Canadians are actively using their mobile devices to research and shop for items in their everyday lives. More and more consumers in Canada are also becoming mobile payers, using their smartphone and tablet instead of a physical plastic card to make purchases or collect reward points.

As a result, mobile devices are transforming the very complex financial industry, creating more ways to save and pay than ever before. The mobile-payments space is quickly evolving, with traditional financial institutions, retailers, tech giants and small startups all getting in on the action. The result? A dynamic environment where consumers can choose the service or app that is right for them to meet their needs of busy lives.

The options for mobile payers are broad, from using a phone to pay for food and/or services to transferring money or using mobile wallets to carry credit card/debit card, boarding pass and rewards card information in a digital form on a mobile device. A recent Nielsen study took a look at how mobile payers are using the services available to them, particularly those using them the most as mobile wallets.

When looking specifically at smartphone users, 29% are actively using their smartphone as a mobile payment system. Awareness of mobile wallets among these mobile payers is universal at 99%; however, only 57% of them are using a mobile wallet in their day-to-day lives. Of those using a mobile wallet, 13% are using it as their primary method of payment where possible, while 44% are using it as a secondary method of payment. However, retailers, developers, banks and manufacturers should take note of those not currently using any form of mobile wallets (43%), as these mobile payers present an opportunity to educate and overcome barriers of adoption. Sixty seven percent of Canadian smartphone mobile payers (who do not use mobile wallet currently) are or will become mobile wallet users in the next six months.

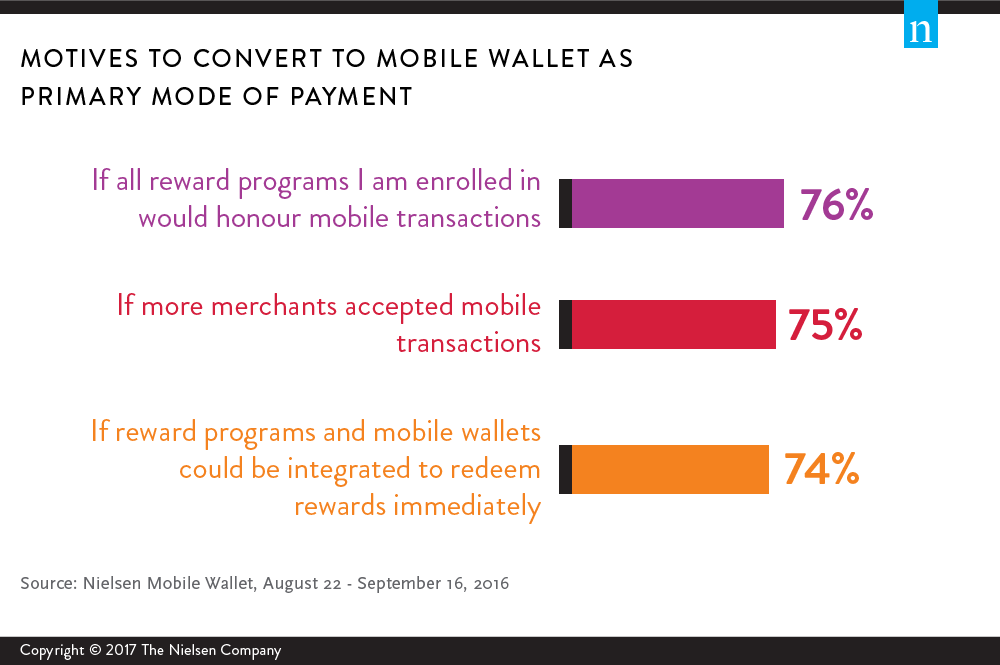

Mobile payers across Canada are open to becoming mobile wallet users. They are always looking to ease complications in their lives and the ability to combine their wallets and smartphones are no exception. Three-quarters (76%) of mobile payers state they would be motivated to make the switch to a mobile wallet if the reward program they are currently enrolled in would honour mobile transactions, followed by 75% who would be motivated if more merchants accepted mobile transactions. Similarly, 74% would like to see rewards programs and mobile wallets integrated to ensure they can redeem rewards points immediately.

Smartphones today are common among all generations and continue to grow in popularity. The number of smartphone users who plan to become a mobile wallet users in the near future opens up significant opportunities for banks, retailers and airlines in Canada. To help consumers with the transition to a mobile wallets and advance the mobile payment practice in general, app developers/owners and mobile manufacturers can ease concerns by providing proof of security and showcasing the need, relevancy and convenience of incorporating a mobile wallet into their everyday lives.

Methodology

The Nielsen Canadian Mobile Wallet syndicated study was fielded online from Aug. 22 to Sept. 16, 2016, in both English and French among 2,009 Canadian respondents aged 18+.To qualify for the study, respondents were screened on the following criteria: They must have paid using their mobile device (smartphone or tablet) in the past 30 days.