A new report by Nielsen reveals that video programming content such as TV, cable shows, professional video or user-generated content still generates its biggest audiences on television screens in Southeast Asia. But while the majority of viewers around the region say bigger is better when it comes to screen size, they also appreciate the convenience and portability of mobile devices. Around seven in 10 think watching video programming on their mobile device is convenient and more than six in 10 say a tablet is just as good as a PC or laptop computer for watching video programming.

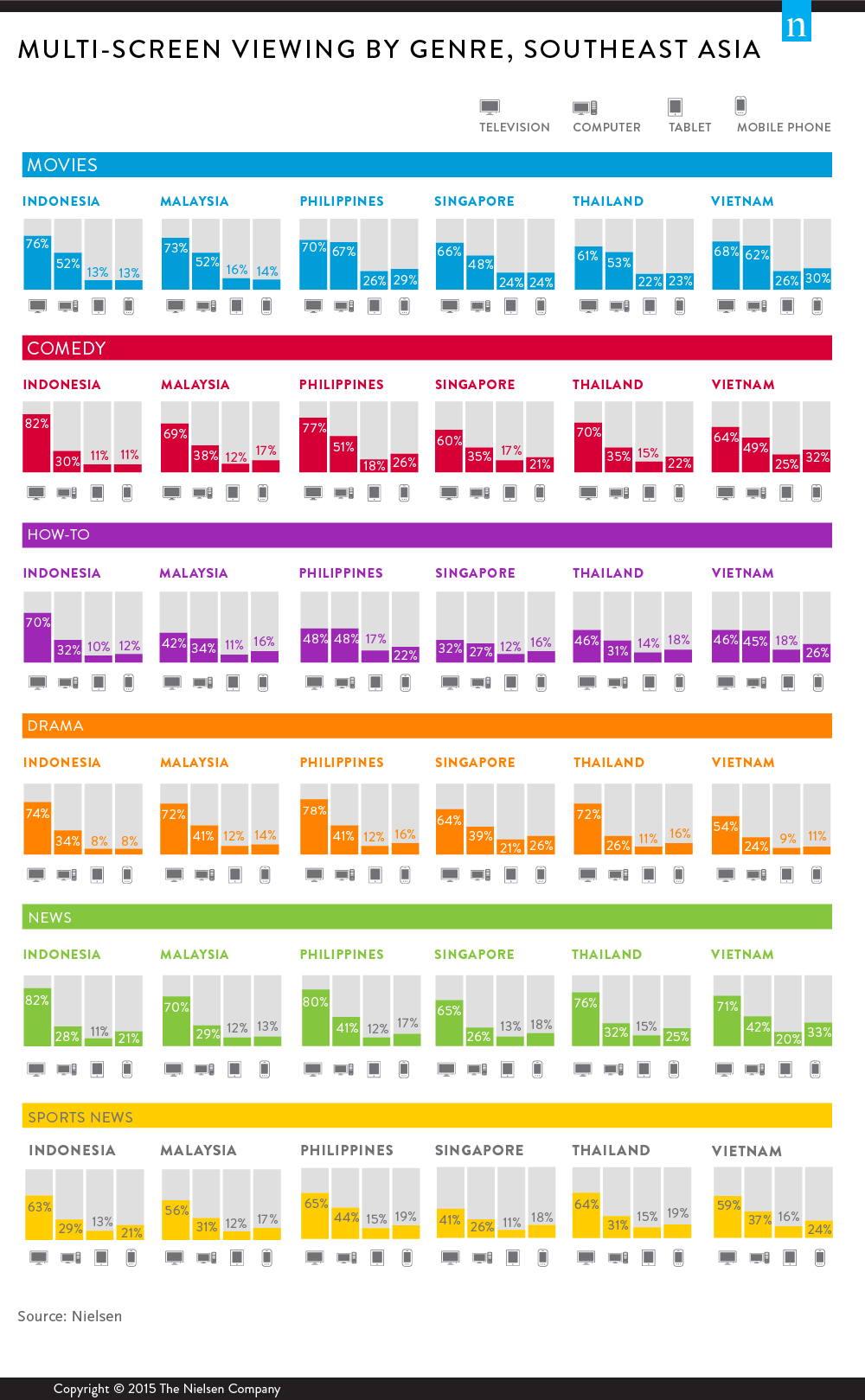

As device ownership in Southeast Asia continues to increase, particular genres and video formats such as movies, how-to shows, comedies, drama, news and sports are building a strong digital following, with Southeast Asian nations ranking among the highest globally when it comes to watching movies on a tablet (refer chart below).

There is a growing affinity among Southeast Asian consumers for anywhere, anytime connectivity and keeping up-to-date with the latest news. Filipinos ranked highest globally in terms of the extent to which they enjoy the freedom of constant connectivity (94%), and Indonesians (89%) ranked second highest globally. Desire for ‘always-on’ connectivity was also high in Thailand (88%) and Vietnam (88%) which, respectively, ranked fifth and sixth globally, while 86% of Singaporeans and 84% of Malaysians enjoy the freedom of being connected anywhere anytime, compared to just 76% globally.

“There is no doubt television still reigns supreme when it comes to consuming video content, but there is evidence of a spike in video consumption via connected devices across many Southeast Asia markets,” observes Anand Kalidasan, Nielsen’s Executive Director of Digital Audience Measurement in Southeast Asia. “Digital screens such as tablets and mobiles provide access to content which may not currently be available via television programming in many of these markets, and so it’s providing viewers with a whole new, broader selection of content to choose from.”

Live video programming holds strong appeal for consumers in Indonesia, the Philippines and Vietnam, particularly content which is linked to social media. More than three quarters of Indonesians (77%) said they prefer to watch video programming live (highest globally), while Thailand, Vietnam, Philippines and Indonesia all rank in the top 10 countries globally when it comes to watching live video programming content more when it is tied to social media.

Time-shifted programming is also popular among Southeast Asian consumers, with the majority saying time-shifted programming better accommodates their schedules. A large proportion of viewers in the regional also access video content via catch-up TV, with many reporting to often watch several episodes on the same day, particularly in the Philippines, Thailand and Indonesia.

As connected device ownership in Southeast Asia continues to expand, the prevalence of dual-screening across the region is amongst the highest in the world. The Philippines, Thailand and Vietnam rank the highest globally for browsing the internet while watching video programming. Likewise, Southeast Asian viewers, particularly Filipinos, Thais, Vietnamese and Indonesia, are avid users of social media during screen time.

“Media consumption habits in Southeast Asia are undergoing the most fundamental change since the introduction of the television,” emphasises Kalidasan. “Increasing access to all types of content across a multitude of platforms is providing viewers with more choice than ever before. Coupled with Southeast Asians’ passion for of social media, this is driving a significant shift in viewing trends.

“This new media landscape is presenting more opportunities for media owners, agencies and advertisers alike to reach and engage viewers, and it is more critical than ever for these stakeholders to understand and tap into evolving media consumption habits.”

This article is based on insights contained in the Nielsen Global Digital Landscape Report.