted in the report include: Cross-border trade and logistics, presence of economic clusters and business process outsourcing areas, the rise of satellite regions, natural resources, vibrant tourism, and a growing consumer base.

“The new consumption hotspots emerging across ASEAN are the result of a combination of several growth drivers,” explains Dodd. “Companies need to examine the forces that are driving growth in middleweight regions to understand past growth as well as assess the sustainability of those growth trajectories.”

Dodd continues: “For the ASEAN region, one size doesn’t fit all. To tap into these markets, companies should focus on product innovation and distribution strategies which cater to the lifestyles, requirements and challenges of consumers in specific areas.”

Dodd recommends three key actions for companies looking to leverage ASEAN’s middleweight regions:

1. Before entering a market, companies should consider that “take-off points” vary significantly across product categories, and also precisely where and when within countries. Companies should develop category activation on a micro region basis.

2. The complex ASEAN landscape calls for granular approach to understand market opportunities in the region. Companies should establish strategies targeting specific customer segments and regions. This approach will help companies prioritize their resources, be it marketing spend or strategic emphasis.

3. Given the diversity of regions in ASEAN and the fragmented business distribution channels, companies should look into the distribution structure within countries so they can better manage relationships and identify where best to cultivate distributor relationships.

CHART 1: The real ASEAN consumer landscape

Source: Rethinking ASEAN Report, June 2017, Nielsen

About AlphaBeta

AlphaBeta is a strategy advisory business serving clients across Australia and Asia from offices in Singapore and Sydney. Its team of advisors are experts in both strategy and economics who partner with clients from the private, public, and not-for-profit sectors to identify the forces shaping their markets and develop practical plans to create prosperity and wellbeing. For more information, visit www.alphabeta.com.

About Nielsen

Nielsen N.V. (NYSE: NLSN) is a global performance management company that provides a comprehensive understanding of what consumers Watch and Buy. Nielsen’s Watch segment provides media and advertising clients with Total Audience measurement services across all devices where content — video, audio and text — is consumed. The Buy segment offers consumer packaged goods manufacturers and retailers the industry’s only global view of retail performance measurement. By integrating information from its Watch and Buy segments and other data sources, Nielsen provides its clients with both world-class measurement as well as analytics that help improve performance. Nielsen, an S&P 500 company, has operations in over 100 countries that cover more than 90 percent of the world’s population. For more information, visit www.nielsen.com.