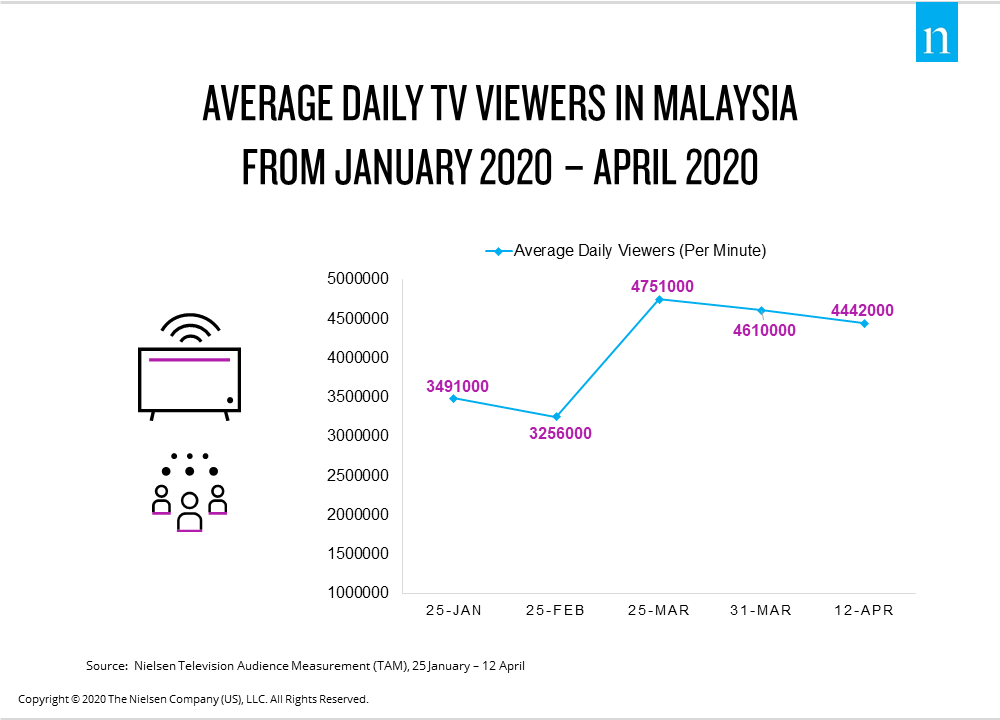

As has been the case around the globe, restricted living amid the novel coronavirus (COVID-19) pandemic has affected every aspect of daily life. It has also had a dramatic effect on media consumption, especially television viewing. In Malaysia, the Movement Control Order (MCO) has sparked an average 30% rise in TV viewers since enacted. While the rise would be expected given the lockdown, viewership data highlights that the restricted living conditions have altered the viewing behaviors of some consumers more than others.

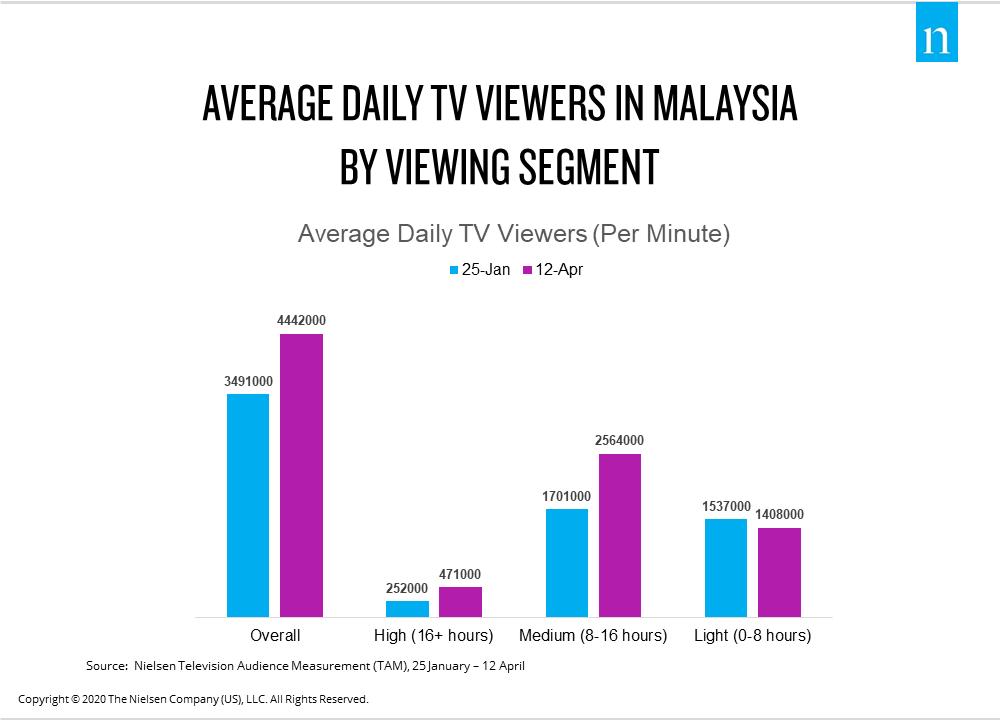

The effect of the MCO on TV viewing has had the biggest effect on consumers who historically watched less TV pre-COVID-19. Pre-MCO, the balance between medium viewers (viewers who watch 8-16 hours per day) and light viewers (viewers who watch 0-8 hours per day) was quite well distributed, at 49% and 44%, respectively. By 12 April, this had changed to 58% and 32%, effectively transitioning a notable portion of viewers into the medium viewer category. This change resulted in the average daily time spent viewing television rising to 7 hours 7 minutes from 5 hours 36 minutes before the MCO.

To look at it in a more simplistic way, at the end of January, the population was viewing a daily total of around 29 million hours of television. By 12 April, this had risen to 43 million hours, a staggering 49% increase. Importantly, increases were seen across both free-to-air and paid-for platforms. While we expected a rise in viewing as more people tune in to television to stay informed as well as to stave off boredom, we are surprised by the extent of the increase, which has surpassed viewing levels seen before the recent digital revolution.

While these unprecedented increases are enjoyed by all broadcasters, the uplift by genre changes, and like during a normal week, they can fluctuate on a day-to-day basis, influenced by the programming schedule. Although the rakyat is thirsty for information, it’s not just news which has benefitted, as significant uplifts are also seen for Reality TV and Cookery & Female Orientated shows.

“It’s natural to assume that once the MCO is lifted, there will be a desire for people to want to experience life outside the confines of their home, which could impact the sustainability of viewership. To help maintain interest, it will be key for broadcasters to get new programming into production and on screen as soon as possible, given that many will have exhausted their content during the MCO,” says Jon-Paul Best, Managing Director, Nielsen Media (Malaysia).

It’s natural to assume that once the MCO is lifted, there will be a desire for people to want to experience life outside the confines of their home, which could impact the sustainability of viewership. To help maintain interest, it will be key for broadcasters to get new programming into production and on screen as soon as possible, given that many will have exhausted their content during the MCO.

Jon-Paul Best, Managing Director, Nielsen Media (Malaysia)

Advertisers need to invest and reinvent

Amid the massive viewing spike, advertisers are pulling back on advertising, as evidenced by the 8% decline in overall TV advertising spend from February to March. While the aggregate figure does not appear too drastic, this is around a 25% decline in like for like advertising spend from the same period last year, with certain industries harder hit than others, including travel and tourism, fast food, entertainment, airlines and department stores.

“Some businesses have questioned the benefit of advertising at this time if the population is severely limited in terms of what it can buy,” says Best. “However, as supermarkets remain open and as FMCG brands are some of the biggest advertisers, we believe that now is the time to invest in reaching out across all key media platforms, when consumers are most attentive and are looking for empathy. For those products and services still available, consumers need reassurance, so companies should remain engaged and ensure that their brands and products remain relevant.”

Methodology

Insights in this article are derived from:

- Nielsen Television Audience Measurement (TAM), January 2020 – April 2020

- Nielsen Ad Intel, March 2020. Total spend includes FTA Television, Newspapers (those papers received at the time of analysis), Magazines (those magazines received at the time of analysis), Digital, Cinema, Radio and In-store.