Today’s consumers face a growing array of devices and ways to connect with content–giving them the option to connect anytime, anywhere—and marketers are scrambling to capture their attention. But in their mad dash to engage consumers, marketers have had a constant companion as new products have been brought to market: radio.

According to Nielsen’s Q3 Cross-Platform report, radio continues to play a huge role in the lives of U.S. consumers, especially as we commute back and forth from work as part of our daily routine.

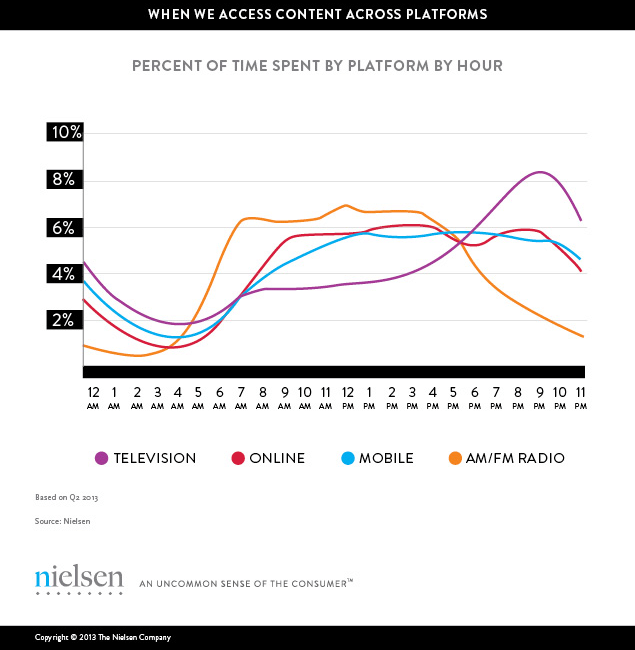

The average American radio listener tunes in to AM/FM radio for over two hours per day, according to recent analysis determining when consumers are engaging with different mediums. Interestingly, audio consumption reaches a plateau in the morning hours, peaks around noon and then stays fairly constant through the day before tapering off as people start their evenings and morph into television viewers. Between the morning and early evening hours, roughly two-thirds of audio listening comes from out-of-home tuning.

Overall, more than 90 percent of Americans listen to radio each week, and those numbers are highest with African Americans (92%) and Hispanics (94%). Additionally, the report noted that people who listen to a lot of traditional radio also spend time with online radio, especially among the millennial generation.

The hyper local nature of audio offers advertisers community-level engagement between content and in-store activity. Often timely, radio spots can catch listeners right before they make their purchase decisions, and an impactful radio spot can inform and influence these decisions.

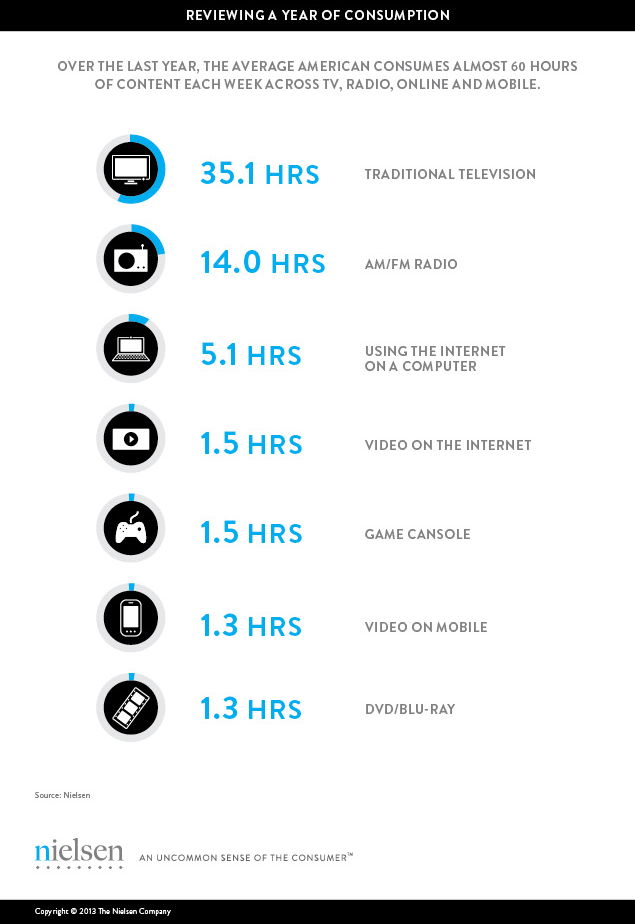

Overall, the Q3 Cross-Platform report found that over a full year, the average American consumes nearly 60 hours of content each week across different platforms like television, radio, online and mobile. That’s about two-and-a-half days!

In terms of viewing, the report found that in the third quarter of 2013, the average American logged an average of 39 hours with content across screens per week.

Weekly time spent saw quarter-over-quarter gains in few categories. Consumption of timeshifted viewing, watching on a DVD/Blu Ray device, using a game console and watching video on the Internet or a mobile phone all saw increases.