There’s nothing quite like the freedom of owning your own car. Demand for this independence is spreading rapidly across the globe, thanks in part to changing population trends, rising wealth accumulation and growing aspirations. Expansion is good news for automakers, but understanding the motivational factors driving this growth in demand is critical to reaching the right consumers. So how can the auto industry effectively connect global consumers to the car of their dreams?

“Linking global automotive demand with consumer sentiments and media habits is vital to developing marketing strategies that connect the right consumers with the right automotive brands,” said Pat Gardiner, president of Nielsen Automotive. “The Asia-Pacific and Latin American regions, as expected, represent large areas of growth opportunity for the industry, but capturing this opportunity hinges on marketers successfully identifying, understanding and effectively connecting with the needs and desires of these buyers.”

One key to unlocking the demand drivers is discerning what role a car plays in the consumer’s life. Is it for utility—simply a mode of transportation to get you from one place to another? Is it to express status—a symbol of the success you’ve achieved in life? Or is it more purely emotional—you just love to drive? While each of these sentiments may play a role in the car-buying decision process, connecting with the emotions that pull at the heartstrings draws consumers more powerfully along the path to purchase.

“Understanding the motivators of car-buying intenders allows marketers to create messaging that will resonate strongly,” said Gardiner. “If you know that consumers are driven by status, then sales efforts centered on the luxury car market should be a priority focus. Similarly, with utility-minded, finance-driven or driver-enthusiast consumers, a keen focus on their desires will ensure that your strategies are proactive and aligned with their wants.”

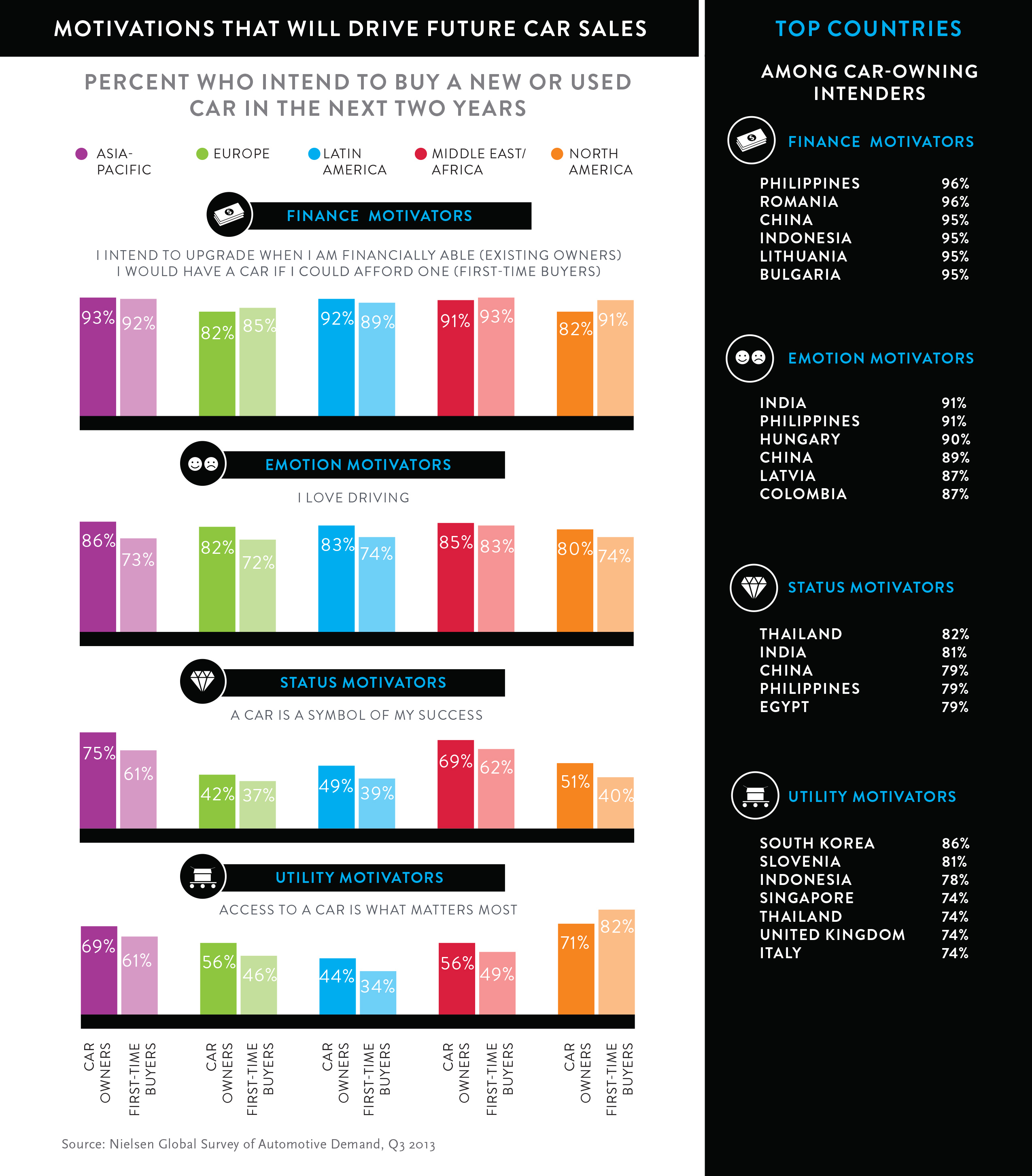

Beyond practicality issues (not surprisingly, financial motivators are the strongest sentiment expressed globally among existing car owners [89%] and first-time car buyers [91%] who intend to buy a car in the next two years), the biggest trigger of automotive sales is purely emotional. Among existing car owners in the market to buy a car, 84 percent expressed a love of driving, which is significantly higher than the desire to fulfill a utilitarian purpose (63%) or to represent a symbol of success (62%).

And age matters. Global Millennial respondents (aged 21–34) are particularly motivated by status. Compared to respondents who are over age 35, Millennial car owners are 68 percent more likely to say the car they drive is a symbol of their success. And first-time Millennial car buyers are 25 percent more likely than older cohorts to believe a car is a status symbol. Interestingly, the research shows that status motivators are important for those who are on the cusp between low and high income groups—those who are typically just able to afford a car.

The love of driving as a purchase motivator among existing car owners is greatest in Asia-Pacific (86%), but three-quarters of respondents in the region are also spurred by the desire for status (75%), followed by the need for utility (69%). Similarly, in the Middle East/Africa and Latin America regions, a love of driving among existing car owners (85% Middle East/Africa; 83% Latin America) and status (69% Middle East/Africa; 49% Latin America) are strong motivators, followed by utility reasons (56% Middle East/Africa; 44% Latin America).

The attitudinal motivators among existing car owners in North America and Europe who intend to buy are similar to one another, with more respondents citing utilitarian reasons (71% North America; 56% Europe) than status intentions (51% North America; 42% Europe). Still the love of driving (80% North America; 82% Europe), while not as strong a motivator in these regions as in Asia-Pacific or Middle East/Africa, trumps utility and status.

Other findings include:

- Insight into how to effectively reach customers with mixed media advertising.

- Global trends in auto alternatives.

- Quick-reference country scorecards.

For more detail and insight, download Nielsen’s global online survey of automotive purchase intent.

About the Nielsen Global Survey

The findings in this survey are based on respondents with online access in 60 countries. While an online survey methodology allows for tremendous scale and global reach, it provides a perspective only on the habits of existing Internet users, not total populations. In developing markets where online penetration is still growing, audiences may be younger and more affluent than the general population. In addition, survey responses are based on claimed behavior, rather than actual metered data.