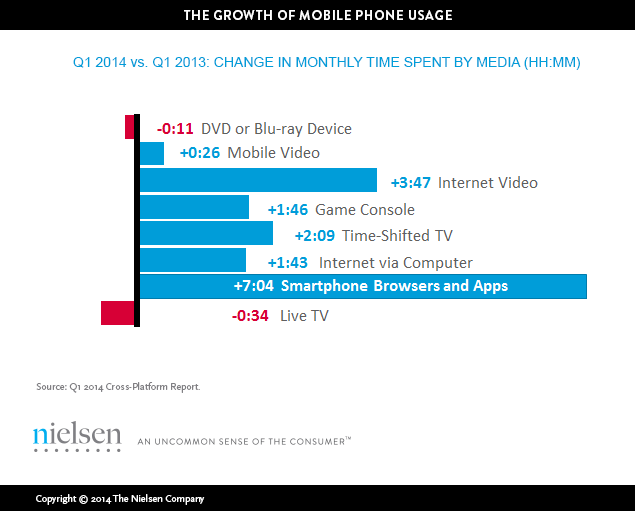

There’s no question that mobile is here to stay. Just look at smartphone penetration, which stands at 70 percent in the U.S. And the ramp-up has happened almost overnight, as the average American now spends seven more hours each month with their phones than they did in 2013.

But it’s not just the devices themselves that are making them more ubiquitous—it’s what they can do for us. People expect a new experience with technology, said Enid Maran, SVP Advertiser Solutions for Tech/Telecom at Nielsen, during a panel on mobile last week at the Advertising Research Foundation (ARF). Consumers expect to interact with technology, and kids expect devices of any and all sizes to respond to their touch—a concept that would have been unthinkable a mere decade ago. Our phones are with us all day every day, giving us recommendations, directions, information and more.

But despite the exponentially growing role of mobile in peoples’ everyday lives, ad spend isn’t keeping pace. That’s because the amount of time people spend with mobile media is disproportionate to the advertising share that mobile attracts: People spend more than 38 hours per month on their phones, according to Nielsen’s Q1 2014 Cross-Platform Report, yet mobile comprises only about 4 percent of total ad spending.

Why isn’t mobile spend keeping up?

So if mobile is “the now,” why is mobile ad spending lagging so far behind mobile usage?

While industry onlookers realize it will take some time for mobile ad spend to grow, panelists at last week’s “Has Mobile’s Day Finally Come?” discussion said the mobile medium has already carved out its own niche. Saying that brands aren’t spending on mobile is a misconception, said Raymonde Greene, VP Director of Media Activation & Partnership at Digitas. He explained that while few companies have dedicated mobile ad budgets, mobile is undoubtedly part of every brand’s overall digital strategy. He elaborated by adding that a substantial amount of brands’ overall digital ad exposure is on mobile, but isn’t credited as such, saying, “It’s the same barriers we saw in (desktop) digital five or six years ago.”

Despite the similar barriers, however, Greene cited some unique challenges with mobile. He pointed out, for example, that viewing sessions are much shorter. Apps are easier to scroll through than a desktop screen, so users spend less time viewing them.

Nileem Jani, Director of Advertiser Strategy for Production & Brand at Verizon Wireless, stressed the importance of context over channel. And to that point, Jani noted that Verizon Wireless considers the environment that the consumer is viewing an ad in before deciding to spend. If an ad is in a context where a user doesn’t want to be reading about phone plans, she said, it has no chance of being effective.

Echoing Jani’s claim, Peter Orban, EVP Research & Innovation, Mobile & Social at the ARF, added that it’s misleading to think of mobile as one consistent environment. Mobile devices are portable and offer many ways to consume content, he said, and brands need to consider everything these attributes bring to the table in order to maximize advertising effectiveness.

Mobile is “different”

Mobile advertising can’t be treated like desktop advertising, added Greene, elaborating that with smartphones, the device is the consumer. It’s more than a medium, he said. “It’s a wearable, extension of the person.”

Agreeing that mobile is a different medium, Ken Lagana, SVP Sales, Entertainment, Sports & News at CBS Interactive, pointed out that publishers need to shift their perspectives to those of their users.

Lagana said CBS Interactive continually evaluates how its users engage with apps in order to innovate on mobile. In the case of fantasy football, for example, Lagana said users engage in a fantasy draft differently from how they interact with other digital experiences. During a draft, people view a single screen for extended periods of time, so CBS has started developing a mobile-specific fantasy drafting app that will allow ads to capitalize on the fact that they will be in view for longer periods of time. And it’s this in-app user experience perspective that Lagana says is a key strategy for publishers like CBS.

But when it comes to business, moves like that are sometimes easier said than done. This is particularly relevant in mobile, as the panelists all agreed that a lack of reliable measurement has been a big challenge in moving things forward.

So what’s the key to mobilizing mobile? Greene says marketers have to start moving mobile into their foundational brand strategies in order to boost key performance indicators (KPIs)—the only way to assess exactly how an ad is performing. And when it comes to performing on mobile, Greene believes solutions like Nielsen Online Campaign Ratings will become valuable.

The ARF’s Orban said that in order to shift more toward mobile, the industry needs more measurement, which means more experimentation.

Some agreed that not being able to measure fraud on mobile is also hindering mobile advertising. “There’s no fraud protection, no way of measuring viewability issues on mobile,” said Lagana, stressing that these issues need to be reconciled in order to forge ahead with mobile.

Mobile is now, the future and beyond

Regardless of affiliation, each member of the panel left stressed that media buyers and sellers must make mobile a priority now. As Verizon Wireless’ Jani noted, the numbers don’t lie. “If 52 percent of people saying mobile is their first screen isn’t enough to show that mobile is important, I don’t know what is.”

Equipped with more powerful mobile measurement tools than in the past, marketers have the ability to dive into mobile advertising more confidently. With many topics still open for debate, the panelists concurred that mobile is here to stay, is changing how we need to think about engaging with consumers, and needs to be a defined part of every brand’s advertising strategy.