For the first time ever, the World Cup will overlap with the holiday season, creating a unique opportunity for brands to turn football fans into festive shoppers. And, as women are often key holiday season spenders, marketers can maximize the impact of both World Cup and holiday campaigns by focusing on reaching and connecting with female fan bases.

As consumers, women are gaining influence and increasing their buying power—women accounted for an estimated $31.8 trillion in global consumer spending in 2019, and direct 83% of all consumption in the U.S., in buying power and influence despite being only half of the population. Women also started to outpace men in retail spending during the holidays, both online and in stores. Nielsen Scarborough data found that 81% of U.S. female consumers shopped online in Q4 of 2021, up 9.5% from Q4 2019, while male consumer online shopping was up 6.7% over the same period.

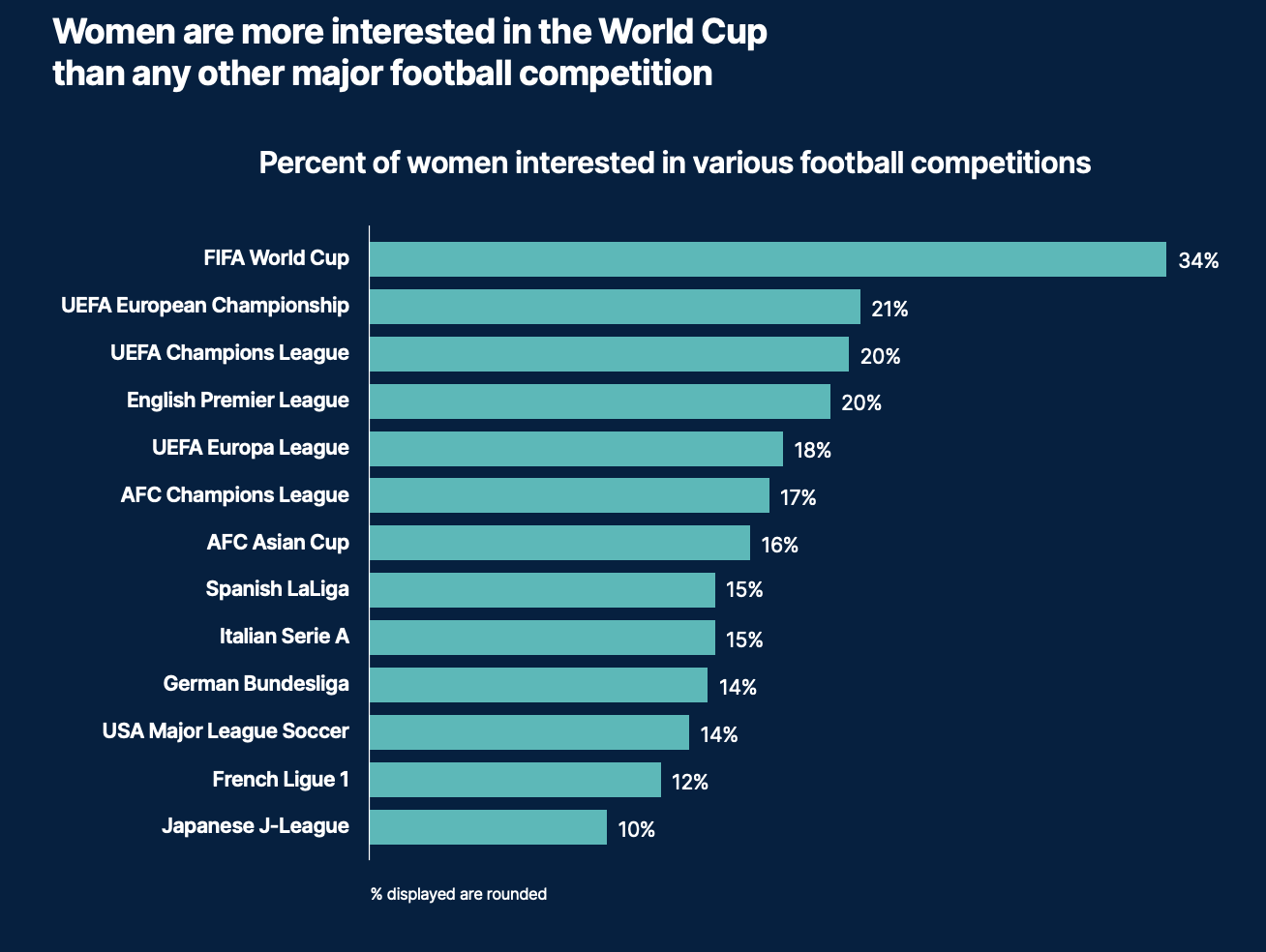

And while more men watch football than women overall, women’s interest in the World Cup dwarfs all other major international football competitions, and women currently make up 37% of all global football fans.

To deepen engagement with these sports fans, female-inclusive advertising is key, but many brands are missing the mark when it comes to representation in their sports ads. An analysis of Super Bowl LVI ads leveraging Nielsen Ad Intel and Pudding.ai, for example, found that only 30% of the ads during the game featured women in the creative. This lags behind the overall representation in U.S. TV content of 43%, according to Gracenote Inclusion Analytics, signaling that advertisers have ground to make up when it comes to creating sports ads that are relevant and engaging for female audiences.

In addition to representing women visually in content and creative, marketers also need to consider where their ad dollars will be most effective by channel. According to Nielsen’s 2021 global Trust in Advertising study, both women and men see brand sponsorships in sporting events as the third most-trustworthy channel. And while men and women are mostly aligned on the trustworthiness of other marketing channels, influencer marketing stands out as the biggest difference, with female consumers finding influencers more trustworthy by three percentage points.

Considering the trustworthiness from influencer marketing, brands may want to consider combining their team sponsorship and influencer marketing to increase reach and impact for campaigns. And this year’s World Cup has a number of player influencers who bring millions in social media value, along with some notable up-and-coming football social media stars who can help brands achieve the most reach and impact for their marketing spend.

And football fans are eager to engage with and buy from brands that sponsor their favorite teams or players—59% of football fans globally would pick a sponsor’s product over a rival’s if price is the same, and 67% of football fans think brands are more appealing when they participate in sports sponsorships.

When it comes to driving action, word of mouth is the most influential with female consumers globally (89% always or sometimes take action), but women are also more likely to take action from branded websites (81%), television ads (78%), influencers (74%) and sports sponsorships (70%).

Combine the high level of trust sports sponsorships have with the correlation between sponsorship and consumer action and shopping trends, and brands have plenty to gain from attracting female fans. A recent analysis of 100 sponsorships between 2020 and 2021 in seven markets across 20 industries, Nielsen found that the sponsorships drove an average 10% lift in purchase intent among the exposed fanbase.

With nearly two-thirds of the world’s total population expected to watch the World Cup over the course of its month-long run, a potential billion-plus female fans will be viewing the action—and advertisements—both on the field and off. Brands that want to capitalize on the convergence of the World Cup and holiday season need data that will help them identify the right channels and talent to turn casual female football fans into loyal shoppers.

Notes:

- World Data Lab, 2020

- Morgan Stanley, 2019