With the holiday season fast approaching, retailers are already bringing out their Christmas decor in hope that this year will bear a better sales return than last year. Nielsen conducted its annual holiday sales forecast and expects holiday spending in 2014 to rise 1.8% in dollars sales, compared with 1.2% in 2013. What’s behind this growth? Many factors, including lower gas prices. But multicultural consumers will push shopping carts to sales growth this season.

Rising number of consumers in the U.S. identify as multicultural. According to the 2014 U.S. Census, 55 million Hispanics live in the U.S., making up 17% of the overall U.S. population. In addition, 44 million African-Americans live in the U.S., which is 14.2% of the entire U.S. population. And 19.4 million Asian-Americans live in the U.S., which translates to 5.4% of the total U.S. population.

While we’ve already explored how these diverse shoppers fit into larger seasonal trends this year, we’re taking a deeper dive into how multicultural consumers will propel holiday sales growth over the next few months.

Seasonal Spending Stars

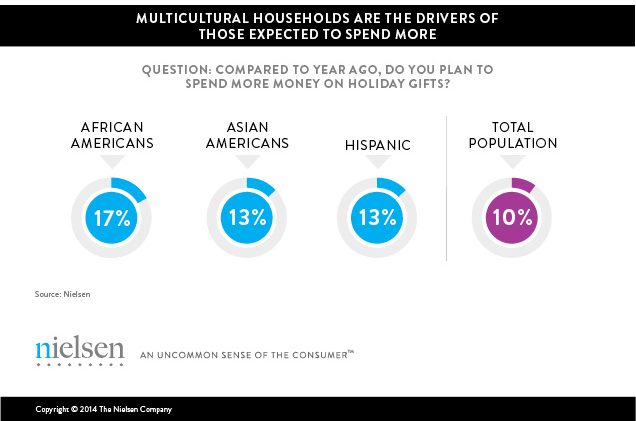

Even though 10% of the U.S. population plans to spend more this holiday season than last year, multicultural households account for 43% of the projected extra spending. That breaks down to 17% of African Americans polled planning to increase their spending, followed by 13% of Asian Americans and 13% of Hispanics. And this anticipated spending is significant. More than a third of each group plans to spend an average of $250-$500 this season on gifts, and over 20% of each segment say they’ll spend an average of $500-$1,000.

How much are you planning to spend while holiday shopping this year?

| Would you say you plan on spending…? | African American | Asian American | Hispanic | Total population |

|---|---|---|---|---|

| Less than $50 | 1.5% | 1.4% | 1.5% | 1.6% |

| $50 to less than $100 | 6.2% | 6.5% | 4.8% | 6.5% |

| $100 to less than $250 | 20.0% | 17.1% | 19.0% | 19.6% |

| $250 to less than $500 | 33.2% | 34.3% | 38.0% | 31.6% |

| $500 to less than $1000 | 20.4% | 21.5% | 22.0% | 22.2% |

| More than $1000 | 5.3% | 7.0% | 5.4% | 7.3% |

| Don’t know/Not sure | 13.2% | 11.9% | 9.0% | 10.9% |

| Source: Nielsen Homescan and September 2014 Online Views Survey. |

‘Tis the Season…Soon

Even though these multi-ethnic consumers expect to spend significantly more this season than they did last year, they will wait longer to spend. Retailers still have time to reach these avid shoppers, as 70% of say they plan to wait for their holiday shopping, compared with 65% of total households.

Topping the Gift List

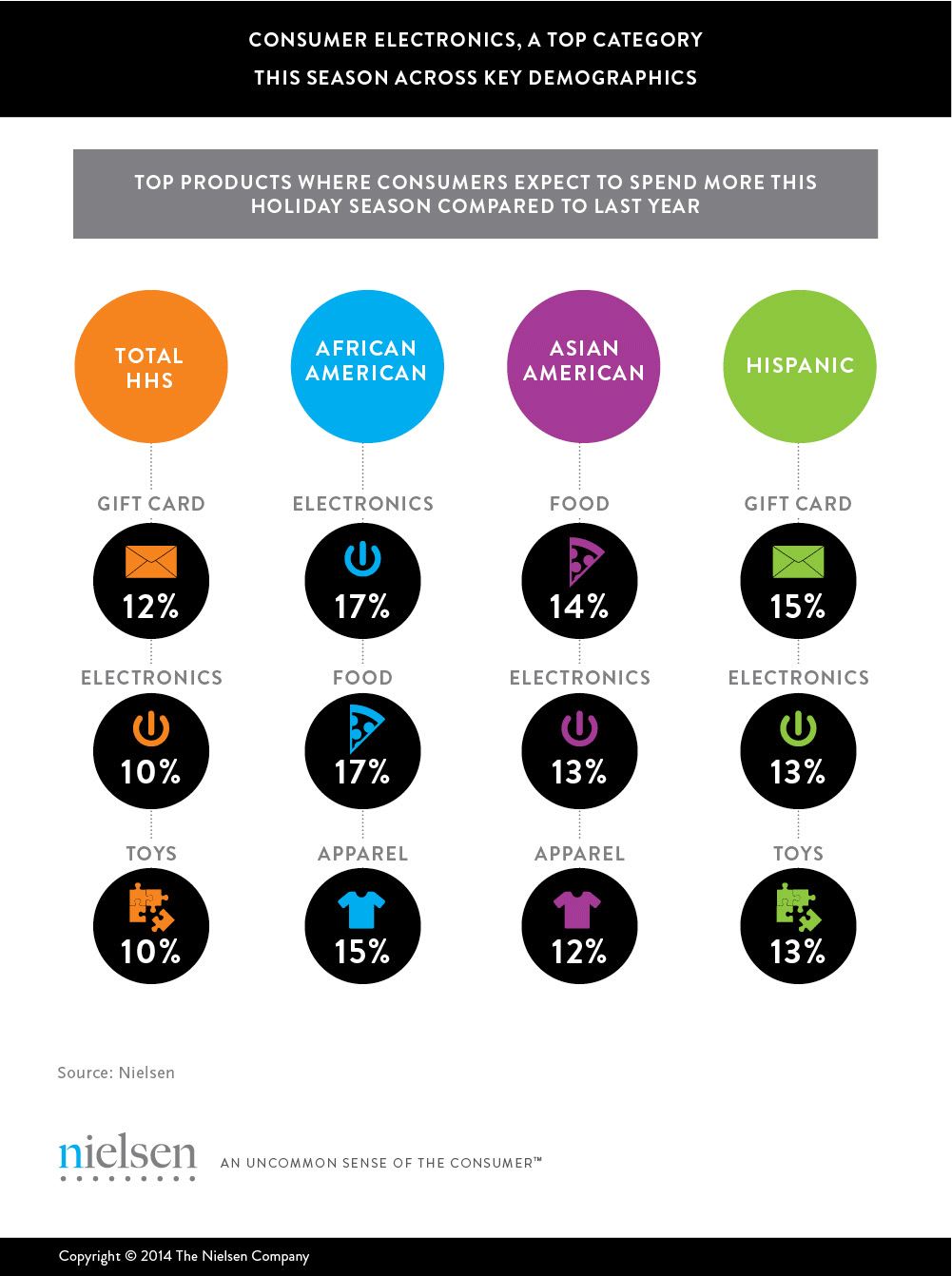

This season, gift cards, electronics and toys will see more shopper dollars. Compared to last year, all shoppers will spend 12% more on gift cards, 10% more on electronic merchandise and 10% more on toys.

While many of the same items top multicultural consumers’ gift lists, these households plan to spend more on their top categories than the general population. African Americans plan to spend 17% more on both electronics and food this year, followed by 15% more on apparel. Food is also important for Asian Americans this time of year, with shoppers reporting spending 14% more than last year on delicious delicacies, followed by 13% more on electronics, and 12% more on apparel. Hispanics plan to spend 15% more than the previous year on gift cards, followed by 13% more on electronics, then 13% more on toys.

Where Shoppers Are Heading for the Holidays

According to the report findings, e-commerce is poised to grow even more this season. Almost of quarter of both Hispanics and Asian-Americans (24% each) and 20% of African-Americans plan to log online for most of their holiday purchases.

Offline, popular holiday shops for multicultural consumers reflect their top purchases. Mass merchandisers—large big box retailers—are the second most popular stop Hispanics (13%) and Asian-Americans (11%). Meanwhile, 15% of African-Americans and 10% of Asian-Americans also plan to head to electronics stores. With toys among Hispanics’ top three categories, it’s not surprising that toy stores (11%) are the third most popular destination for their holiday buys. African-Americans plan to spend more on food this season, and 15% will head to grocery stores for holiday shopping.

The Most Wonderful Time of the Year (And Year-Round)

As the economy gains traction, holiday sales are poised to skyrocket. With multicultural consumers driving the rise in spending, marketers, retailers and manufacturers have a big opportunity to reach these consumers with the items they’re looking for and the places they’re shopping.

And these lessons aren’t just for the holidays. Seasonal spending reflects the larger consumer retail landscape, and multicultural consumers are increasingly influencing dollar growth and a fundamental component to business success today. Marketers, retailers and manufacturers would do well to heed this new reality and appeal to multicultural consumers not only now but throughout the year.

Methodology

The insights in this article were derived from an English language consumer survey of more than 25,000 U.S. households in September 2014.