For Black Americans, content provides a common ground and sense of cultural credibility. Defined through media and exported globally in fashion, TV, music and more, this culture is fundamental in its ability to bridge meaningful connections with an increasingly diverse audience. And while representing Black America is already complex, 16% of the Black population is expected to be foreign-born by 20601. That means that content will need to continue evolving to stay relevant for this media-hungry audience.

Media has become omnipresent among many consumers, but engagement is highest among Black audiences, who spend about 12 hours more time with media each week than the general population2. In addition to its ability to connect, today’s media landscape offers immense choice—a quality that facilitates stories and experiences that can more completely emulate the complexity of the growing Black community.

As with all audiences, Black Americans spend the biggest portion of their media time with TV, followed by their smartphones and radio. Unlike other audiences, however, TV plays a much bigger role in their daily lives than the general population. Not only does TV account for a larger share of their media diets, Black adults spend 31.8% more time with TV each week than the general population.

In total, Black viewers spend almost 55% of their media time with TV: live programming, time-shifted viewing and content they access through TV-connected (CTV)3 devices. Among audiences 65 and older, TV accounts for almost 69% of all media use. Through the lens of total TV usage, Black audiences are the most proportionate with the time they spend with all TV content, embracing everything TV offers them.

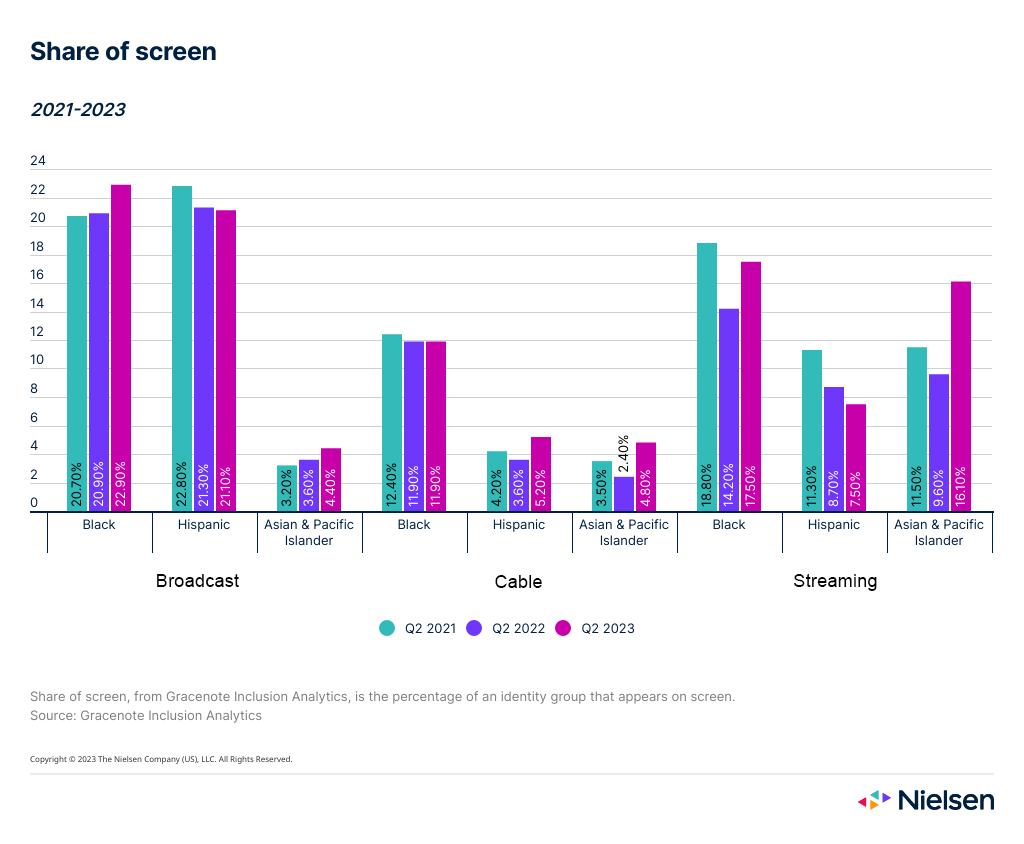

Much of the allure of TV content among Black audiences stems from its growing variety and inclusiveness. Across linear channels and streaming services, U.S. audiences now have access to more than 1.1 million unique titles4 to choose from, an increase of more than 75% in just three years. In terms of appeal, this massive library is very inclusive of the Black community. In fact, in second-quarter 2023, Black talent had a higher share of screen5 than other historically excluded populations.

Yet while Black talent has never been more visible on TV—and well above parity6—audience demand suggests there’s room for even more. In fact, Nielsen’s 2023 Black Diaspora Study powered by Toluna found that the desire for more inclusion on TV was higher among Black audiences than any other identity group.

And while U.S. Black audiences are 1.4x more likely than the general population7 to say there’s not enough representation, the demand is even higher in other countries. This suggests that while the presence of Black talent may be widespread at a macro level, global survey respondents don’t believe it captures the complex intersectionality across Black communities around the world.

Perhaps more important than representation, however, is the need for diverse, authentic and accurate portrayals in content—something Black audiences feel needs to be improved. While this sentiment is high globally, it’s particularly outsized in Nigeria.

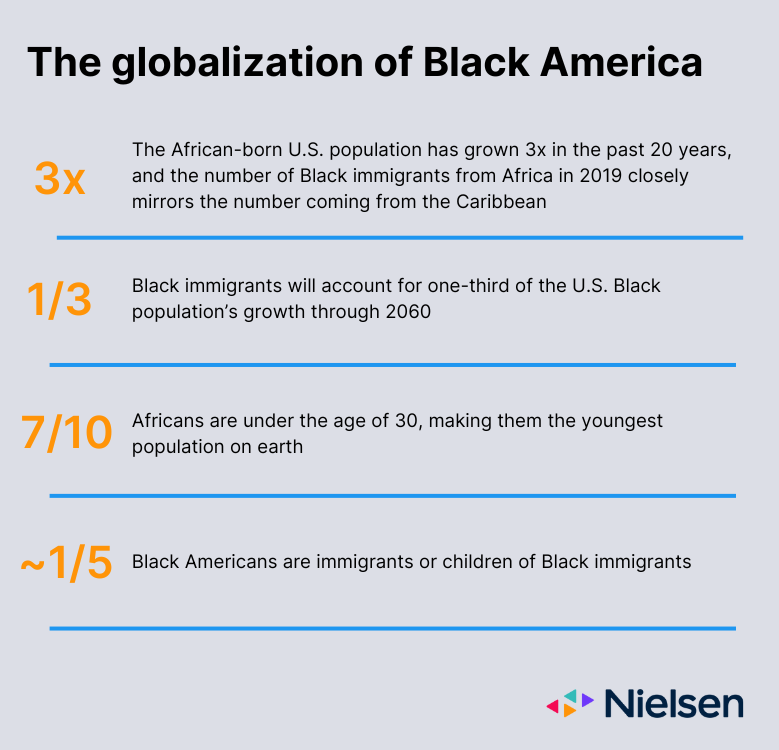

In looking at immigration trends, the sentiment from Nigeria and South Africa is particularly noteworthy. While the Caribbean remains the largest contributor of the rising foreign-born Black population in the U.S., Africa now accounts for the fastest growth, contributing more than 2 million in 2019 alone8. Diverse in its own right, that influx comprises individuals from 51 countries9, introducing a range of ethnic, linguistic and educational backgrounds.

With such a large infusion of people and cultures expected in the coming decades, complemented by the importance of media within the Black community, the globalization of Black America sets the stage for brands and programmers looking to engage with this diverse audience in a rapidly expanding media landscape.

For additional insights, download our latest Black Diverse Intelligence Series report: The global Black audience: Shaping the future of media.

Notes

1Pew Research Center; January 2022

2Nielsen National TV Panel; Q2 2023

3CTV refers to any television that is connected to the internet. The most common use case is to stream video content.

4Gracenote Global Video Data; October 2023

5Share of screen, from Gracenote Inclusion Analytics, is the percentage of an identity group that appears on screen.

6Above parity means that the percentage of representation is higher than the percentage of the U.S. Black population, which is 13.6%, according to the U.S. Census Bureau.

7Nielsen 2023 Black Diaspora Study powered by Toluna

8U.S. Census Bureau 2010, 2019 American Community Surveys (ACS), and Campbell J. Gibson and Kay Jung, “Historical Census Statistics on the Foreign-born Population of the United States: 1850-2000“

9The Migration Policy Institute; May 2022