Despite the growing wealth of content options available to consumers, few rival the influence of live sports, as evidenced by the boom in NFL viewership this season, which culminates with Super Bowl LVI on Feb. 13, 2022. And while consumers have been watching professional football on TV for decades, connectivity is playing an increasingly important role in how they watch today, as 28% of all U.S. TV households now use broadband connections for their TV viewing.

Broadband-only (BBO) homes account for the predominant type of cord cutters—homes that receive their TV programming without access to traditional cable or satellite services (the other type uses a physical, typically digital antenna to access programming). In total, 44% of households have cut the cord or have never had traditional cable or satellite services (cord nevers). Five years ago, 81% of U.S. TV households accessed TV content through traditional cable or satellite boxes.

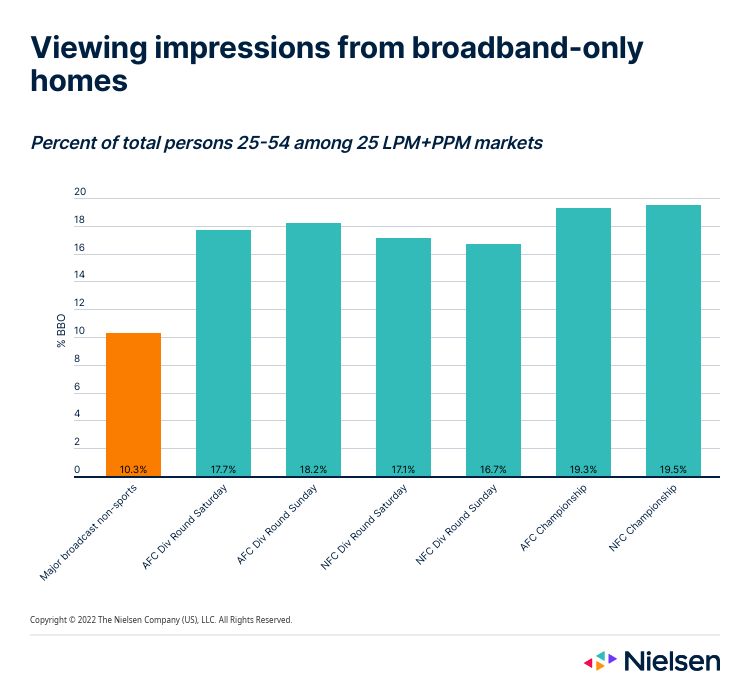

While the shift is a clear indicator of how Americans are changing the ways they consume content, BBO households are leading the charge where sports are concerned, especially during this year’s NFL playoffs. In fact, viewers 25-54 in BBO homes across LPM+PPM markets accounted for 17%-18% of the TV audience for the divisional playoff games on Jan. 22 and 23. Fast forward a week to the Conference Championship and that number was just under 20%. Comparatively, between Jan. 6 and Jan. 23, viewers 25-54 in BBO homes accounted for approximately 10% of the non-sports programming on the three networks that carried the divisional and conference championship playoffs. But BBO homes are interested in more than just professional football. Last year, for example, persons 25-54 in BBO homes made up 11% of all NBC Olympic viewing minutes.

In addition to highlighting the importance of sports programming to BBO homes, the data also illustrates how BBO homes use their connectivity for much more than just streaming movies from over-the-top services like Netflix, Hulu and Amazon Prime Video. It’s true that connectivity has driven massive growth in content that Americans are streaming, especially during the pandemic, but broadband usage was growing among U.S. households well before COVID-driven lockdowns began. And that growth is accelerating.

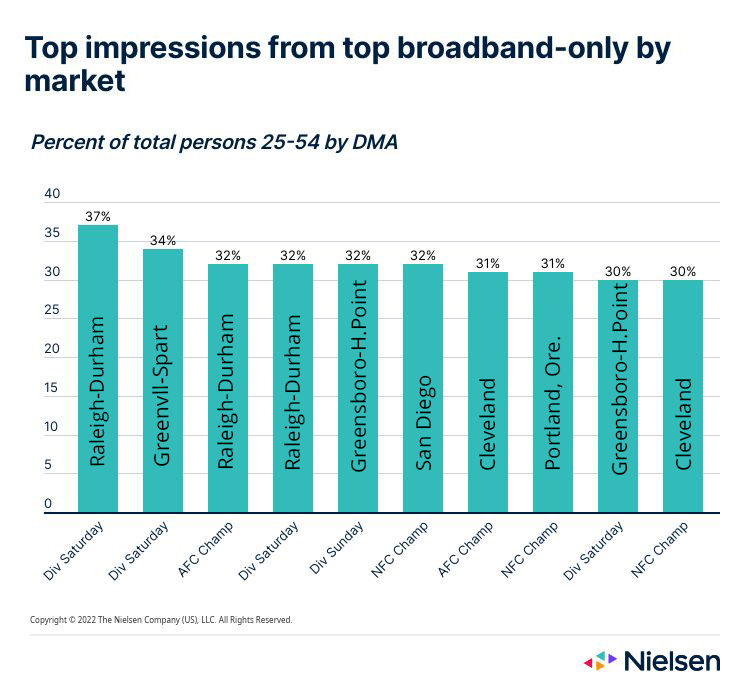

In January 2022, more than 83% of U.S. homes had at least one TV connected device—that’s up 10 percentage points from January 2020 (74%). And while increasing connected TV device penetration has also fostered the growth of broadband-only (BBO) homes in the U.S., which now account for 28% of all TV households, penetration in some markets is higher than 36%. Importantly, BBO isn’t just prominent in major city-anchored DMAs. In fact, the Federal Communications Commission (FCC) recently announced new funding of as much as $1.2 billion through the Rural Digital Opportunity Fund to expand broadband access in 32 states. Through this funding, 23 providers will bring broadband service to more than 1 million locations.

While the FCC’s announcement speaks to future investment, we can already see the impact of broadband connectivity in markets that are notably smaller than large cities like Los Angeles, New York and Chicago. In fact, when we look at viewership of the divisional and championship playoff games, the top DMAs for BBO viewership are notably more rural in nature than New York and Los Angeles.

Amid a growing wealth of media options, broadband internet has established itself as a means to access an array of video content—not just programming from streaming services. In fact, TV households that receive their TV programming through broadband connections now outnumber those that receive their programming through over-the-air antennas (broadcast-only homes). Sports programming has always been a primary driver of scheduled, appointment viewing, but the dramatic engagement with sports content suggests that even homes that are more likely to consume content on their schedules will watch scheduled programming when it’s the programming they’re looking for.