There’s no doubt a digital age is upon us. Today, the average American owns four digital devices, and we’re increasingly using these tools and platforms to keep ourselves entertained. But have audiences switched completely to digital when viewing TV and movie content?

With 73% of Americans age 12 and up actively consuming movies and TV shows for home viewing, it’s important to understand the habits of such a powerful volume of consumers. And a new report from Nielsen, the Home Entertainment Consumer Trends report, found that while the type of content these consumers watch and what content they pay for has shifted over the past few years, their path isn’t always towards digital.

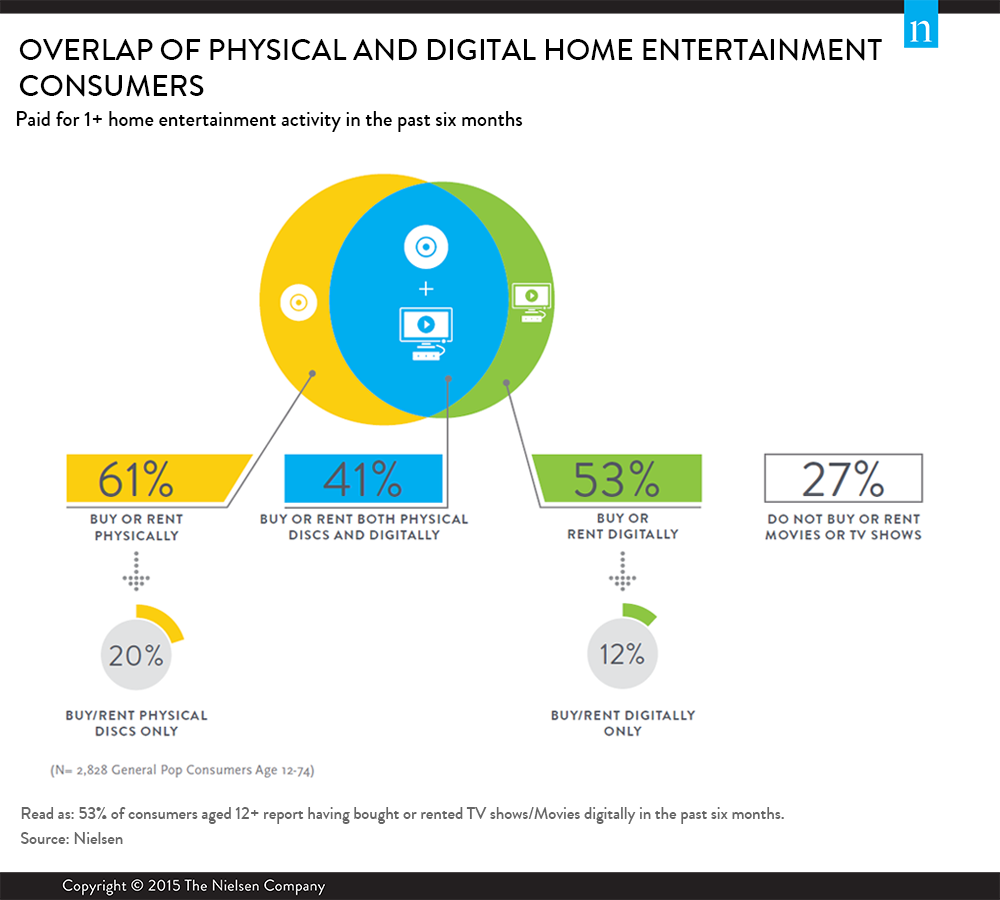

In the changing home entertainment landscape, one thing is constant: Consumers are watching roughly the same amount of movies and TV overall. What varies are their methods. Digital viewing methods are popular, with over half of consumers reporting that they’ve bought or rented one or more TV shows digitally in the past six months. Still, the number of digital-only consumers of entertainment remains low—just 12% of consumers have reported that they have shifted entirely to digital means for their TV and movie consumption. The majority of people (41%) say they buy or rent their content both physically and digitally. And even though Blockbuster filed for bankruptcy five years ago, 20% of people said they still buy or rent physical discs only.

Digital content may not account for the majority of purchases or rentals, but it takes up the majority of consumers’ time. On average, consumers reported that they spend 25% less time during a typical week watching physical content than digital, with most of their digital viewing happening via subscription streaming services.

Overall, consumers reported that 19% of their total viewing hours over the past week were spent on digital content, including 10% on subscription streaming movies, 4% on TV/movies owned digitally, 4% on TV on cable video on demand (VOD; ordering on-demand or Pay Per View through a cable or satellite provider for a one-time fee) and 1% on movies rented digitally online for a one-time fee. Comparatively, consumers reported spending only 11% of their entertainment hours on physical content (7% on TV/movies purchased on disc and 4% on those rented). The remaining viewing hours were spent on activities, such as watching live and time-shifted TV, playing video games or watching movies in theatres.

Although there may not be room in consumers’ schedules for physical content, there’s certainly room in their wallets. Consumers reported spending about twice as much on physical disc purchases and rentals than on digital ones in the past month. Ten percent of consumer dollars last month went towards TV/movie disc purchases and 6% went towards physical rentals, whereas only a combined 9% went towards digital consumption. However, this surplus doesn’t extend to every type of physical content; consumers said they bought fewer movies, both in disc and digital forms, and bought less TV content in both forms as well than they did last year.

Some consumer groups in the study were not price conscious, including the under-35 males who were defined as “content kings” because of their heavy purchases and rentals of discs and digital content. On the whole, however, both digital and physical entertainment purchases are carefully thought out. And more frugal segments, such as “old school homebodies” (conservative and self-reliant older adults) and “cordless creatives” (largely Millennials), take spending into account before consuming.

In fact, consumers on the whole indicated a rising preference in free (and subscription streaming) TV content over going to the movie theater or even watching movies in general. According to Nielsen’s 2014 Moviegoing Report, although 77% of U.S. moviegoers saw at least one movie in a theater last year, their frequency of going has declined slightly. And in comparison to last year, watching free TV content rose across all viewing methods, including live TV, time-shifted TV via DVR, Internet VOD (renting a digital copy for a one-time fee) and cable VOD.

Methodology

Nielsen’s Home Entertainment Consumer Trends report provides a comprehensive view of the home entertainment category (which includes any paid format used to access TV and movie content) and explores trends in physical and digital usage, time and dollars spent, as well as the methods used to access content. A representative online survey of nearly 3,000 U.S. consumers aged 12-74, including a representative sample of English- and Spanish-speaking Hispanic Americans, was fielded in March 2015.