Given today’s digitally charged, on-demand media environment, it’s easy to get caught up in the excitement around the growing array of video streaming options, especially amid the proliferation of internet-connected devices and smart TVs. And there’s good reason for the buzz: 56% of U.S. adults stream non-linear content to their TVs. That fact notwithstanding, our actual TV streaming habits have yet to truly live up to the buzz.

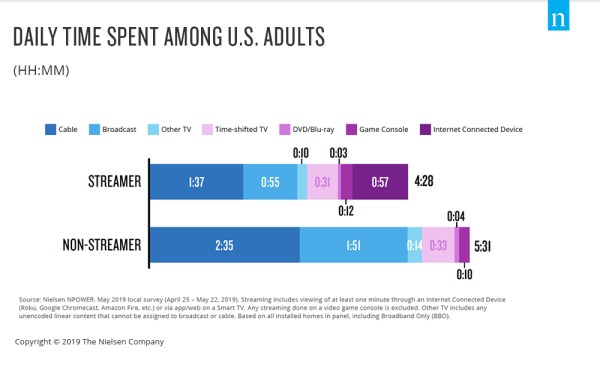

In fact, research in the latest Local Watch Report reveals that the typical U.S. adult streamer spends an average of just under one hour (57 minutes) streaming non-linear content to their TVs in a regular day. That’s significantly less time than streamers spend with linear TV: two hours 42 minutes.

While broadcast, cable and other TV options maintain their dominance from a video viewing perspective, there’s no denying the growing reach of streaming across the U.S. But that growth is far from homogeneous across regions and markets. In terms of device ownership, for example, growth in southern markets has outpaced all others over the last two years.

Importantly, not all on-demand video streaming content comes from the major players. According to Nielsen’s second-quarter 2019 Streaming Meter Data Insights Report, content from these players accounts for approximately 70%-80% of TV streaming activity. The remaining portion of content that consumers are streaming to their TVs can include non-linear local station content.

But this isn’t the only streaming opportunity for local stations. Linear content is also increasingly being included in streams from vMVPDs (virtual multichannel video programming distributors)—and vMVPD adoption is rising. This is particularly relevant for stations in LPM (local people meter) markets, which include 25 of the country’s 26 largest DMAs (designated market areas). Households in LPM markets, which represent approximately 50% of U.S. households, spend the most time streaming non-linear content to their TVs. Time spent with non-linear video is typically above the national average.

Given streaming engagement among LPM households, local stations in these markets would be wise to consider streaming as an opportunity instead of a challenge—and double down on their OTT strategies by enabling their apps for connected device brands like Roku and Apple.

The same can be said for stations in set meter markets, which account for just over 20% of U.S. households in 31 mid- to small-markets. That’s because non-linear streaming video has the highest reach among set meter markets (average reach of 59% across set meter markets). And given the high reach, it’s not a stretch to expect streaming viewing time to increase as more options—including those from local stations—become available.

Access to and reach of non-linear TV streaming content doesn’t, however, always correlate with usage—another critical consideration for local stations assessing which markets to invest in digitally. Across the U.S. for example, Austin and Columbus have the highest conversion rates among streaming device owners. Conversion rates consider access to device and usage of that device. In Austin, 76% of adults have a streaming device and 70% use them to stream content to their TVs. That’s a 93% conversion rate. In Columbus, the conversion rate is 92% (67% device ownership and 61% usage). On the flipside, Philadelphia and Seattle have the lowest conversion rates, at 71% and 74%, respectively.

The streaming market is vast and growing quickly, making it easy to generalize and make assumptions about viewers and viewing trends. Being able to analyze and really understand trends is critical, and that’s even more true at the local level. For example, many view streaming as a media that primarily appeals to young adults. In aggregate, Millennials are very engaged with on-demand content, but in some markets, streaming reaches more older generations than younger ones. For example, the average reach in set meter markets is 59% and the median age of streamers is 50.

Importantly, the streaming market isn’t closing doors and eliminating opportunities. Rather, it’s the opposite. But in order to activate in the space, marketers, stations and advertisers need to understand that streaming activity is not all the same—especially at the local level.

For additional insights, download the latest Local Watch Report.