Most may be aware that few industry verticals benefit more from the adage “It’s better the devil you know” than insurance. Insurance customers often stick with the provider they know, and loyalty incentives, such as reduced premiums, no claim bonuses and discounted bundled policy offers, result in high customer retention.

As insurance companies certainly would enjoy the benefits of having such high retention, the downside is that acquiring new insurance policy holders is highly competitive and very challenging. Insurance consumers looking to change providers are scarce, and they spend very little time in the market. For insurance companies, long-term strategies focussed on the next generation of insurance customers represents a much greater opportunity, and that next generation is Australia’s 3.5 million Millennials.

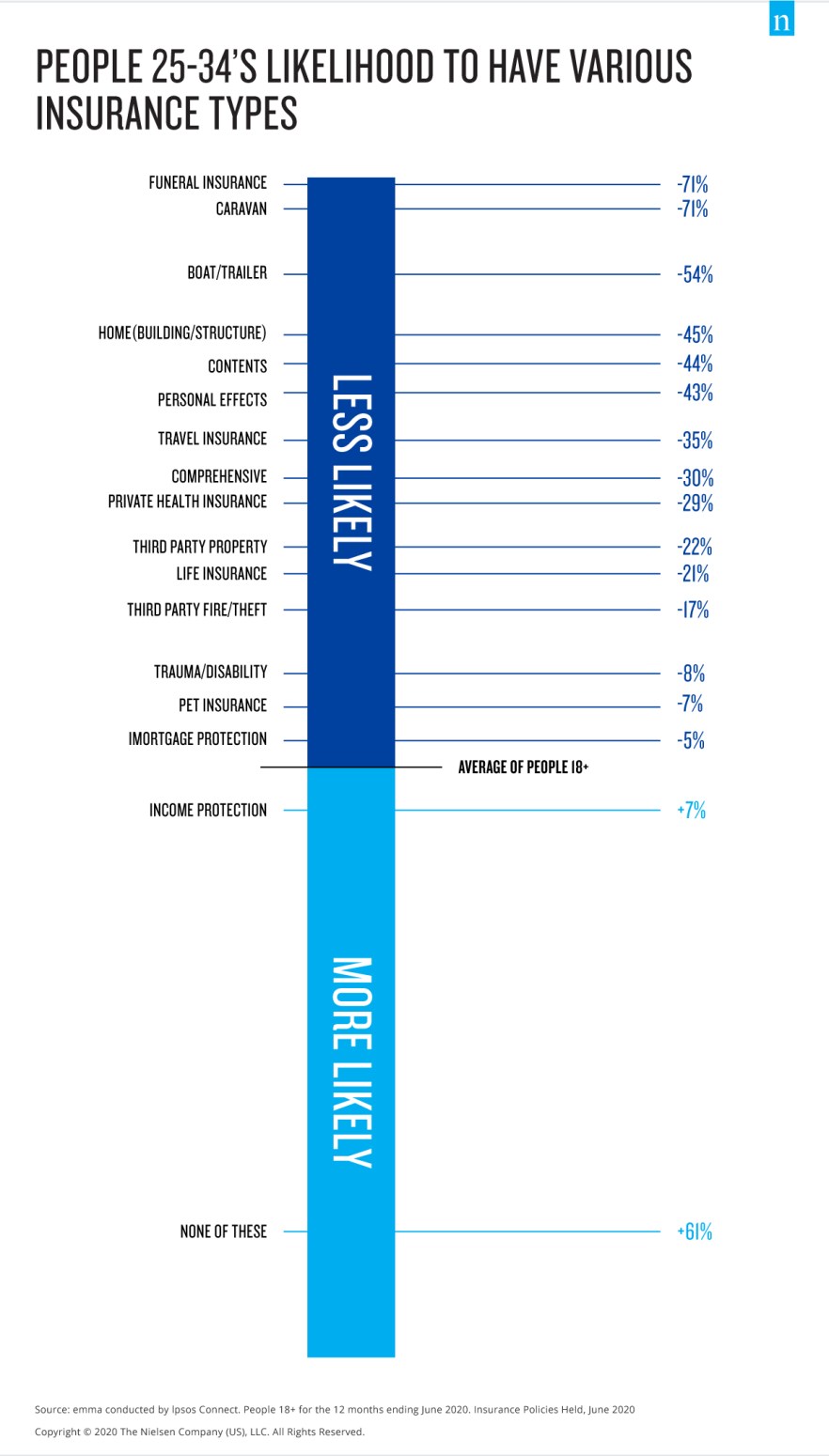

Compared with other Australians, Millennials are significantly less likely to have insurance in general. The only policies that they are slightly more likely to have are income protection and trauma/disability insurance, indicating that the immediate priority for this group is more about the protection of their livelihood than it is for their family, property or investments. While insurance may not be a priority for Millennials now, their circumstances will change dramatically throughout the next decade, and so will their need to be well insured and protected.

A number of major life changes and events lay ahead for Millennials over the next decade. In 10 years, we expect Millennials to see a 20% increase in their income, will be 63% more likely to be married, 92% more likely to have children and 57% more likely to be living in a home they own or are paying off than they are today. These life changes will have a profound impact and trigger a need to have insurance.

While Millennials represent a huge opportunity in the not too distant future, effective long-term brand building strategies will be crucial for insurance companies over the next decade. Another thing that makes insurance companies unique is that for them, brand building takes course of not just years but even decades. Only 27% of Millennials care about who they are insured with and feel that not all insurance companies are the same, a sentiment that really doesn’t shift until the mid-40s to mid-50s, where it is 40%.

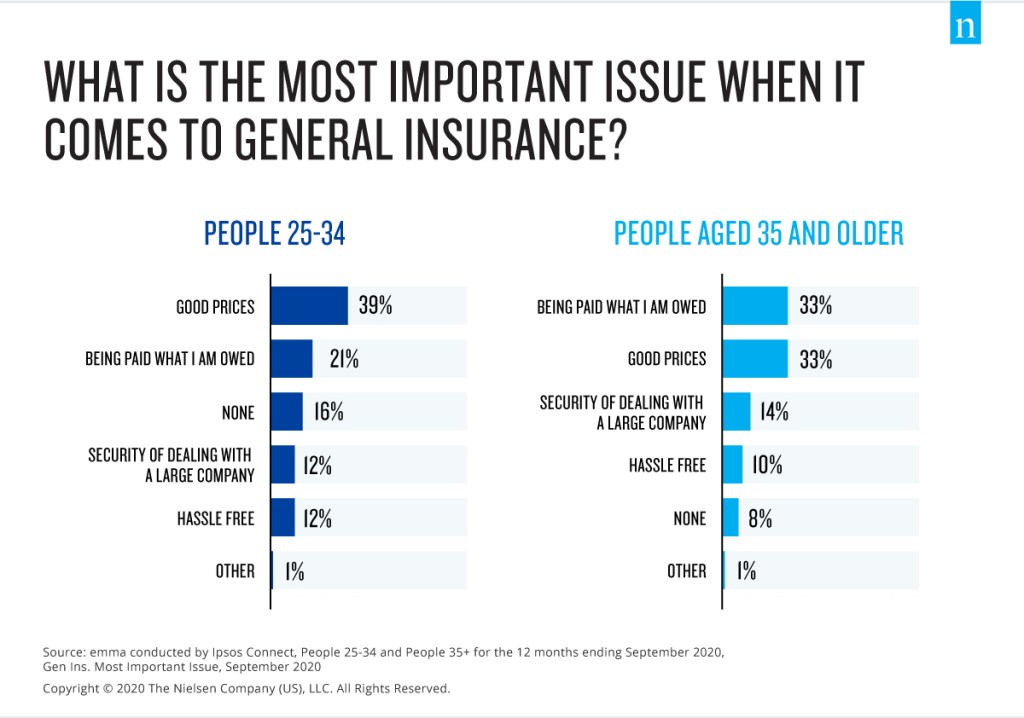

To a large extent, insurance isn’t something that Millennials are currently overly concerned about. As this of course will change quite a bit during the next decade, insurance is a grudge purchase and low prices are Millennials’ highest priority. For many Millennials, private health insurance is something they have because it’s less expensive than paying an additional medicare levy, and comprehensive car insurance is something that they must have as new car owners.

As brand building takes course over a very long period of time, the next 10 years will be a challenge for insurance companies as they endeavour to build their brand among an audience that is not overly concerned about insurance. To achieve long-term success with their next generation of consumers, insurance companies need long term strategies that encompass two core objectives. Firstly, the branding, creative and marketing messages that they use over the course of the next decade need to be memorable. Secondly, as those brandings, creatives and marketing messages may not resonate with Millennials now, they will need to when the time comes that they are in the market.

Methodology

ABOUT NIELSEN EMMACMV

Nielsen and The Readership Works (TRW) have a relationship that sees Nielsen’s national Consumer & Media View (CMV) incorporated into emma Cross Platform readership data. This is known as emmaCMV. For over 20 years, Nielsen’s CMV has surveyed consumers across Australia capturing an array of insights that help clients tackle marketing and media challenges. Whether they are involved in the planning, buying or selling of advertising, or responsible for brand strategy, Nielsen CMV insights provide the power to create effective marketing strategies and, ultimately, achieve business and marketing goals. emmaCMV is an enhanced and convenient solution that integrates Nielsen’s CMV into emma to provide readership, attitudinal, lifestyle and product data in one place. This information provides a comprehensive profile of the print consumer and their purchase intentions which supports more actionable analysis and insights.