Sports, unlike all other genres, have the power to attract large, consistent TV viewership—and on set schedules. You’d have to have been living under a rock this past year to have not been exposed to the whirlwind NFL season, which culminated in record viewership for Super Bowl LVII. Regardless of the appeal, however, the immense competition for sports rights amid an increasingly fragmented media landscape makes it challenging—and frustrating—for fans to find the games they’re looking for.

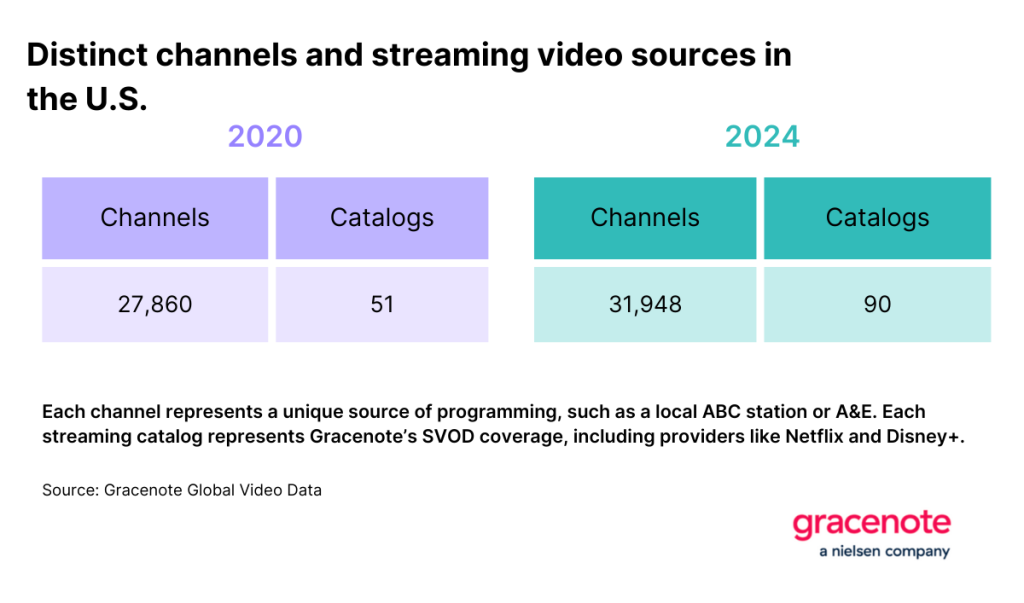

While not every publisher can afford to bid for sports rights, the field of content destinations is far more expansive than it was just four years ago—and sports rights are steadily headed to streaming services, including select, high-profile NFL playoff games.

And at the same time, some publishers that once expressed little interest in live sports have changed position and are now staking claim to what remains the most watched content on TV. Netflix, for example, has hosted two live sports events since November, ending an extensive period of previously abstaining from entering the space.

Not every event, however, has the notoriety of the Super Bowl, Thursday Night Football and Netflix’s recent Netflix Slam tournament—an important consideration as the new MLB season kicks off, which features 30 teams that each play 162 games. Die-hard fans of the New York Yankees, for example, will need access to three traditional TV networks (YES Network, ESPN, FOX) and three streaming services (Apple TV+, Amazon Prime Video, MLB TV) if they want to catch all of the season’s on-screen action. On the west coast, fans of the Los Angeles Dodgers have even more to navigate, as their 2024 season will be televised across ABC, CBS, ESPN, FOX, FOX Sports 1, SportsNet LA and Apple TV+.

TV audiences watched almost 330 billion minutes of MLB game action last season.

And outside of major markets like New York, Boston and Philadelphia that can sustain regional sports networks (RSNs) because they have major teams across the NFL, MLB, NBA and NHL, teams and leagues in smaller markets have started striking over-the-air broadcast rights deals with local TV stations while simultaneously offering games direct-to-consumers via streaming apps.

The bottom line in this extremely fragmented market is that live sports command massive audiences, but only if the audiences can find the games. A recent web search, for example, noted that a recent NHL game between the Arizona Coyotes and the Washington Capitals was on ESPN+, but the results proved to be incorrect—a frustrating experience for anyone outside of the local markets looking to watch the matchup.

This is not a unique example, nor will it be the last. The proliferation of services and the drive for monetization with high-profile content suggests that the future will grow even more fragmented.

When Nielsen launched The Gauge, for example, streaming accounted for 26% of our total time with TV, and only five services had enough viewership to warrant being independently reported. Two of the services also didn’t include advertising. In January 2024, by contrast, streaming accounted for 36% of TV usage and 11 services are independently reported (and all either include ads or have ad-supported subscription tiers). And what’s more, four have exclusive rights to select sporting events, as do ESPN+ and Apple TV+.

At a very high level, a single season of the five major sports leagues in the U.S. includes thousands of games. The MLB, for example, has nearly 2,500 in a single season. Historically, audiences would be able to find complete game listings in the weekly TV Guide, but today, not even the internet can keep up with program information for live sports schedules. And on the flipside, publishers are typically focused on providing information solely for the contests that they host.

This is where consumer electronics makers (OEMs), MVPDs and digital service providers can take the lead—and ultimately win with audiences and rights holders. With a clear understanding about the power of live sports, which remain the largest driver of audiences, these organizations can deliver information about live sports and related content across over-the-top platforms, giving audiences comprehensive, real-time information for a streaming-first media landscape.

A version of this article originally appeared on sportsbusinessjournal.com.

Source

1Services are independently reported once usage represents at least 1% of TV usage.